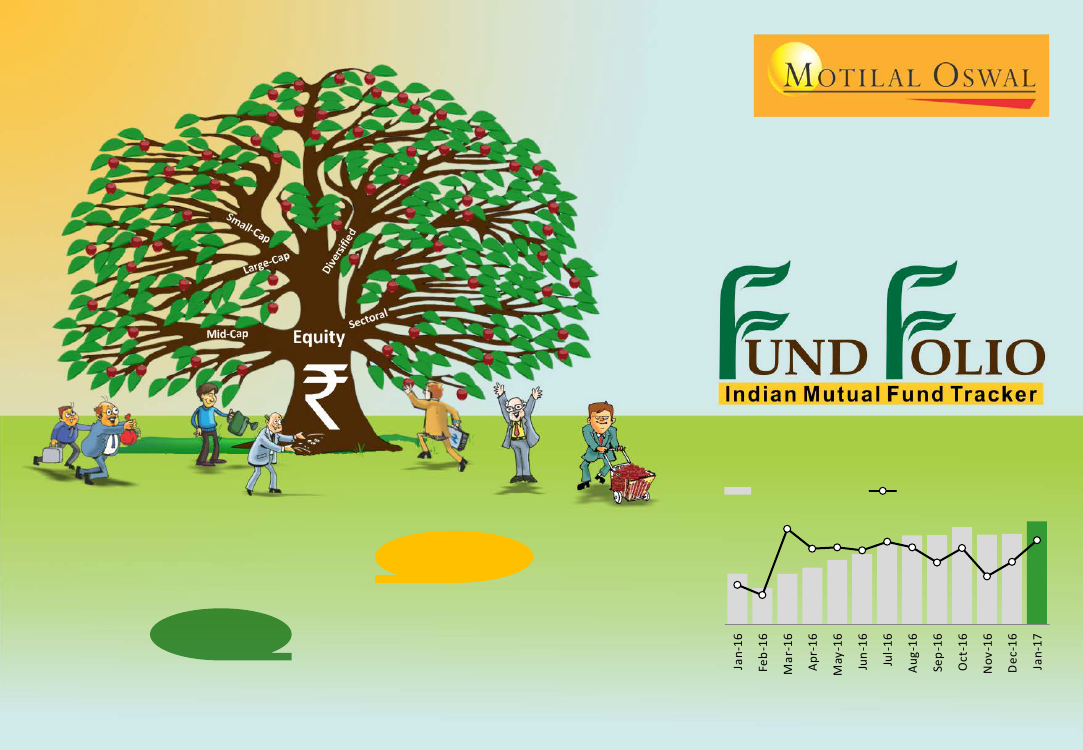

Equity AUM up 5.5% in January - the highest rise

in last 10 months

Equity AUM (INR t)

8.3

Equity AUM Chg MoM (%)

3.6

-3.2

5.5

Total AUM of MF industry at all-time high; up

5.5% MoM—the 3rd quickest 1t jump

5.2 3.8

3.5 3.8 3.1

INR17.4t

0.1

0.3

-5.3

-7.8

3.5 3.2 3.4 3.6 3.7 3.8 4.0 4.2 4.2 4.3 4.2 4.2 4.4

INR37b

Net inflows in January

down 60% MoM

Investors are advised to refer to important disclosures made at the last page of the Research Report.

February 2017