Container Corporation

BSE SENSEX

28,334

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,794

CCRI IN

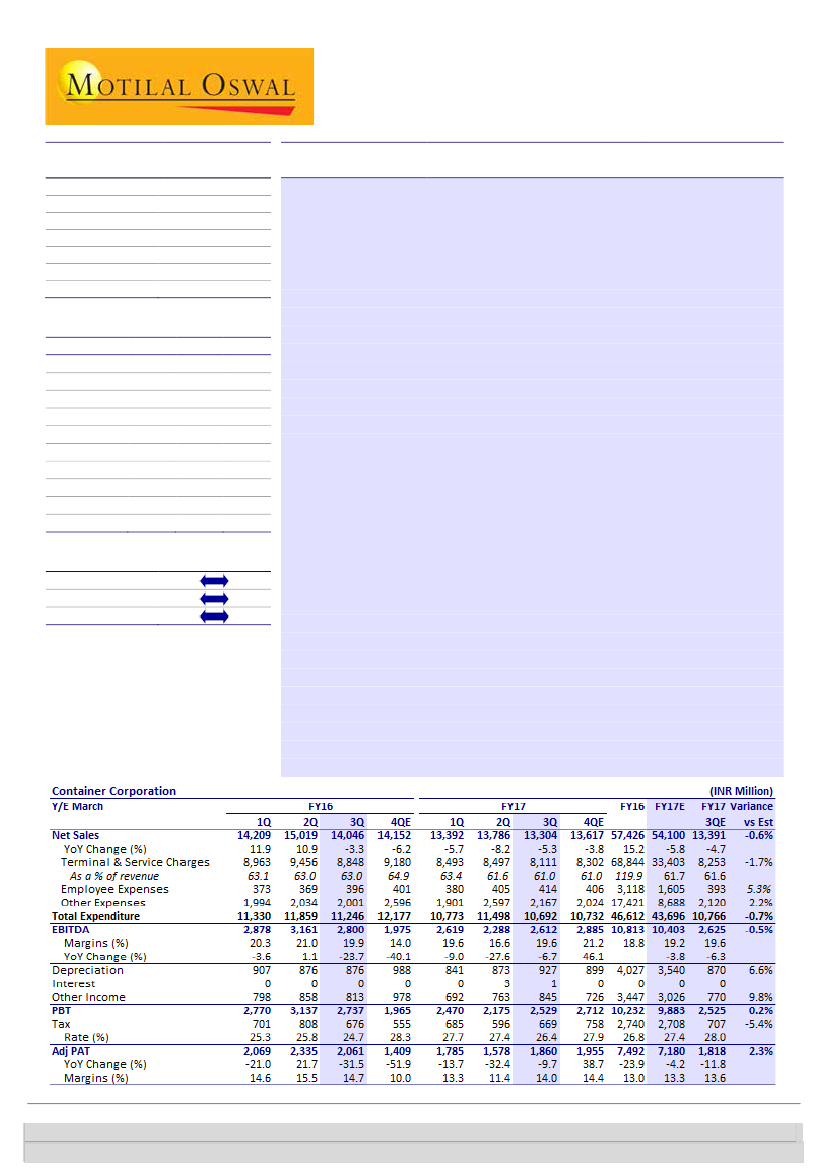

In-line performance amid weak macro; market share gain is encouraging

195

n

Sequential improvement in operating performance:

3QFY17 EBITDA

258.6 / 3.9

increased 14% QoQ (-7% YoY) to INR2.62b (in-line), led by absence of

1544 / 1055

revision of land license fees pertaining to the previous period. However,

2/-11/-5

margin weakness over last 3-4 quarters was due to lower leads and higher

288

discounting. PAT of INR1.86b was marginally higher than estimate of

43.3

14 February 2017

3QFY17 Results Update | Sector: Logistics

CMP: INR1,278

TP: INR1,309(+2%)

Neutral

Financials & Valuations (INR b)

Y/E Mar

2016 2017E

Net Sales

63.1

59.5

EBITDA

11.6

10.4

PAT

7.8

7.0

EPS (INR)

40.1

36.0

Gr. (%)

-25.8

-10.3

BV/Sh (INR)

409.5

430.9

RoE (%)

10.1

8.6

RoCE (%)

9.7

8.3

P/E (x)

31.8

35.5

P/BV (x)

3.1

3.0

2018E

64.6

12.9

8.9

45.8

27.1

458.1

10.3

9.9

27.9

2.8

Estimate change

TP change

Rating change

INR1.82b due to higher other income and a lower tax rate.

n

Originating volumes grow modestly:

Originating volumes rose 7% YoY, led

by a pick-up in export volumes, as also exhibited by a 13% YoY rise in export

handling volumes for 3QFY17. Total handling volume grew 10% YoY to 783k

TEUs (EXIM at 666k TEUs: +11%YoY; domestic at 116k TEUs: +6% YoY).

n

Realizations continue to slide:

3QFY17 revenue declined 5% YoY (-3% QoQ)

to INR13.3b due to lower realizations, partially offset by higher volumes.

Realizations have been structurally trending lower due to a reduction in lead

distance by ~11% YoY in EXIM movement in 3QFY17. Hence, realizations in

EXIM (per teu) stood at INR15,883 (-16% YoY, -5% QoQ) and in domestic at

INR23,277 (-5% YoY, -2% QoQ).

n

EXIM EBIT (per teu) was INR2,718 (-22% YoY, +4% QoQ), while domestic EBIT

came in at INR27m due to higher empty running expenses. EXIM EBIT

retention/TEU appears to be lower due to higher trans-shipment volumes

and increased discounting. Management expects margin to improve due to

increased proportion of double stacking at Khatuwas terminal.

Valuation and view

n

While CONCOR’s volume recovery has been delayed, its growth story remains

intact. Completion of the dedicated freight corridor (DFC) expected in 2HFY19

will be a significant efficiency/profitability driver for CONCOR. However, long-

gestation MMLP projects are likely to impact the company’s near-term ratios

(RoEs at sub ~10% in FY17/18). A hike in freight rates by railways poses a near-

to medium-term risk.

n

On DFC-based valuation (WACC: 12.3%, TGR: 4.5%), we arrive at a fair value

of INR1,309. The stock trades at 25.5x FY19E EPS of INR50. With near-term

volume concerns, rich valuations and limited upside to our fair value, we

maintain

Neutral.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Abhishek Ghosh

(Abhishek.Ghosh@motilaloswal.com); +91 22 3982 5436

Abhinil Dahiwale

(Abhinil.Dahiwale@motilaloswal.com); +91 22 3980 4309