P&G Hygiene and

Healthcare

BSE SENSEX

28,335

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

8,768

PG IN

32.5

219.8 / 3.3

7280 / 5620

-5/1/12

41

29.4

2 February 2017

3QFY17 Results Update | Sector: Consumer

CMP: INR6,963

TP: INR8,250 (+18%)

Buy

Sales disappoint, EBITDA and PAT well ahead of expectations

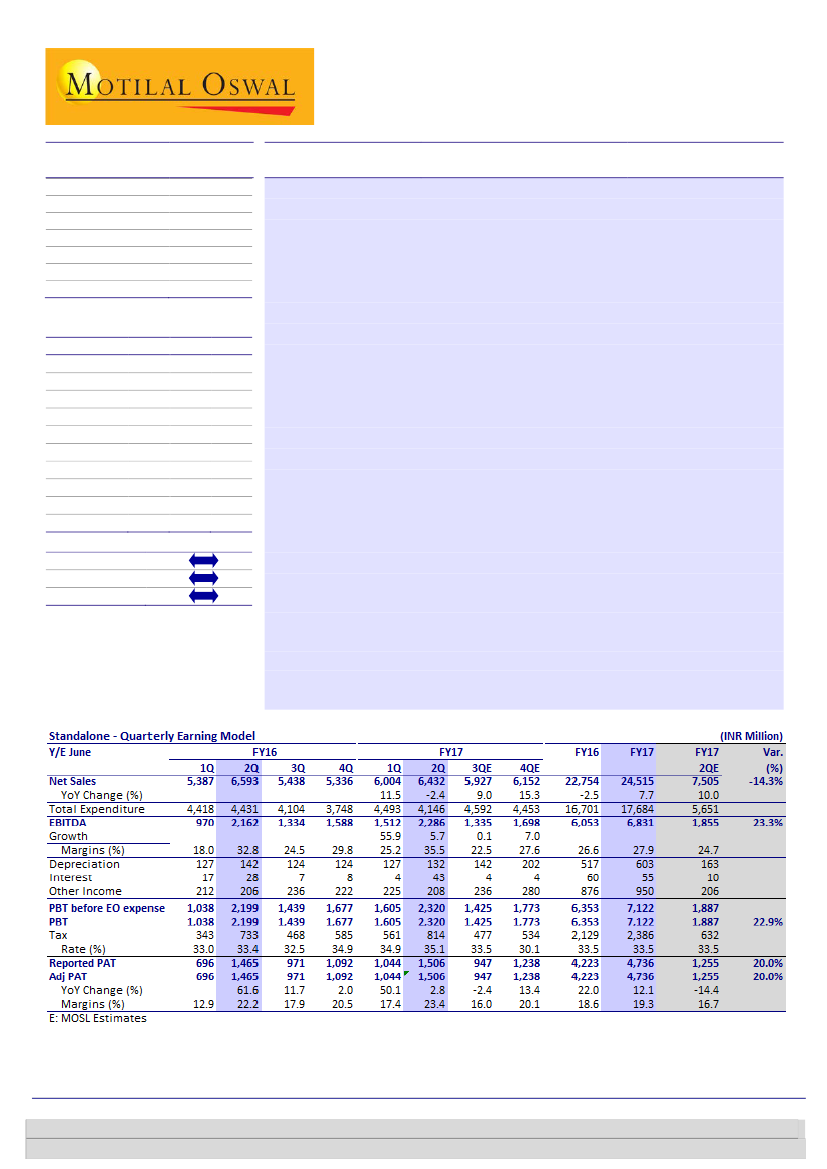

Sales declined 2.4% YoY (est. of +10%) to INR6.43b.

EBITDA margin at 35.5%,

however, was up 270bp YoY (est. of -700bp due to fears of a high base). EBITDA

increased by 5.7% YoY (est. of -14.3%) to INR2.29b and PAT by 2.8% YoY (est. of

-14.4%) to INR1.51b.

Demonetization affects sales:

Management stated that unforeseen liquidity

crunch impacted trade inventories and consumer offtake. While the company

did not give segmental details, we assume that Healthcare (29% of sales in

FY16) is likely to have been affected more post demonetization.

Gross margin expansion healthy:

Gross margin expanded 330bp YoY to 63.7%.

Staff costs were flat YoY at 4.3% of sales and advertisement costs declined

10bp YoY to 8.5% of sales. However, other expenses increased 70bp YoY to

15.4% of sales, partially offsetting gross margin gains.

Balance sheet highlights:

(1) Both inventory and debtors have increased over

June 2016 levels. Net working capital was marginally positive at end-December

2016 at INR228m, as against negative INR470m at end-June 2016. We expect

net working capital to normalize by end-June 2017. (2) Inter-group lending,

which has been reducing sharply over past two years, was flattish in December

2016 compared to June 2016.

Valuation and view:

PGHH’s has distinct advantages over FMCG peers, as (1) it

is in a much faster growing category and (2) it enjoys far superior barriers to

entry in its key Feminine Hygiene segment (69% of sales). Its ongoing

distribution expansion and unmatched category development efforts will only

enhance the entry barriers further. Consequently, longer-term earnings

prospects are far superior to FMCG peers. We maintain 45x target multiple on

December 2018 EPS, arriving at a target price of INR 8,250 (8,340 earlier).

Financials & Valuations (INR b)

Y/E June

2016 2017E 2018E

Net Sales

22.8

24.5

29.2

EBITDA

6.1

6.8

7.9

NP

4.2

4.7

5.4

EPS (INR)

129.9 145.7 167.7

EPS Gr. (%)

22.0

12.1

15.0

BV/Sh. (INR)

465.6 539.8 624.8

RoE (%)

30.8

29.0

28.8

RoCE (%)

31.3

29.4

29.1

P/E (x)

53.6

47.8

41.5

P/BV (x)

15.0

12.9

11.1

Estimate change

TP change

Rating change

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 3982 5428

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 3980 4261

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.