30 January 2017

3QFY17 Results Update | Sector: Healthcare

Granules India

BSE SENSEX

27,850

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,633

GRAN IN

Continued margin improvement; multiple levers ahead

221

After growing in low-to-mid single-digits for four quarters, revenue grew

25.7 / 0.4

11% YoY to INR3.6b (in-line) in 3QFY17. EBITDA margin came in at 21.2%

151 / 91

(+160bp YoY, +80bp QoQ; est. of 20.2%), much higher than ~11% in FY13,

3/-17/-12

172

led by product mix change and capacity expansion. EBITDA rose 17% YoY to

48.1

INR761m, implying a 4% beat. PAT grew 43% YoY to INR391m (in-line).

CMP: INR116

TP: INR160(+38%)

Buy

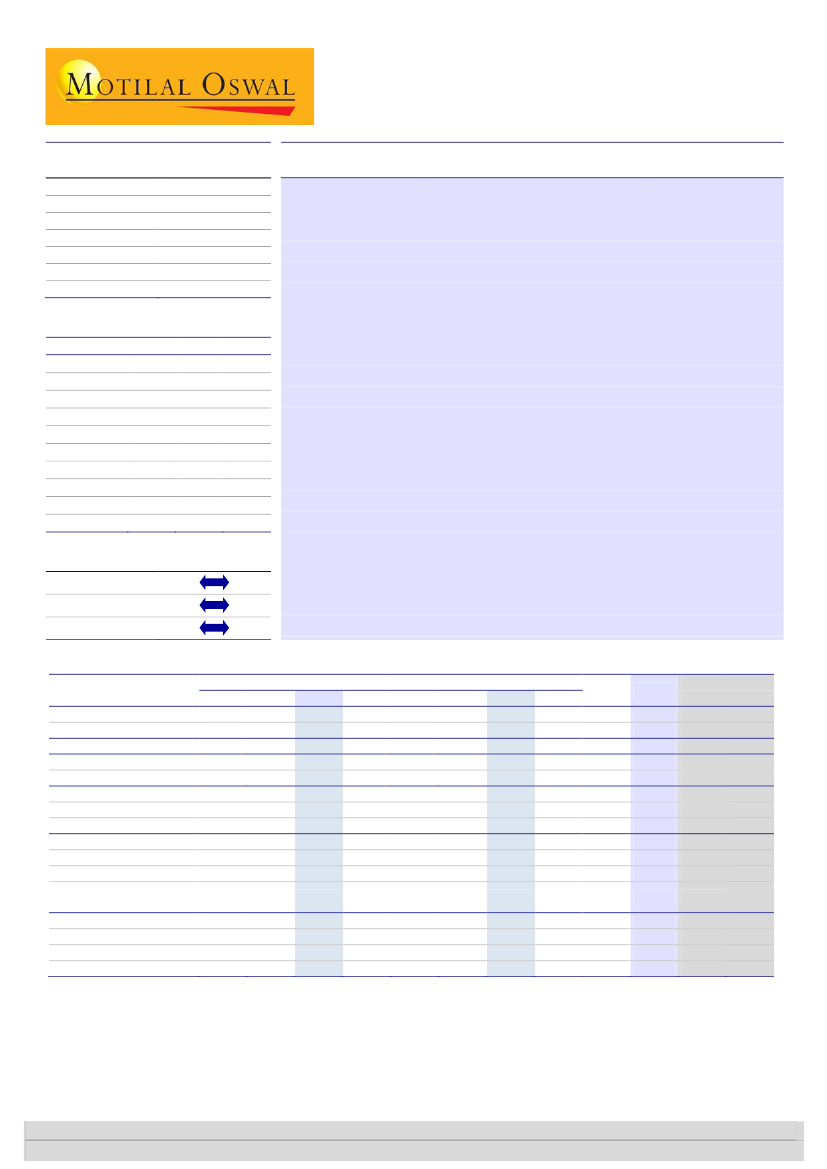

Financials & Valuations (INR b)

2016

2017E

Y/E Mar

14.3

14.3

Net Sales

2.8

2.9

EBITDA

1.2

1.6

PAT

5.5

7.0

EPS (INR)

22.8

27.8

Gr. (%)

30.7

40.9

BV/Sh (INR)

21.6

19.9

RoE (%)

14.0

11.7

RoCE (%)

21.0

16.5

P/E (x)

3.7

2.8

P/BV (x)

2018E

Finished dosage continues to deliver robust growth:

Finished dosage

16.8

3.5

2.0

8.0

15.2

59.3

16.6

9.9

14.3

1.9

Estimate change

TP change

Rating change

segment’s revenue grew 33% YoY to ~INR1.6b, driven by scale-up in Rx

business. Revenue of PFI segment declined ~7% YoY, while that of API

segment fell 11% YoY to INR1.2b. Capacity constraints, along with captive

consumption of API, led to muted revenue growth. GRAN expects revenues

to bounce back, led by expanded capacity in API and PFI segments.

Concall takeaways:

1) Plans to file six ANDAs by end-FY17 (including two

complex fillings from Virginia facility). 2) Plans to incur INR9b as capex over

FY17 and FY18 (spent ~INR2.65b in 9MFY17). 3) Re-inspection of the

Gagilapur-based CRAMS JV facility to start from tomorrow; the company

expects resolution over next few days. 4) Fixed asset to reach to INR16b post

FY18. The company expects asset turnover to reach ~2x over next few years.

Earnings acceleration to drive valuation upside:

GRAN trades at ~10x

FY19E EPS. We believe the stock has the potential deliver >50% return over

next 12-18 months, led by multiple re-rating (to >15x forward earnings) and

strong EPS CAGR of ~30%. Our TP of INR160 is based on 16x 1HFY19E PER.

FY17

2Q

3,638

3.1

2,896

742

20.4

185

83

39

513

156

30.4

-51

408

408

43.1

11.2

Est.

3QE

3,621

5.0

2,890

732

20.2

189

92

35

486

145

29.9

-50

391

391

43.8

10.8

-0.2%

Y/E March

(Consolidated)

Net Sales

YoY Change (%)

Total Expenditure

EBITDA

Margins (%)

Depreciation

Interest

Other Income

PBT before EO expense

Tax

Rate (%)

Minority Interest & Profit/

Loss of Asso. Cos.

Reported PAT

Adj PAT

YoY Change (%)

Margins (%)

Quarterly Performance (Consolidated)

1Q

3,226

3.7

2,599

627

19.4

139

81

14

420

133

31.6

2

285

285

24.8

8.8

FY16

2Q

3Q

3,529

3,449

14.7

7.9

2,844

2,772

685

677

19.4

19.6

144

167

88

114

10

26

462

422

144

151

31.1

35.7

-4

323

323

46.2

9.1

0

272

272

15.2

7.9

(INR Million)

Var.

vs Est

-0.7%

4Q

3,723

5.0

2,940

783

21.0

174

99

14

525

193

36.7

0

332

332

48.2

8.9

1Q

3,498

8.4

2,813

685

19.6

163

79

30

472

154

32.5

-71

390

390

36.5

11.1

3Q

3,595

4.2

2,832

763

21.2

187

84

43

535

176

32.9

-31

390

390

43.5

10.8

4QE

3,605

-3.2

2,856

749

20.8

188

100

28

489

151

30.9

-67

405

405

49.2

11.2

FY16

14,295

11.2

11,571

2,725

19.1

643

399

77

1,759

617

35.1

2

1,140

1,140

36.9

8.0

FY17E

14,336

0.3

11,397

2,939

20.5

723

346

140

2,010

637

31.7

-220

1,593

1,593

39.7

11.1

4.3%

10.1%

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.