Ultratech Cement

BSE SENSEX

27,117

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,392

UTCEM IN

Volumes surprise led by market share gains

274.4

Modest volume decline:

UTCEM’s 3QFY17 revenue declined 2% YoY to

965.2 / 14.4

INR55.4b (estimate: INR53.43b). Its gray cement volume declined only 0.6%

4130 / 2680

YoY, led by higher exports (+90% YoY; ramp up of Gujarat unit). PAT grew 7%

9/0/18

1106

YoY to INR5.6b, aided by lower depreciation and lower tax expenses.

37.7

Cost control helps to partially offset weak realizations:

Gray cement

23 January 2017

3QFY17 Results Update | Sector: Cement

CMP: INR3,518

TP: INR4,058(+15%)

Buy

Financials & Valuations (INR b)

Y/E Mar

2016 2017E

Net Sales

238.4 233.7

EBITDA

43.5

45.4

PAT

21.7

25.6

EPS (INR)

79.3

93.5

Gr. (%)

7.9

17.9

BV/Sh (INR)

755.8 837.6

RoE (%)

11.0

11.7

RoCE (%)

9.3

10.1

P/E (x)

44.4

37.6

P/BV (x)

4.7

4.2

2018E

259.4

55.7

35.6

129.6

38.7

949.8

14.5

12.3

27.1

3.7

Estimate change

TP change

Rating change

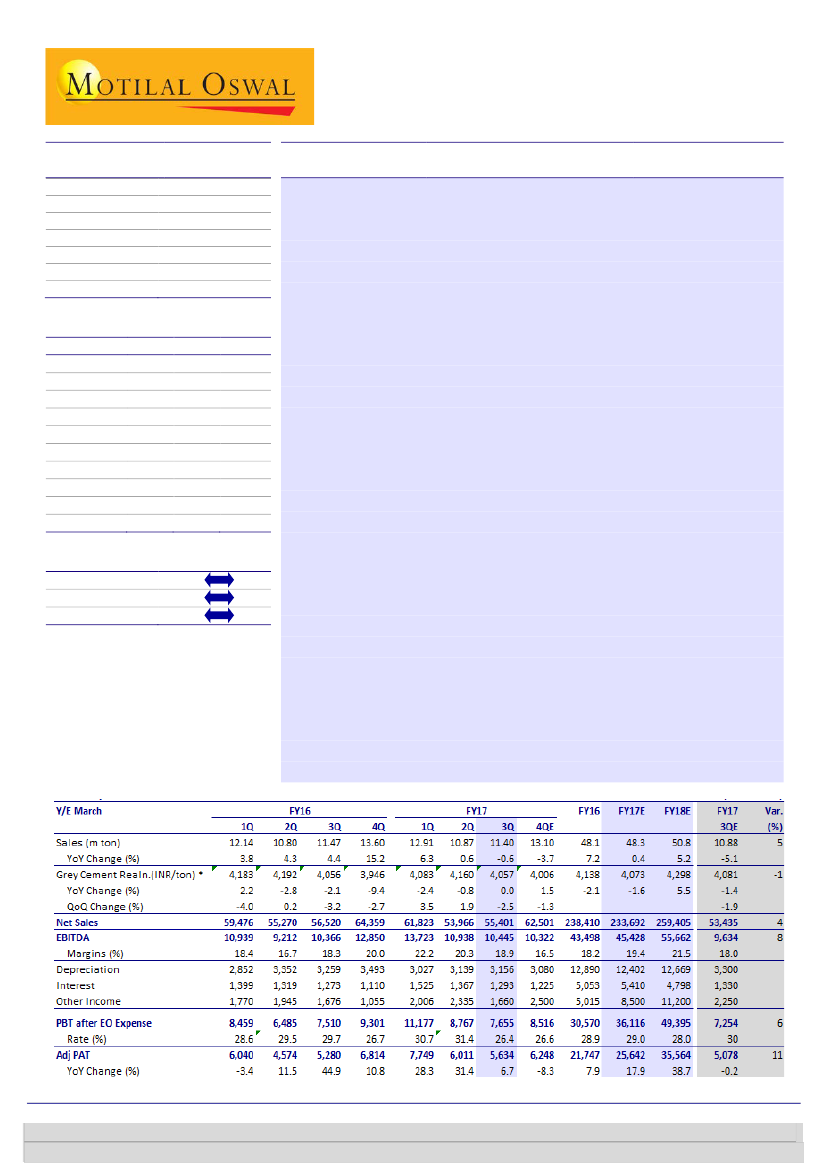

Quarterly Performance (Consolidated)

realization declined 2.5% QoQ to INR4,057/ton due to weak realization in

December. However, UTCEM’s trend of consistent cost improvement

continued, with unitary cost at INR3,832/ton (-2% YoY; flat QoQ).The cost

savings were driven by lower power and fuel cost (better power

consumption) and freight cost (lower lead distance). EBITDA rose 1% YoY to

INR10.4b (our estimate: INR9.6b), translating to EBITDA/ton of INR903 (-

INR89 QoQ; +INR25 YoY) and margin of 18.9% (-1.4pp QoQ; +0.6pp YoY).

Other highlights:

(a) JPA assets operating at 30% utilization; acquisition to

be completed by end-FY17/1QFY18; (b) Capacity expansion of 3.5m tons in

Dhar in MP at cost of USD110/ton likely to be commissioned by 4QFY19; (c)

Capacity utilization at 67% for UTCEM v/s industry utilization of ~60%.

Management commentary:

(1) Demand in South/East markets to remain

buoyant; (2) North likely to see some pressure on volumes due to state

elections; (3) Demand growth in 4Q to be a challenge due to high base; (4)

December realization 4% lower than average of 3QFY17; (5) Impact of power

& fuel cost to the extent of USD5/ton increase in petcoke prices in 4QFY17.

Valuation and view:

Even in challenging times post demonetization,

UTCEM’s strong focus on market share gain and cost efficiency have helped

deliver better than estimated results. It is a strong bet on the cycle upturn,

and in our view, success in asset creation should overshadow any near-term

concerns for long-term investors. We factor in 5-6% volume CAGR and 21%

EBITDA CAGR over FY17-19. We value UTCEM at INR4,058 (EV of 15x FY19E

EBITDA and USD225/ton).

(INR Million)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Abhishek Ghosh

(Abhishek.Ghosh@motilaloswal.com); +91 22 3982 5436

Varun Gadia

(Varun.Gadia@motilaloswal.com); +91 22 3982 5446