17 February 2017

Market snapshot

Equities - India

Sensex

Nifty-50

Nifty-M 100

Equities-Global

S&P 500

Nasdaq

FTSE 100

DAX

Hang Seng

Nikkei 225

Commodities

Brent (US$/Bbl)

Gold ($/OZ)

Cu (US$/MT)

Almn (US$/MT)

Currency

USD/INR

USD/EUR

USD/JPY

YIELD (%)

10 Yrs G-Sec

10 Yrs AAA Corp

Flows (USD b)

FIIs

DIIs

Close

Chg .%

28,301

0.5

8,778

0.6

16,096

1.7

Close

Chg .%

2,347

-0.1

9,771

-0.3

7,278

-0.3

11,757

-0.3

10,455

0.2

19,348

-0.5

Close

Chg .%

55

0.0

1,239

0.4

5,983

-1.1

1,884

-0.8

Close

Chg .%

67.1

0.2

1.1

0.7

113.2

-0.8

Close 1MChg

6.8

0.0

7.8

0.1

16-Feb

MTD

0.0

0.4

0.1

0.6

16-

Volumes (INRb)

Feb

MTD*

Cash

244

276

F&O

7,111

4,810

Note: YTD is calendar year, *Avg

YTD.%

6.3

7.2

12.2

YTD.%

4.8

5.6

1.9

2.4

11.3

1.2

YTD.%

-0.6

7.5

8.3

10.5

YTD.%

-1.3

1.5

-3.2

YTDchg

0.3

0.2

YTD

0.4

1.3

YTD*

243

4,266

Today’s top research ideas

CEAT (Initiating Coverage): Well balanced

CEAT will continue focusing on the consumer-facing passenger segment –

two wheeler (2W)/passenger vehicles (PV), evident from its plan to double

capacity over FY16-18. This is likely to help expand its market share in

2W/PV from 27%/9%.

Its foray into high-margin, export-focused off-highway tyres is likely to drive

the dwindling exports business.

The product mix should improve further in favor of 2W/PV from 38% to 49%

over FY16-19E, partly insulating the company against rubber price volatility

and improving margins.

Over FY17-19E, we expect revenue/PAT CAGR of 11%/ 25%, with a 150bp

margin expansion and a 260bp RoE improvement to 19%. We value the

stock at 10x FY19E EPS, and initiate coverage on CEAT with a Buy rating and

a target price of INR1,406 (implying ~29% upside).

Expanding capacity in PV/2W to bolster growth

Research covered

Cos/Sector

Telecom

Capital Goods

Cadila

Voltas

Key Highlights

Consolidation to change industry dynamics for the better

Bangalore Aero Show; ‘Make in India’ focus visible

Moraiya re-inspection over with no 483s

Operational results above estimates; maintain Neutral

CEAT (Initiating Coverage)

Well balanced; Expanding capacity in PV/2W to bolster growth

Piping hot news

TCS announces buyback; Infosys, Wipro may follow

Barely a week after the US-based software services player Cognizant

Quote of the day

Money, if it does not bring you

happiness, will at least help you be

miserable in comfort

Technology Solutions, which has several delivery centres in India, announced

plans to return $3.4 billion to its shareholders through buyback of shares and

dividends…

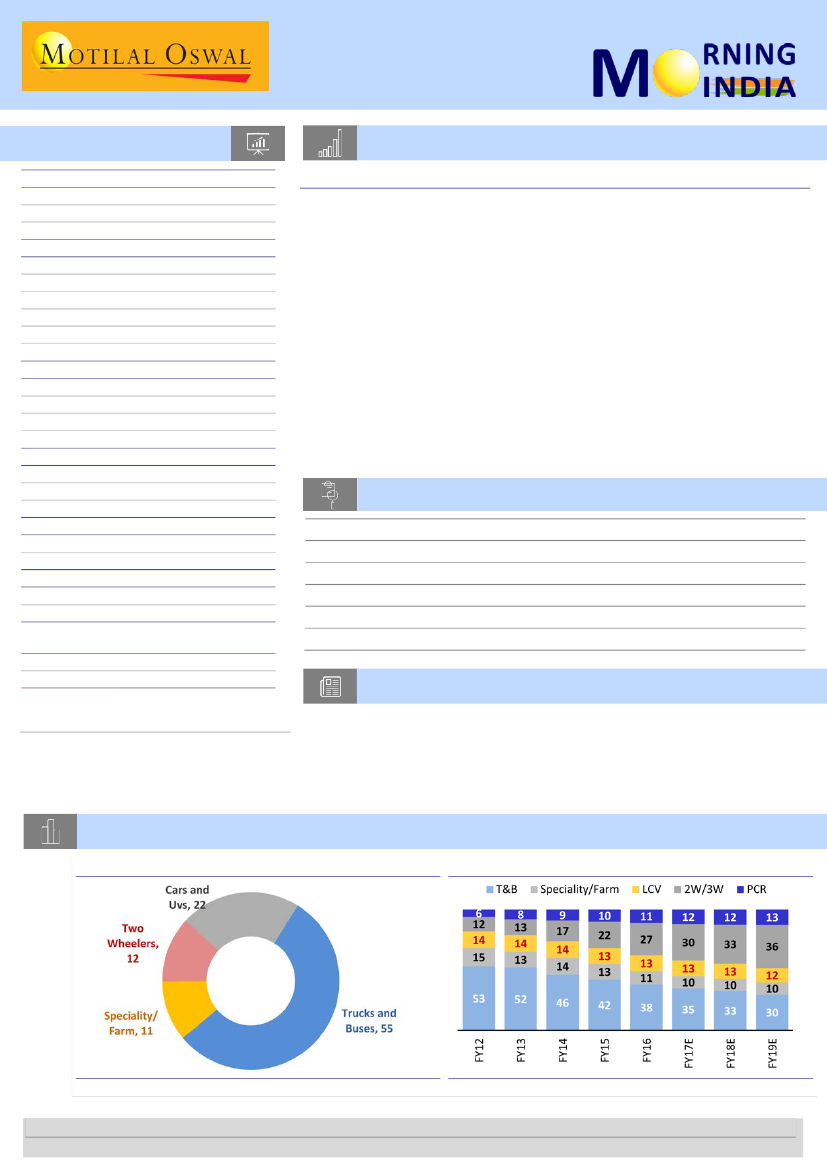

Chart of the Day:

Ceat -

Strategic capital allocation in profitable segments

Industry product mix relied on T&B

Shift in product mix to 2W/PV

Source: Company, MOSL

Source: MOSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.