Commodities Daily

Thursday, April 20, 2017

Overview

•

Asian markets mixed

•

Japan’s trade data better-than-forecast

•

UK lawmakers vote 522-13 to back June 8 snap

election

•

French elections becoming a four-way fight

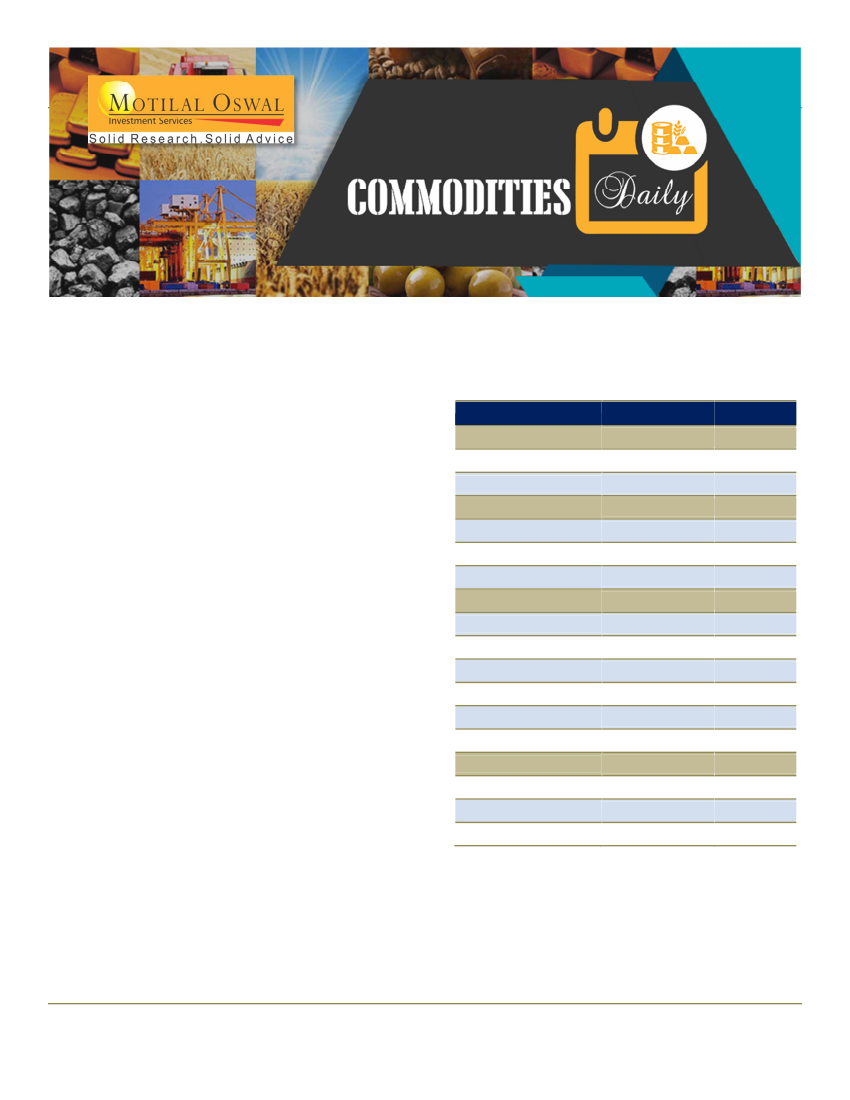

Close

Precious metals

Gold

Silver

Energy

WTI Crude oil

Brent Crude

Natural gas

Base metals – LME

COMEX Copper

Copper

Aluminium

Nickel

Lead

Zinc

Others

DXY

US 10yr

CBOE VIX

%Chg.

-0.8%

-1.0%

-3.6%

1.0%

1.2%

-0.6%

-0.4%

0.0%

-0.1%

-1.1%

-1.0%

0.2%

0.3%

1.7%

1278.91

18.08

50.44

53.35

3.197

343.5

5570

1912.5

9380

2136.5

2543

99.738

2.2089

14.91

Precious Metals

Precious metals are flattish at the open after yet

another choppy session yesterday. The Fed’s beige

book suggested that US economic activity continues

to grow at a modest-to-moderate rate across the

nation. The report also suggested that the labor

market continues to tighten as employers quoted

increasing turnover rates. Gold prices may however

find support owing to nervousness ahead of the

French election which have become a four-way fight.

Opinion polls show far-right leader Marine Le Pen

and centrist Emmanuel Macron will qualify for the

second round on May 7. Over the past few days, geo-

political concerns have also increased after the US

warning to North Korea.

Consequently, rate hike

p

robabilities have dropped in all remaining FOMC

meetings this year. Pricewise, we believe that

precious metals may continue to remain choppy even

as the trend remains bullish.

Please Refer to Disclaimer at the end of the report

Page 1