22 March 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

29,485

-0.1

Nifty-50

9,122

-0.1

Nifty-M 100

16,926

-0.2

Equities-Global

Close

Chg .%

S&P 500

2,344

-1.2

Nasdaq

5,794

-1.8

FTSE 100

7,378

-0.7

DAX

11,962

-0.8

Hang Seng

10,644

0.6

Nikkei 225

19,456

-0.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

50

-1.6

Gold ($/OZ)

1,232

-0.1

Cu (US$/MT)

5,748

-1.8

Almn (US$/MT)

1,914

0.2

Currency

Close

Chg .%

USD/INR

65.2

-0.2

USD/EUR

1.1

0.4

USD/JPY

112.8

-0.5

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.9

0.0

10 Yrs AAA Corp

8.1

0.0

Flows (USD b)

21-Mar

MTD

FIIs

0.3

3.0

DIIs

-0.1

-1.2

Volumes (INRb) 21-Mar

MTD*

Cash

345

283

F&O

3,902

4,060

Note: YTD is calendar year, *Avg

YTD.%

10.7

11.4

17.9

YTD.%

4.7

7.6

3.3

4.2

13.3

1.8

YTD.%

-9.2

6.3

4.1

12.3

YTD.%

-3.9

2.4

-3.7

YTDchg

0.4

0.5

YTD

4.6

-0.4

YTD*

261

4,322

Today’s top research Idea

Delta Corp: Favorable odds

Dominating in ‘brick world’, entering ‘click world’

v

Delta Corp is the leading player in India's underpenetrated gaming market.

Gaming is an emerging industry in India; given its paltry size of ~USD150m

(Global size of USD183b), the growth potential is huge.

v

Approval of its casino in Daman is a key growth trigger for DELTA, as it would

nearly double its gaming capacity to ~3,000 and further cement its first-mover

advantage.

v

M&A opportunities in the fast-growing online gaming business in India would

allow DELTA to leverage its current strength and open up new avenues for

growth. It recently announced the acquisition of Adda52.com, an online poker

gaming website.

v

We expect 35% revenue CAGR, 45%/62% EBITDA and PAT CAGR over FY17-

19E. EBITDA would be driven by strong operating leverage. We initiate

coverage with a Buy rating. Our PT is INR229 (30x FY19E EPS), upside of ~36%.

Research covered

Cos/Sector

Delta Corp

Dr. Reddy’s

Divi’s Lab

Marico

Oil & Gas

Aviation Monthly

Key Highlights

Favorable odds; Dominating in ‘brick world’, entering ‘click world’

Duvvada 483 observations out; data integrity issues persist

Unit-2 receives import alert; key products exempted

Demand outlook improving; focus on technology paying off

Not much synergy in ONGC-HPCL merger

Feb-16 domestic air passenger growth at ~20% YoY

Piping hot news

Oil advances on talk of extension to Opec output cuts

v

Oil prices on Tuesday fell close to its lowest in a week as the market discounted

Quote of the day

Inflation is taxation without legislation.

the latest talk by OPEC that it would extend output cuts beyond June. That

decline also came ahead of the release of weekly U.S. crude inventory data later

Tuesday and on Wednesday that is expected to show a crude stock build of 2.6

million barrels, according to a Reuters poll.

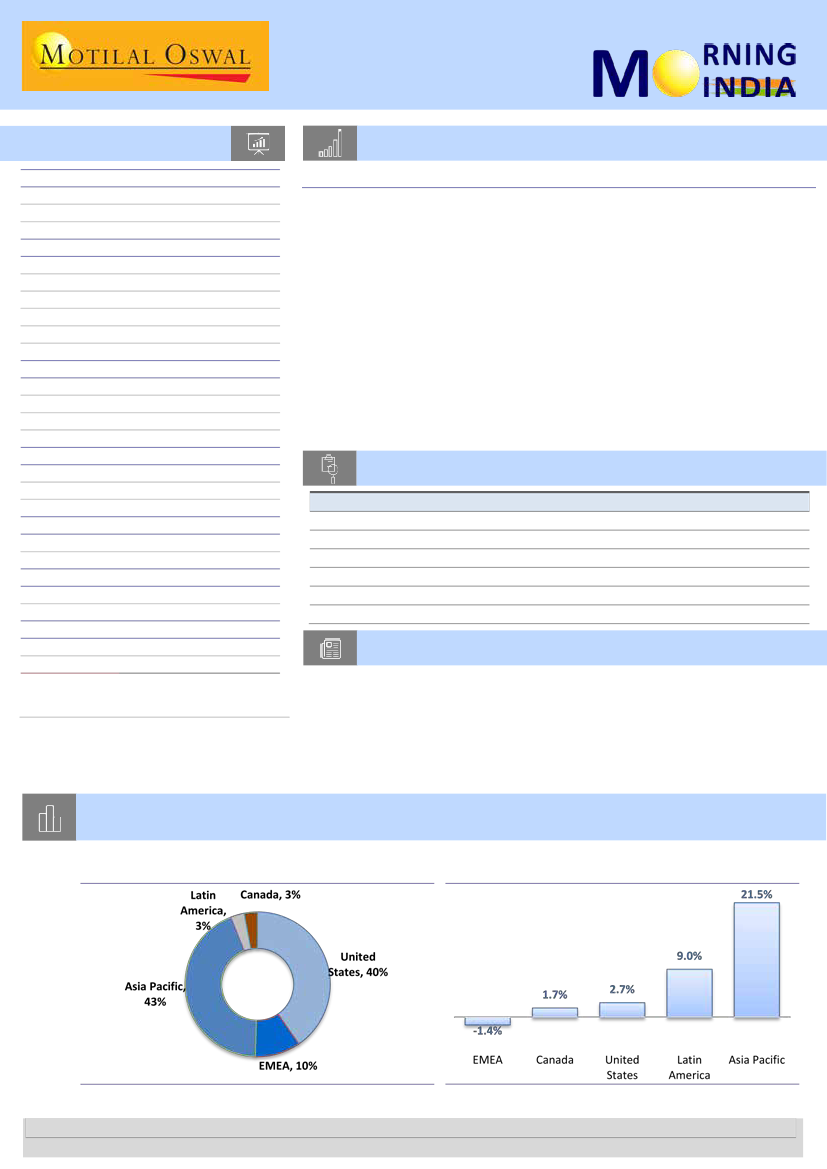

Chart of the Day:

India’s gaming market has huge potential (current size of USD150m)

Exhibit 1:

Asia Pacific region now dominates global

gaming market size of USD183b

Exhibit 2:

Asia Pacific has been the growth driver for the

industry (10year CAGR)

Research Team (Gautam.Duggad@MotilalOswal.com)

Source: Company, MOSL

Source: Company, MOSL

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.