KPIT Technologies

BSE SENSEX

27,309

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,435

KPIT IN

197

27.3 / 0.4

197 / 108

-3/5/-12

144

83.3

19 January 2017

3QFY17 Results Update | Sector: Technology

CMP: INR138

TP: INR150 (+9%)

Neutral

Recovery rolled forward!

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

32.2

33.1

Net Sales

4.4

3.5

EBITDA

3.0

2.1

PAT

14.1

11.7

EPS (INR)

19.0

-16.9

Gr. (%)

69.0

79.8

BV/Sh (INR)

21.0

14.0

RoE (%)

24.3

16.0

RoCE (%)

10.3

12.4

P/E (x)

2.1

1.8

P/BV (x)

Estimate change

TP change

Rating change

Revenue decline led by multiple issues:

KPIT’s 3QFY17 revenue of USD123m

(-0.6% QoQ) was in line with our estimate. Growth was bogged down by

seasonality, divestment in the functional safety business, cross-currency

headwinds and a decline in Telematics revenue. Even excluding non-

recurring factors, revenue came in flat. Revenue growth has failed to pick up

in 2H, despite investments made in the beginning of the year.

Recovery further delayed:

Organic revenue growth is not expected to pick

2018E

up in 4Q as well, pushing revival even further than initial estimates and

36.3

lowering the FY17 exit rate. Profitability took a hit as KPIT maintained hiring

4.4

for the last three quarters amid absence of revenue growth, resulting in

2.8

operational inefficiencies. Higher salary cost increases and lower utilization

13.8

18.2

impacted 3Q margins (-80bp QoQ to 10.2% v/s est. of 12.0%).

93.7

Product Engineering holding strong(er):

Portfolio issues have been weighing

15.9

on KPIT’s performance, with cloud migration impacting SBUs of SAP and IES.

18.6

Product Engineering, Products and Platforms have been consistent (growth

10.5

of 9.2% YoY) in 9MFY17 v/s flat overall revenue. In 3Q, it divested its

1.5

investment in Medini (functional safety product business) as the scope was

beyond focus verticals. It used the proceeds to invest in MicroFuzzy, an

electrical powertrain company, resulting in exceptional gains of INR261m.

Excluding this, PAT came in at INR475m (-16% QoQ), lower than our estimate

of INR619m (+10% QoQ).

Revenue revival key to re-rating:

Amid sluggish revenue growth momentum

and execution issues, profitability is likely to remain under pressure for a few

more quarters. We cut earnings by 11.5/6.1% for FY18/19E to factor in the

miss in 3Q and a further delay in recovery. Inconsistent revenue performance

and consequent volatility in profits are the key drags on valuation. We

maintain

Neutral

with a revised TP of INR150, discounting FY19E EPS by 10x.

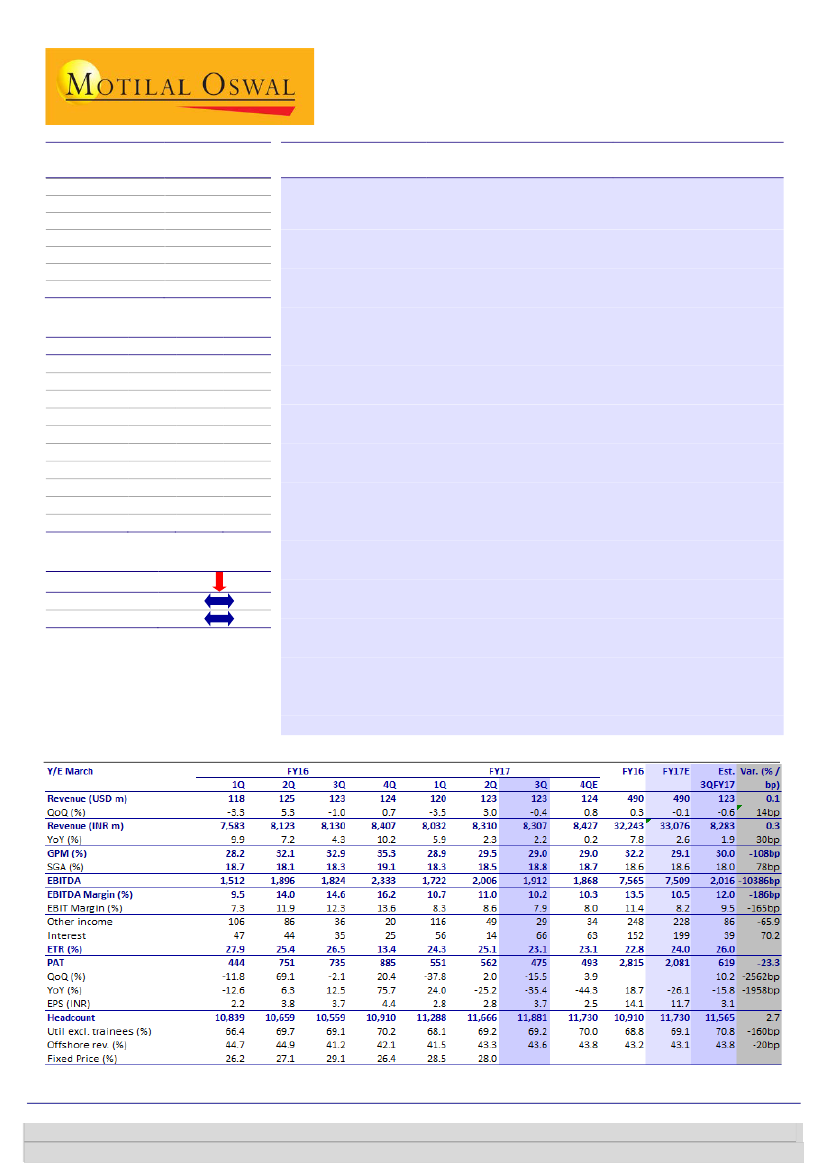

Quarterly Performance (Consolidated)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531