25 October 2016

2QFY17 Results Update | Sector: Financials

Federal Bank

Buy

BSE SENSEX

27,309

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,435

FB IN

1,719.0

139.2/2.1

82/41

13/61/40

414

100.0

CMP: INR77

TP: INR105 (+36%)

Strong balance sheet and core PPoP growth; Stable asset quality

Federal Bank’s (FB) 3QFY17 PAT grew 26% YoY to INR2.05b (10% beat), led by

strong core PPoP growth (+42% YoY) and lower credit costs (64bp annualized).

NII grew 31% YoY and 9% QoQ to INR7.9b, driven by strong loan growth and

stable sequential NIM (+28bp YoY to 3.3%). Adjusted for one-off income of

INR190m, NII grew 28% YoY.

Other income increased 44% YoY (5% miss), led by strong growth in fee income

(+33% YoY). Trading gains were lower than expected at INR860m (27% of PBT)

Strong loan growth of 32% YoY was driven by corporate (+71% YoY;

predominantly consisting of working capital loans) and retail (ex-gold loans,

+35% YoY). Deposit growth of 23% YoY (+7% QoQ) was led by strong

mobilization in SA deposits (+32% YoY). CASA ratio improved 360bp QoQ to

34.7% (CASA grew 33% YoY)

Incremental slippages increased marginally to INR2.73b from INR2.66b in 2Q

(annualized slippage ratio of ~2.1%), led by higher slippages in corporate and

retail. The bank made use of the RBI’s 90dpd dispensation on portfolio of

~INR350-400m. Absolute GNPA increased 7% QoQ, but remained stable in

percentage terms (2.77%). There was no sale to ARC during the quarter.

Valuation and view:

We are enthused by FB’s core operating performance, driven by

its strong balance sheet. Although the bank’s corporate asset quality issues may

not be completely behind, we believe it is ahead of corporate lending peer banks

on the asset quality curve. Considering asset quality distractions in the PSU space,

we believe FB is well positioned to gain market share in highly rated corporates.

We largely maintain FY17/18 estimates, and retain

Buy

with a target price of

INR105 (1.8x December FY18 BV) based on RI model.

FY16

2Q

6,083

0.4

1,823

7,906

4,540

3,366

-17.9

873

2,493

880

1,613

-32.9

3.1

14.3

5.0

15.0

2.9

3Q

6,057

3.2

1,828

7,885

4,630

3,255

-18.1

751

2,504

877

1,627

-38.5

3.1

14.1

9.8

16.8

3.2

4Q

6,859

10.1

2,269

9,128

5,183

3,945

-15.9

3,886

59

-44

103

-96.3

3.4

11.8

13.3

16.7

2.8

1Q

6,927

14.5

2,370

9,297

5,039

4,259

16.0

1,685

2,574

901

1,673

18.3

3.3

12.5

19.3

17.5

2.9

FY17

2Q

3Q

7,262

7,914

19.4

30.7

2,616

2,633

9,878

10,547

5,128

5,798

4,750

4,749

41.1

45.9

1,684

1,588

3,066

3,161

1,053

1,104

2,013

2,057

24.8

26.4

3.3

17.0

27.2

18.2

2.8

3.3

23.3

32.0

19.5

2.8

4QE

8,043

17.3

2,854

10,897

6,064

4,833

22.5

1,506

3,327

1,163

2,165

2,010.0

3.2

22.0

25.0

20.9

2.9

FY16

25,042

5.2

7,864

32,906

18,668

14,238

-12.5

7,041

7,197

2,440

4,757

-52.7

3.2

11.8

13.3

16.7

2.8

FY17E

30,145

20.4

10,473

40,619

22,029

18,590

30.6

6,463

12,128

4,220

7,907

66.2

3.3

22.0

25.0

20.9

2.9

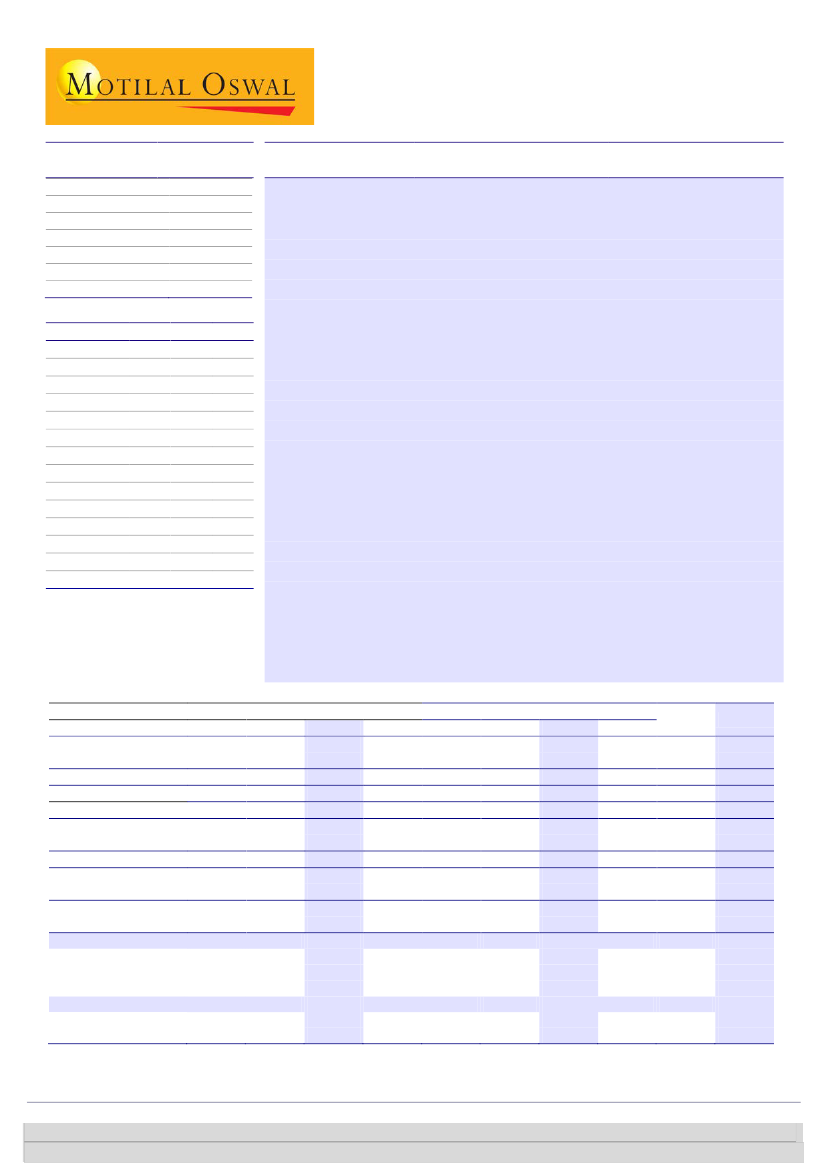

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E

NII

25.0

30.1

35.2

OP

14.2

18.6

21.7

NP

4.8

7.9

9.4

NIM (%)

3.2

3.3

3.1

EPS (INR)

2.8

4.6

5.5

EPS Gr. (%)

-52.9 66.1

19.1

BV/Sh. (INR)

47

51

55

ABV/Sh. (INR)

43

47

51

ROE (%)

6.0

9.4

10.4

ROA (%)

0.5

0.8

0.8

Payout (%)

29.3

23.2

23.2

Valuations

P/E(X)

27.8

16.8

14.1

P/BV (X)

1.6

1.5

1.4

Quarterly Performance

Net Interest Income

% Change (YoY)

Other Income

Net Income

Operating Expenses

Operating Profit

% Change (YoY)

Other Provisions

Profit before Tax

Tax Provisions

Net Profit

% Change (YoY)

Operating Parameters

NIM (Cal, %)

Deposit Growth (%)

Loan Growth (%)

Asset Quality

Gross NPA (INR b)

Gross NPA (%)

E: MOSL Estimates

1Q

6,048

7.2

1,939

7,987

4,315

3,672

4.5

1,531

2,141

727

1,414

-35.8

3.2

16.7

10.1

13.0

2.6

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com);+91 22 3982 5521