13 February 2017

3QFY17 Results Update | Sector: Metals

NMDC

Buy

BSE SENSEX

28,352

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,805

NMDC IN

3,164

459.6 / 6.9

150 / 79

-3/44/61

406

25.1

CMP: INR145

TP: INR179(+23%)

Strong quarter used for cleaning balance sheet

Strong volumes and prices driving upgrades; Reiterate Buy

NMDC’s 3Q results marked a significant improvement in its performance as

EBITDA increased 72% QoQ/121% YoY to INR14.2b (in-line) led by higher

volumes and realization. The EBITDA is adjusted for a few non-cash one-offs

(Exhibit 1). Other income was down 43% QoQ to INR1.6b on lower cash balance

post large buy-back. PAT, adjusted for the one-offs and exceptional charge, was

up 45% QoQ/57% YoY to INR10.3b (in-line).

Sales were up 25% QoQ/39% YoY to 10.1mt, led by an increase in domestic

steel production (+8.5% YTD December). Exports share was 7.8% (vol. of

0.78mt).

Production was up 54% QoQ/32% YoY to 9.7mt.

Domestic iron ore realization was up 15% QoQ to INR2,403/t. EBITDA/t rose

INR384 to INR1,415.

Raising volumes, prices and target price; Reiterate Buy

NMDC’s dispatches continue to grow strongly, driven by an increase in

domestic steel production, particular at the key customers of NMDC.

Favorable pellet economics is also fueling domestic iron ore demand.

Volumes in January were up ~39% YoY and likely to exit the year with ~36mt.

Earnings growth will be fueled by recently announced price hikes of INR125-

300/t on supportive international iron ore prices and strong demand.

We raise volumes by ~2% and realization by ~3% for FY18E/19E. TP is revised

to INR179/share (from INR168/share) based on 6.5x FY18E EV/EBITDA.

The stock trades cheap at 4.7x FY18E EV/EBITDA adjusted for the CWIP for

EBITDA CAGR of ~33% over FY16-18E.

Reiterate Buy.

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

64.6

87.8

Net Sales

32.3

47.2

EBITDA

33.2

38.6

PAT

8.4

12.2

EPS (INR)

-49.7

45.9

Gr. (%)

75.9

76.1

BV/Sh (INR)

15.9

13.5

RoE (%)

15.6

12.5

RoCE (%)

17.3

11.9

P/E (x)

1.9

1.9

P/BV (x)

2018E

99.1

57.5

38.9

12.3

0.8

81.2

15.6

14.6

11.8

1.8

Estimate change

TP change

Rating change

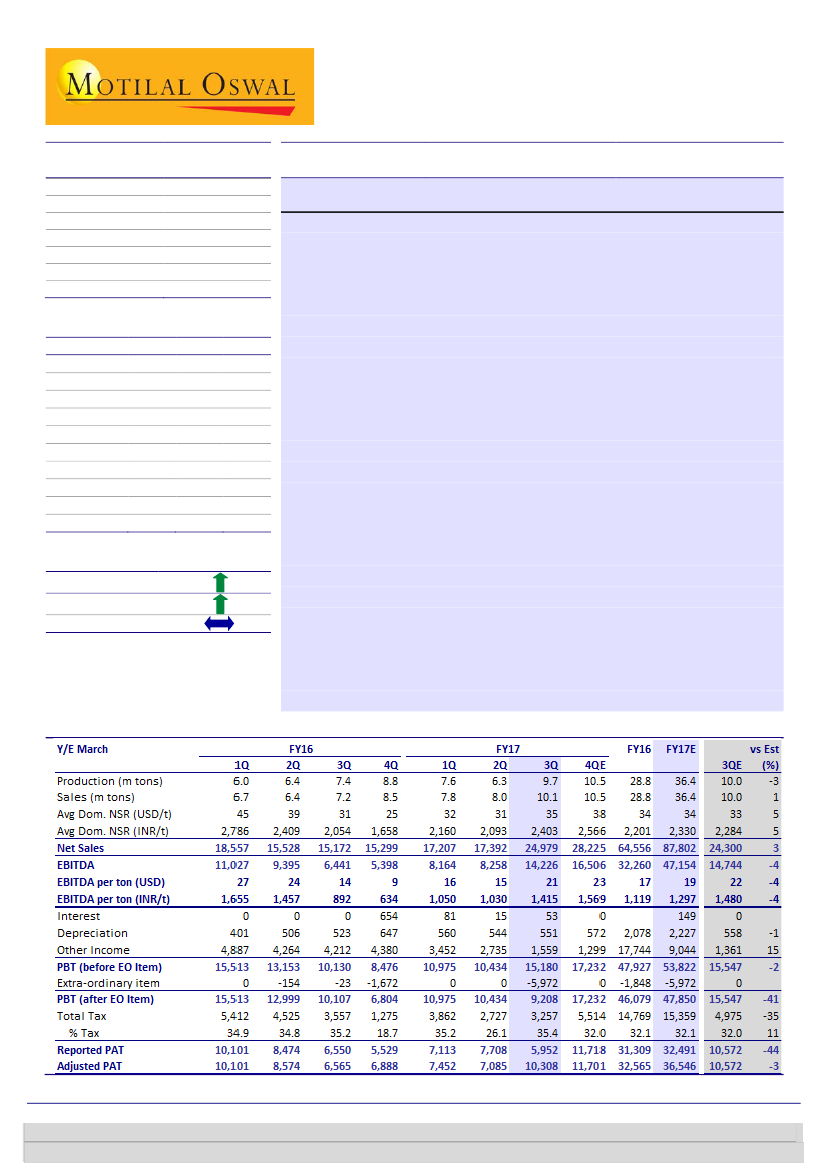

Quarterly Performance – INR million

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 6129 1523

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 6129 1549