17 March 2017

Economy

Diving into Trending Themes

Only two states implement 7

th

Pay Commission in FY18

FY17 revised deficit, however, much higher than budgeted

Of the 15 major states that have presented their 2017-18 budget by now, only two (Madhya Pradesh and

Rajasthan) have made provisions for the 7

th

Pay Commission (PC) in FY18. Six states have already implemented

the 7

th

PC in 2016-17, while the rest are yet to do so.

Not surprisingly, on an aggregate basis, spending on salary & wages (S&W) is budgeted to grow slower in FY18

(12%) than in FY17 (15%). Furthermore, budgeted spending growth is not very high from average growth over

past three years (9.6%) and much lower than 23%-24% growth during the 5

th

and 6

th

PCs.

Furthermore, we find that the 5

th

and 6

th

PCs boosted physical savings, not consumption. This time, however,

with limited arrears and generally lower increase in salaries, a boost to (physical) savings is doubtful, let alone

consumption.

Finally, since many states have implemented the 7

th

PC in the current year, the fiscal deficit for FY17 as per the

revised estimate (RE) is much higher than the budget estimate (BE). Nevertheless, with only two states making

provisions for the 7

th

PC next year, the FY18 fiscal deficit for the states is likely to be in control.

in which we deep-dive into trending macro-economic

themes. This new product complements our existing

“Ecoscope” product, which is reserved for regular

updates on macro-economics.

“EcoKnowLedge”

is Motilal Oswal’s new product

About a year ago, there was too much excitement about

the Pay Commission awards. Not only was the central

government expected to implement 7

th

Central PC in

2016-17, but also most of the states were likely to follow

suit in the following years. The central government

employs about 5 million people (including defense

forces), while the state governments combined have a

workforce of about 10 million people. PC awards,

therefore, are not only important for the government

employees, but also for the economy due to the

expected consumption pick-up. As expected, the Center

implemented the 7

th

CPC in 2016-17 and the arrears

were disbursed with the

August 2016 salary.

However,

what went almost unnoticed was that several states also

implemented the PC in 2016-17 and revised the salaries

of the state government employees. A look at the 2017-

18 budgets of the 15 major states (accounting for ~65%

of total state budgets) reveals that total S&W spending

of these states grew 15% YoY in FY17 (as per revised

estimate (RE)) and is budgeted to grow 12% YoY in FY18

(as per budget estimate (BE)) versus growth of 9.6% in

the previous three years

(Exhibit 1).

It is also important

to note that this increase is much lower than 22.5%

growth during the 5

th

PC in late 1990s and 24% during

the 6

th

PC. Payout growth in the previous two PCs of the

states was broadly in line with that in the Center’s PC.

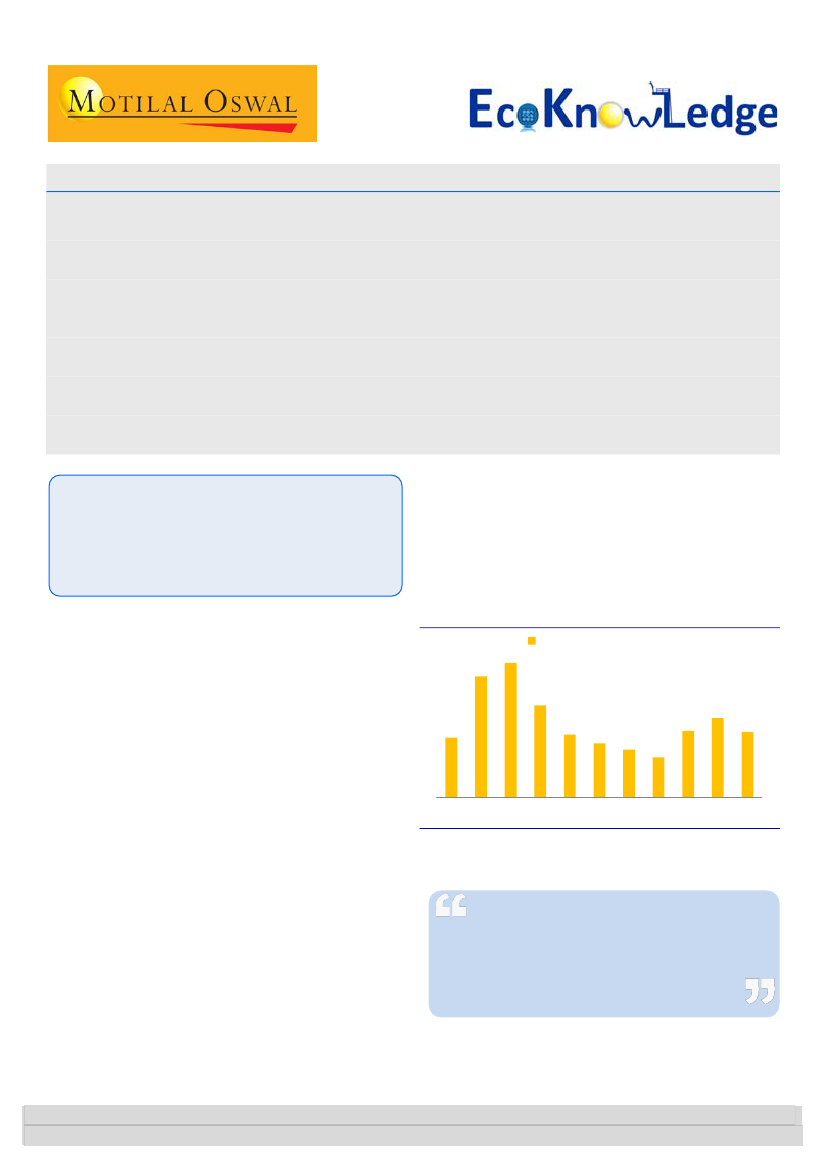

Exhibit 1: S&W bill for states* over the past decade

(% YoY)

23

25

S&W spending of states

17

11

12

10

13

9

7

15

12

FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18

* For 15 major states, accounting for ~65% of total state budgets

Source: State budget documents, Reserve Bank of India (RBI), MoSL

Total S&W spending of 15 states grew

15% YoY in FY17 (as per revised estimate

(RE)) and budgeted to grow 12% YoY in

FY18 (as per budget estimate (BE)) vs a

growth of 10.2% in the previous 3 years

Nikhil Gupta

(Nikhil.Gupta@MotilalOswal.com); +91 22 3982 5405

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.