Jyothy Laboratories

BSE SENSEX

27,035

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

S&P CNX

8,349

JYL IN

182

62.6 / 0.9

381 / 253

-3/22/13

47

33.1

20 January 2016

3QFY17 Results Update | Sector: Consumer

CMP: INR345

TP: INR365 (+6%)

Neutral

Resilient sales in a difficult environment; fabric care shines

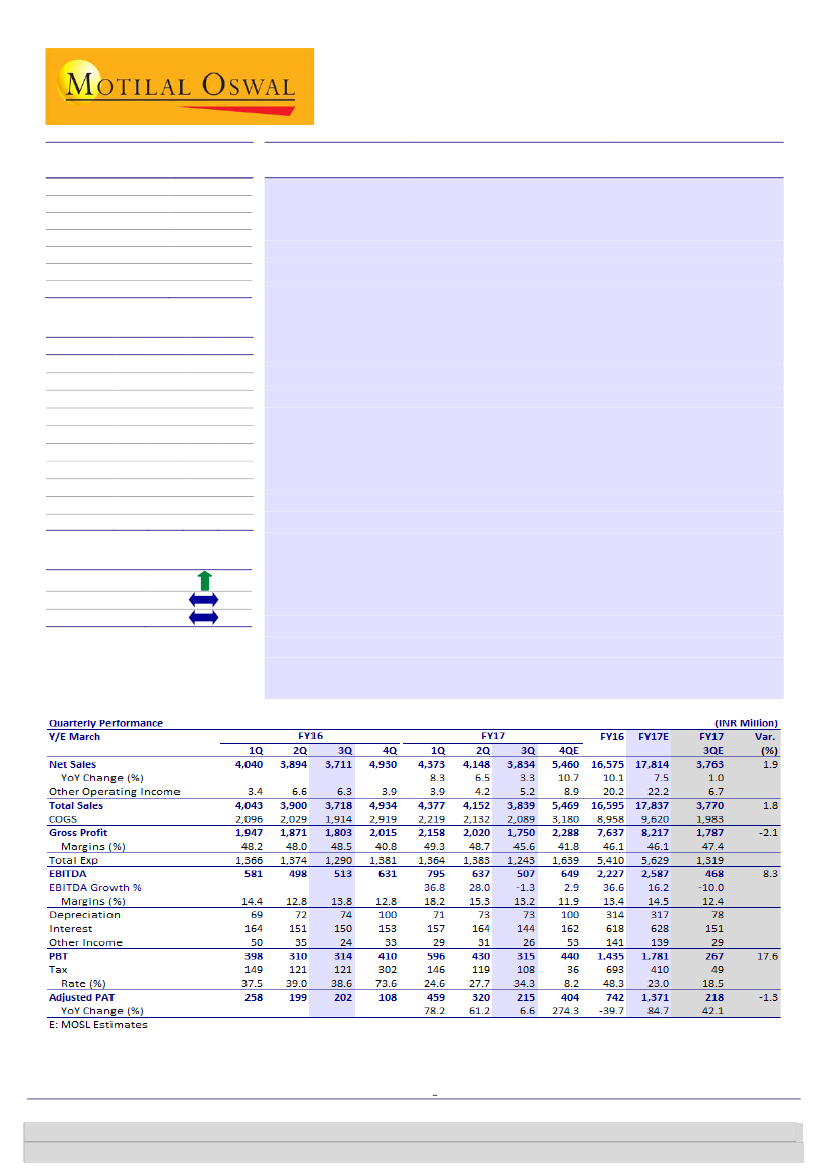

Consolidated net sales rose 3.3% YoY

to INR3.83b (Ind-AS; est. of +1% YoY to

INR3.76b). Overall volumes grew 3.6% YoY. Power brand sales rose 2.1% YoY,

with 2.6% volume growth. EBITDA declined 1.3% YoY to INR507m (est. of -10%

YoY to INR468m). PAT grew 6.6% YoY to INR215m (est. of 218m).

Consolidated gross margin contracted 290bp YoY

to 45.6% (est. of 47.4%), as

higher crude prices led to increased costs. However, savings on staff costs

(-50bp YoY) and lower A&P (-110bp YoY)/other expenses (-70bp YoY) restricted

consolidated EBITDA margin contraction to 60bp YoY to 13.2% (est. of 12.4%).

Segment-wise performance:

Fabric care sales grew 10.4% YoY, followed by

Dishwashing (+2.2%) and personal care (+1.4%). Mosquito repellent sales

(-15.2%), however, came in much lower than expectations. Among the major

brands, Ujala sales grew by 7.5% YoY, Henko by 20%, Exo by 2% and Pril by

2.7%. However, sales of Maxo (-15.2%) and Margo (-6%) disappointed.

Concall highlights:

(1) 3QFY17 was impacted by demonetization, but overall

demand is back to normal. (2) Input costs have started rising. Expect 5-7% price

increase/grammage reduction in 4QFY17 to protect margins. (3) A&P will be

back on track in 4Q at ~7-8% of sales (Ind-AS). (4) Henkel deal: 31

st

March 2017

is the deadline; can be extended by a couple of weeks if required.

Valuation and view:

JYL exhibited reasonable resilience in volume growth,

especially in a tough business environment post demonetization. However,

valuations are fair at 38.4x FY18 EPS and 22.4x FY18 EV/EBITDA. Upside on our

target price of INR364 (22x December 2018 EBITDA) is limited. Potential

speculation around Henkel call option will overshadow the underlying

fundamentals in the near term, in our view. Maintain

Neutral.

Financials & Valuations (INR b)

Y/E Mar

2016 2017E 2018E 2019E

Net Sales

16.6 17.8 20.2 23.3

EBITDA

2.2 2.6

2.9

3.2

PAT

0.7 1.4

1.6

1.9

EPS (INR)

4.1 7.6

9.0 10.5

Gr. (%)

-41.7 84.7 18.6 16.8

BV/Sh (INR) 46.7 49.8 54.3 60.4

RoE (%)

9.1 15.7 17.2 18.3

RoCE (%)

7.2 12.5 13.8 14.7

P/E (x)

84.1 45.5 38.4 32.9

EV/EBITDA

30.1 25.4 22.4 19.9

Estimate change

TP change

Rating change

Krishnan Sambamoorthy

(Krishnan.sambamoorthy@motilaloswal.com

); +91 22 3982 5428

Vishal Punmiya

(Vishal.Punmiya@motilaloswal.com ); +91 22 3980 4261

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.