31 January 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

27,850

-0.1

Nifty-50

8,633

-0.1

Nifty-M 100

15,639

0.0

Equities-Global

Close

Chg .%

S&P 500

2,281

-0.6

Nasdaq

9,448

0.3

FTSE 100

7,118

-0.9

DAX

11,682

-1.1

Hang Seng

9,804

-0.5

Nikkei 225

19,369

-0.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

54

-0.7

Gold ($/OZ)

1,196

0.4

Cu (US$/MT)

5,811

-1.2

Almn (US$/MT)

1,797

-1.0

Currency

Close

Chg .%

USD/INR

67.9

-0.1

USD/EUR

1.1

0.0

USD/JPY

113.8

-1.2

YIELD (%)

Close 1MChg

10 Yrs G-Sec

6.4

0.0

10 Yrs AAA Corp

7.6

0.0

Flows (USD b)

30-Jan

MTD

FIIs

0.1

-0.1

DIIs

0.0

0.6

Volumes (INRb) 30-Jan MTD*

Cash

226

219

F&O

2,080

4,001

Note: YTD is calendar year, *Avg

YTD.%

4.6

5.5

9.0

YTD.%

1.9

2.1

-0.3

1.7

4.4

1.3

YTD.%

-1.7

3.8

5.2

5.4

YTD.%

0.0

1.7

-2.7

YTDchg

-0.1

0.0

CY16

2.9

5.3

CY16*

220

3,447

Today’s top research ideas

v

Vodafone and Idea Cellular issued a press release on 30 January 2017 highlighting

that they are in a preliminary discussion to explore merger opportunities. This deal

is likely to have large-scale ramifications in the telecom industry, as the merged

company may emerge as a leader with ~42% revenue market share and a strong

broadband network.

v

It would also help reduce their annual capex by ~20-25% and improve EBITDA

margin by ~500bp. Assuming both Vodafone and Idea have an equal stake, the

combined entity should be valued at ~7x EV/EBITDA, reducing leverage by 10-15%,

albeit with a low post-tax RoCE of 5%. We believe Idea’s stock is not a play on

valuation, but on the likely improvement in its market standing post the merger,

which should address the key concern around its earnings visibility.

Idea: Vodafone-Idea merger; Telecom behemoth in the making

Research covered

Cos/Sector

Idea Cellular

HDFC 3QFY17

Bajaj Fin. 3QFY17

Shree Cement 3QFY17

Godrej Cons. 3QFY17

Tech Mah. 3QFY17

Grasim Ind. 3QFY17

Emami 3QFY17

Info Edge 3QFY17

Dish TV 3QFY17

Just Dial 3QFY17

Granules 3QFY17

Results Flash

Results Expectation

Key Highlights

Vodafone-Idea merger: Telecom behemoth in the making

Pick-up in corporate business leads strong core PBT beat

Profit beat led by strong AUM growth

Steady performance in challenging environment

Domestic branded volume growth down 3%; healthy margin performance

Continuum of recovery in Telecom and margins

VSF continues to shine; Chemical under pressure

Robust domestic performance; margin expansion continues

Slump in Recruitment drives significant miss

Demonetization impacts recharges and subscriber additions

Focus on core business; advertisement campaign launch soon

Continued margin improvement; multiple levers ahead

GE T&D | V-Guard | Monsanto | Kitex Garments

BJAUT | CDH | DABUR | IOCL | ICICIBC | INDIGO | JSTL | KSCL | MPHL |

ONGC | OINL | SHOP | SHTF | TTKPT

Quote of the day

A business that makes nothing but

money is a poor business

Piping hot news

Vodafone confirms Idea merger talks, could create India’s biggest telecom firm

v

Consolidation in India’s $27 billion telecom industry received a massive boost

with Vodafone Group Plc. confirming that it is in talks for a merger of its

Indian unit with Aditya Birla Group’s Idea Cellular Ltd.

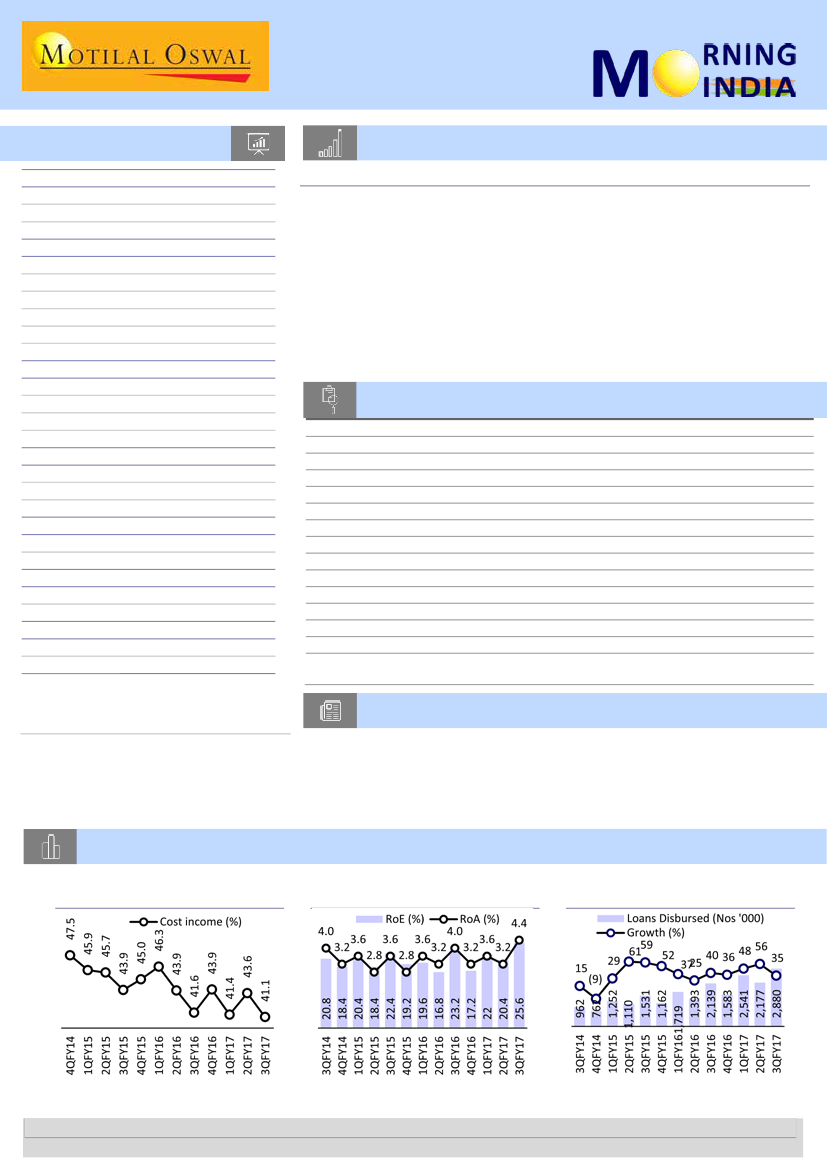

Chart of the Day: Bajaj Finance - Profit beat led by strong AUM growth

Cost/income ratio on a downward

trajectory

Trend in RoE and RoA

Nos. of loan disb. grew at healthy 35%

YoY

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.