Power monthly

Generation up 3.5% YoY in

February

Sector Update | Utilities

Sector: Utilities - Power

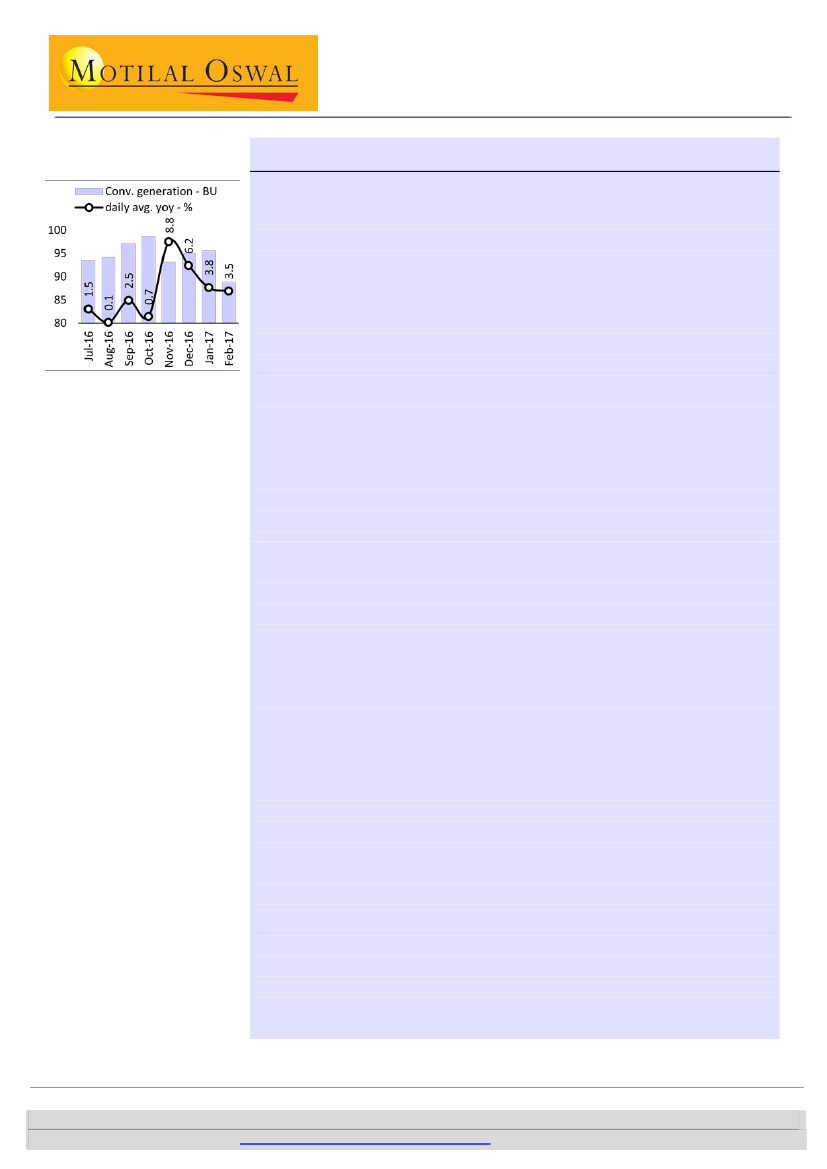

February 2017: daily avg. generation up 3.5% YoY

Quarter of incremental power demand met by RE in 10mFY17

Conventional daily avg. generation up 3.5% YoY in February (+4.6% YTD)

Conventional daily avg. power generation increased by 3.5% YoY in February

2016.

Generation growth was largely similar at ~3-4% YoY across central, state and

private sector plants. Overall coal based generation growth of 3.4% YoY was also

similar to the broader trend.

NTPC standalone’s coal-based generation was flat YoY (leap year adjusted) in

February. PLF for its coal-based plants was down 180bps YoY to 80%.

Generation increased 4.6% YoY to 1,052bkwh in 11mFY17.

RE generation grew 32% YoY in January (latest reported). Wind and Solar

generation was double YoY. RE generation is up ~27% YoY in 10mFY17.

Share of RE has increased to 6.8% for 10mFY17 against 5.7% last year. As share

of incremental generation RE represented a significant ~24% in 10mFY17.

Including RE all-India generation grew 6.3% YoY in 10mFY17.

There was 1.1GW capacity added in January. Six units of Teesta-III (1,000MW)

were commissioned. Capacity addition stood at 7.3GW (v/s 12.9GW same

period last year) in 10mFY17.

All-India PLF of conventional capacities declined by 125bp YoY to 50% in

February and by 55bp YoY to 50% in 11mFY17.

PLF of coal-based power plants was down 226bp YoY to 60% in February and

261bp YoY to 60% in 11mFY17.

In January, southern region consumption growth was the highest at ~8% led by

growth in Karnataka, AP and Telangana. UP also reported strong growth of

~16%.

In 10mFY17, UP (+13%), Karnataka (+11%) and TN (+11%) have reported the

highest growth.

Wind and Solar generation doubles YoY in January; RE share increasing

1.1GW capacity added in January, PLFs down 125bps YoY

Strong growth in consumption in southern regions in January

IEX: rates uptick marginally MoM; volume growth moderates

IEX all-India rates were up ~2% MoM to INR2.5/kWh, following ~8% MoM

increase in January. IEX volumes were up ~8% YoY (leap year adjusted).

JSW Energy: Vijaynagar PLF was up MoM to 78% in February, on back of 650MW

PPA with Karnataka. Ratnagiri’s PLF remains low at ~33% on shutdown.

CESC: Dhariwal’s PLF was at ~30%, largely unchanged MoM.

Rattan India: Plant is effectively shut for last eight months.

Merchant plants: JSW Vijaynagar’s PLF improves

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through important disclosures made at the last page of the Research Report.

1

8 March 2017

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.