Sector Update | 17 March 2017

Logistic

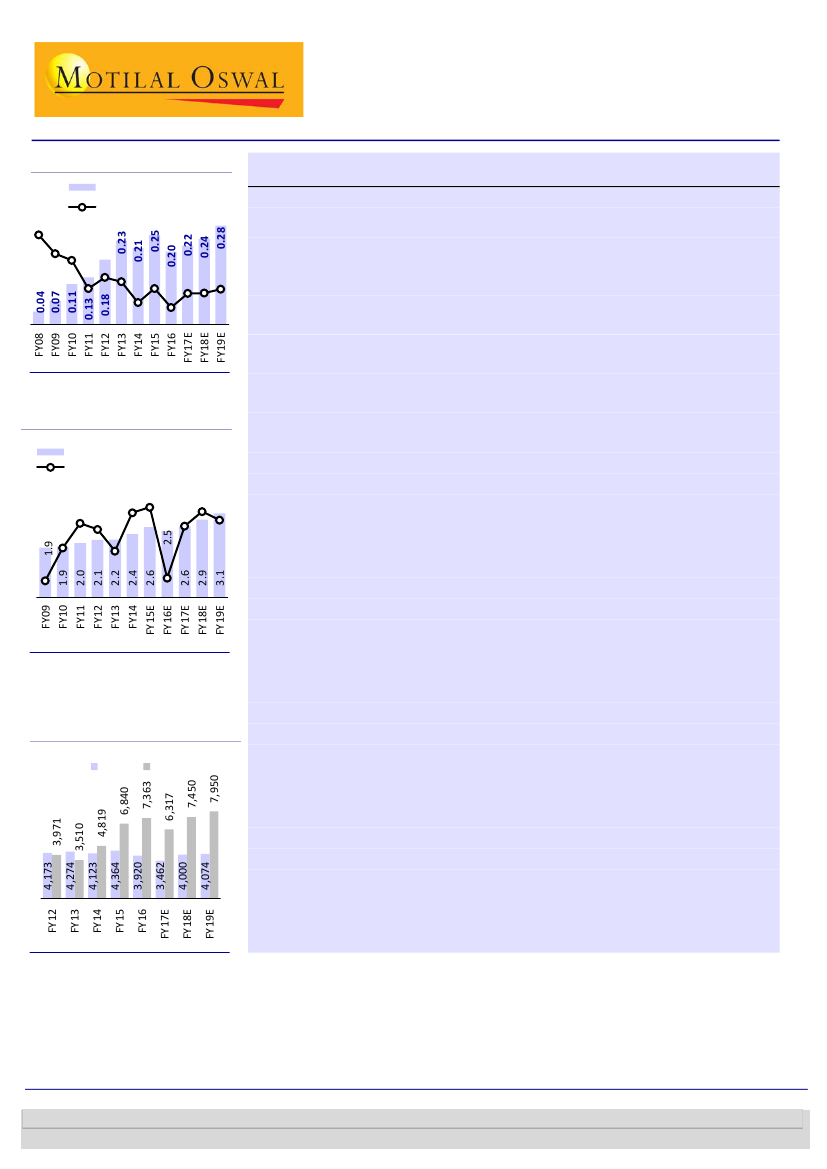

Gateway rail volume trend

Gateway Rail (M TEU)

116

81

YoY (%)

69

17

37 29

-9

17

-18

8 8 16

Revival in rail container volumes likely

Pricing environment improving

Concor EXIM volume trend

Concor EXIM - Volumes (M TEU)

Y-o-Y Change (%)

7.2 5.8

1.5

-6.2

-5.6

0.8

9.711.0

10.0

6.6 8.0

We expect a pick-up in container rail volumes over next 12-18 months, led by: 1) a

revival in EXIM trade and 2) the rail sector becoming more competitive and thus taking

market share from road sector.

Pricing in the rail sector has likely bottomed out, given easing competitive intensity.

Against this backdrop, Container Corp (Concor) has initiated price hikes on the key

routes of Kathuwas and Ludhiana with effect from 1 March 2017.

Margins of the rail logistics players are likely to improve due to better volume

aggregation and cost-efficient measures adopted by players like Concor and Gateway

Rail Freight Limited (GRFL).

We prefer Gateway Distriparks (GDPL) over (Concor) due to the former’s better RoCE

profile, led by efficient capital allocation and a superior revenue mix.

Rail container volume revival on the cards

Container rail volumes in tonnage terms have been sluggish for past 24 months,

as the haulage hike taken toward end-FY15 led to market share loss for

container train operators (CTOs). Weak EXIM trade (particularly exports) further

impacted rail volumes for CTOs. We, however, expect a revival in container rail

volumes over next 12-18 months, led by 1) a recovery in EXIM trade growth (a

low base and a pick-up in exports) and 2) market share gains by the rail sector

due to its improved competitiveness (no haulage hike over past 24 months and

the subsequent increase in diesel prices).

Pricing environment improving led by reduced competitive intensity

EBITDA/TEU trend for Concor and

GRFL

CCRI

GDL

Pricing was under pressure over last 12 months as the commencement of new

terminals at Kathuwas and Ludhiana led to intensified competition among CTOs.

However, we do not anticipate the major terminals to add capacity in the north

region over next 12-18 months. Against the backdrop of easing competitive

intensity, Concor initiated a price increase in the Kathuwas and Ludhiana sectors

from 1 March 2017.

Margins bottoming out

Margins have been under pressure over past 24 months due to the subdued

pricing environment, as well as higher empty running charges led by trade

imbalance. With pricing improvement in the rail logistics space, GDPL

commencing the Virmagam terminal and higher double-stacking for Concor, we

expect margins for both Concor and GRFL to recover from the current levels.

Abhishek Ghosh

(Abhishek.Ghosh@MotilalOswal.com); +91 22 3982 5436

Abhinil Dahiwale

(Abhinil.Dahiwale@MotilalOswal.com); +91 22 3980 4309

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

8 August 2016

1