Amara Raja Batteries

BSE SENSEX

27,035

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,349

AMRJ IN

170.8125

158.1 / 2.3

1077 / 776.5

0/3/1

293.9

47.94

23 January 2017

3QFY17 Results Update | Sector: Automobiles

CMP: INR902

TP: INR1,087(+20%)

Buy

Financials & Valuations (INR b)

2016 2017E 2018E

Y/E Mar

46.9

53.8

63.6

Net Sales

8.2

9.1

11.3

EBITDA

4.9

5.3

6.9

NP

28.7

30.9

40.1

EPS (INR)

19.8

7.8

30.0

EPS Gr. (%)

123.0 148.8 182.3

BV/Sh. (INR)

25.8

22.7

24.2

RoE (%)

24.2

21.6

23.1

RoCE (%)

32.0

29.7

22.8

Payout (%)

7.4

6.2

5.0

Div. Yield

Estimate change

TP change

Rating change

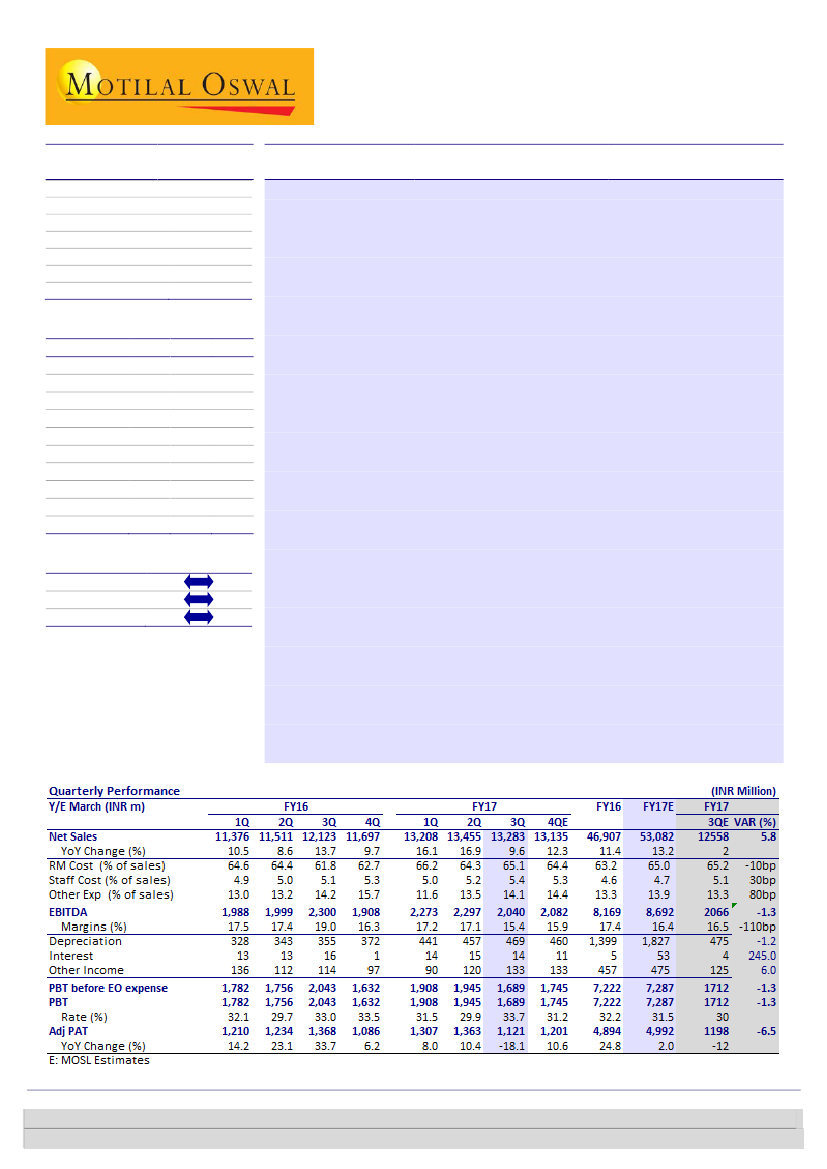

Operating performance in-line; sales grew ~10% YoY; EBITDA margin lowest in

14 quarters due to higher fixed cost; first PAT decline since 3QFY09

Net sales grew 10% YoY (but declined 1% QoQ) to INR13.3b (v/s our estimate

of ~INR12.6b), driven by 16-17% YoY growth in the automotive segment;

industrial segment grew by a modest 2-3% YoY.

EBITDA margin declined 170bp QoQ (and 360bp YoY) to 15.4% (v/s our

estimate of 16.5%) due to higher employee and other expenses, despite in-line

gross margin.

RM cost increased ~80bp QoQ (and 330bp YoY) due to increase in lead prices,

despite increase in prices by 3% in November and 4% in December in the

replacement market.

Fixed cost was higher due to new tubular plant, bonus provisioning for

employees and negative operating leverage. This translated into EBITDA

decline of ~11% YoY/QoQ to INR2.04b (v/s our estimate of INR2.06b).

Adjusted PAT declined 18% YoY/QoQ to INR1.12b (v/s our estimate of

INR1.2b), impacted by higher tax rate.

Takeaways from management interaction:

(a) Impact of demonetization felt in

2W segment, (b) Increased market share in both 2W and 4W replacement

segment, (c) Auto OEM growth in low single digit, implying strong growth in

replacement segment, (d) New tubular plant operated at ~30% utilization (off-

season), (e) Lead prices for 3QFY17 at USD1,950-2,000/ton, which could be over

USD2,150/ton for 4QFY17, (f) Expansion of 4W battery capacity by 2.4m units (to

10.8m) on track for commissioning in 4QFY17, (g) Inventory is slightly higher due

to lower demand in 2W batteries and on account of pre-season buildup of inverter

batteries, (h) Capex for FY17 to be at INR4.5b-5b for 2W and 4W battery capacity,

and (i) Net cash as at the end of December 2016 at INR2.5b.

Valuation and view:

We have cut our EPS estimates by 1.5-2.7% to factor in

stronger than estimated revenue growth and higher costs (RM and fixed costs). The

stock trades at 23.9x/19.9x FY18/19E EPS. Maintain

Buy

with a target price of

~INR1,087 (25x December 2018E EPS).

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 6129 1524

Aditya Vora

(Aditya.Vora@MotilalOswal.com); +91 22 6129 1533