19 January 2017

3QFY17 Results Update | Sector: Technology

MindTree

Neutral

BSE SENSEX

27,309

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,435

MTCL IN

50

38.9 / 0.8

804 / 400

-7/-11/-45

374

86.3

CMP: INR485

TP: INR530(+9%)

Deal wins strong, top clients and visibility not so

Continued revenue pressure…:

MTCL’s 3QFY17 revenue declined 0.4% QoQ

(+0.4% QoQ CC), in line with our estimate, led by project cancellations,

slower ramp-up at large clients and continued weakness in acquired entities.

With softness in top clients expected to continue, growth is not likely to pick

up in 4Q. Clarity on the FY18 outlook remains elusive, partly negating

confidence that deal wins could support growth recovery.

…but deal wins touching new highs:

Deal wins clocked USD314m in 3QFY17,

as against four-quarter average of USD222m, taking LTM deal wins to

~USD1b (+30% YoY). That said, it came on the back of a sluggish September

quarter and, consequently, 2HCY16 TCV of USD497m matches 1H’s

USD501m. 34% of TCV in the quarter came from Digital, with many of the

deals channeled through third-party advisers. Average deal sizes in Digital

continue to inch up, now at ~USD900k for new clients.

Profitability beat on lower headcount and SGA:

EBITDA margin expanded

90bp (v/s est. of flat margins) led by SGA optimization. PAT grew 8.8% QoQ

to INR1b (v/s est. of INR1.1b). While revenue revival remains the key, other

levers to achieve growth are offshoring, lesser sub-contracting, large

transformational deals to tackle pricing pressure, and improved profitability

in Bluefin and Magnet360.

Valuation view:

We cut earnings by 6.9%/0.2% for FY18/19E to factor in

delay in revenue recovery and consequent lowering of FY17E exit rate. While

MTCL is an attractive long-term Digital play, greater confidence in the same

will be a function of traction in revenues, especially from top clients. Valuing

it at 14x FY19E earnings, we maintain

Neutral

with a revised TP of INR530.

Financials & Valuations (INR b)

Y/E Mar

2016 2017E

Net Sales

46.9

52.3

EBITDA

8.3

7.1

PAT

6.0

4.2

EPS (INR)

35.9

25.1

Gr. (%)

12.4

-29.9

BV/Sh (INR)

142.4

151.2

RoE (%)

27.4

17.1

RoCE (%)

30.6

19.6

P/E (x)

13.5

19.2

P/BV (x)

3.4

3.2

2018E

58.6

8.5

5.7

33.7

34.2

170.5

21.0

22.8

14.3

2.8

Estimate change

TP change

Rating change

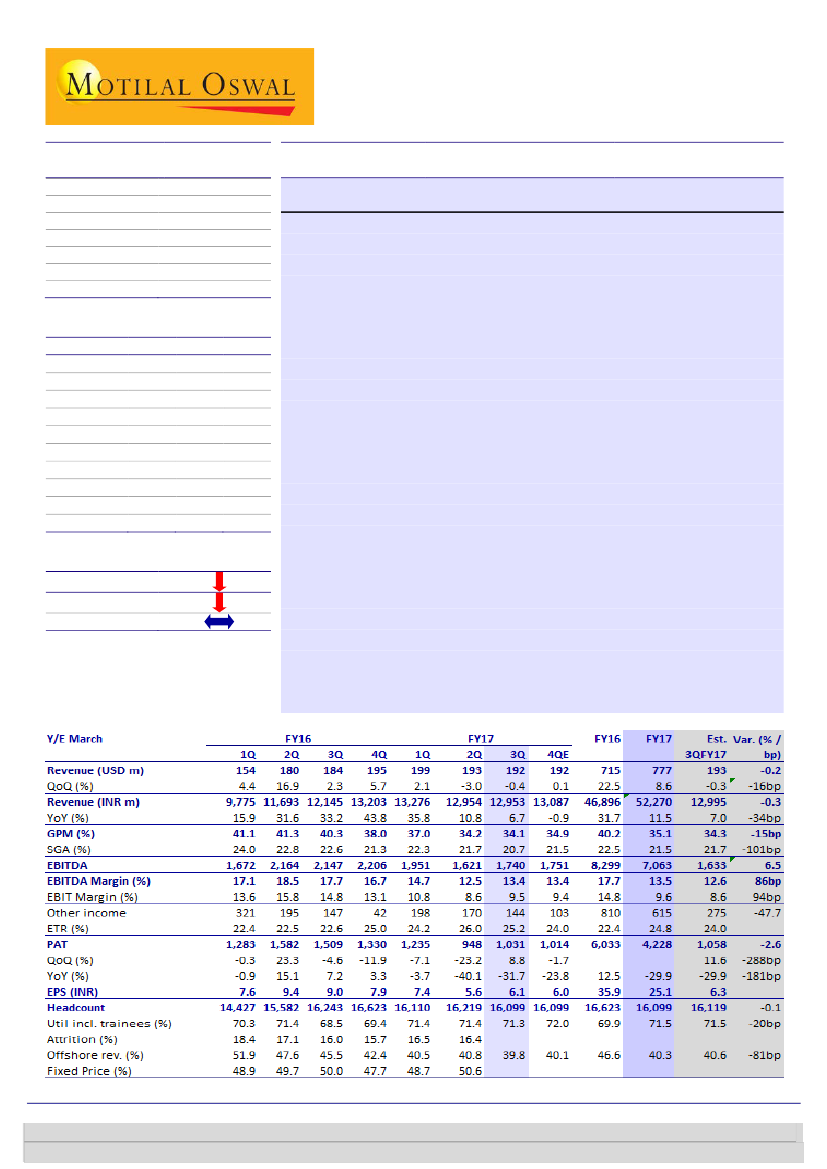

Quarterly Performance (Consolidated)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531