27 April 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

30,133

0.6

Nifty-50

9,352

0.5

Nifty-M 100

18,023

-0.2

Equities-Global

Close

Chg .%

S&P 500

2,387

0.0

Nasdaq

6,025

0.0

FTSE 100

7,289

0.2

DAX

12,473

0.0

Hang Seng

10,318

0.4

Nikkei 225

19,289

1.1

Commodities

Close

Chg .%

Brent (US$/Bbl)

51

-0.5

Gold ($/OZ)

1,265

-0.4

Cu (US$/MT)

5,689

0.2

Almn (US$/MT)

1,956

0.1

Currency

Close

Chg .%

USD/INR

64.1

-0.3

USD/EUR

1.1

0.1

USD/JPY

111.3

0.7

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.0

0.0

10 Yrs AAA Corp

7.9

0.0

Flows (USD b)

26-Apr

MTD

FIIs

-0.1

-0.2

DIIs

0.2

1.0

Volumes (INRb)

26-Apr

MTD*

Cash

345

301

F&O

7,953

5,107

Note: YTD is calendar year, *Avg

YTD.%

13.2

14.2

25.6

YTD.%

6.6

11.9

2.0

8.6

9.8

0.9

YTD.%

-7.8

9.1

3.0

14.8

YTD.%

-5.5

3.3

-5.0

YTDchg

0.4

0.3

YTD

6.4

1.2

YTD*

281

4,589

Today’s top research theme

Economy: Is fiscal policy reaching limits?

v

Over the past few years, states' tax receipts have weakened sizably, increasing

their reliance on the center. The combined tax-to-GDP ratio budgeted for

2017-18 is still meaningfully lower than the peak seen over a decade ago. Not

surprisingly then, the states have budgeted 13-year lowest growth in their

total spending, in line with the 12-year lowest growth budgeted by the center.

v

Not only the center, but the states too are focused on investments.

Consequently, the states have budgeted for 15-year lowest growth in

consumption spending. As per the second advance estimates, government

consumption spending is estimated to have grown 17% in FY17 and

contributed one-fourth to real GDP growth of 7.1%.

v

With flows from fiscal taps slowing and private investments remaining

lackluster, it might be difficult for private consumption to offset the entire

adverse effect. We would not be surprised if real GDP growth fails to pick up

in FY18.

Research covered

Cos/Sector

Economy

Axis Bank

LIC Housing Fin.

IDFC Bank

Zensar Technologies

KPIT Technologies

Results Expectation

Key Highlights

Is fiscal policy reaching limits?

NIMs surprises positively; Pool of stress loans remain unchanged

Core retail growth remains moderate at <10%YoY; Valuation limits upside

Focusing on retail assets; stressed assets stable

Two steps ahead, one step back; Profitability bogged down by restructuring

In-line performance, excluding the addition of MicroFuzzy

Biocon | Kotak Mah. Bank | Maruti | Shriram Trans | TVS Motor

Quote of the day

Piping hot news

If a financial institution is too big to fail, it

Sebi allows options trading in commodities

v

Capital market regulator the Securities and Exchange Board of India (Sebi) on

is too big to exist.

Wednesday announced the much-awaited commodity market reform of

permitting exchanges to launch options contracts.

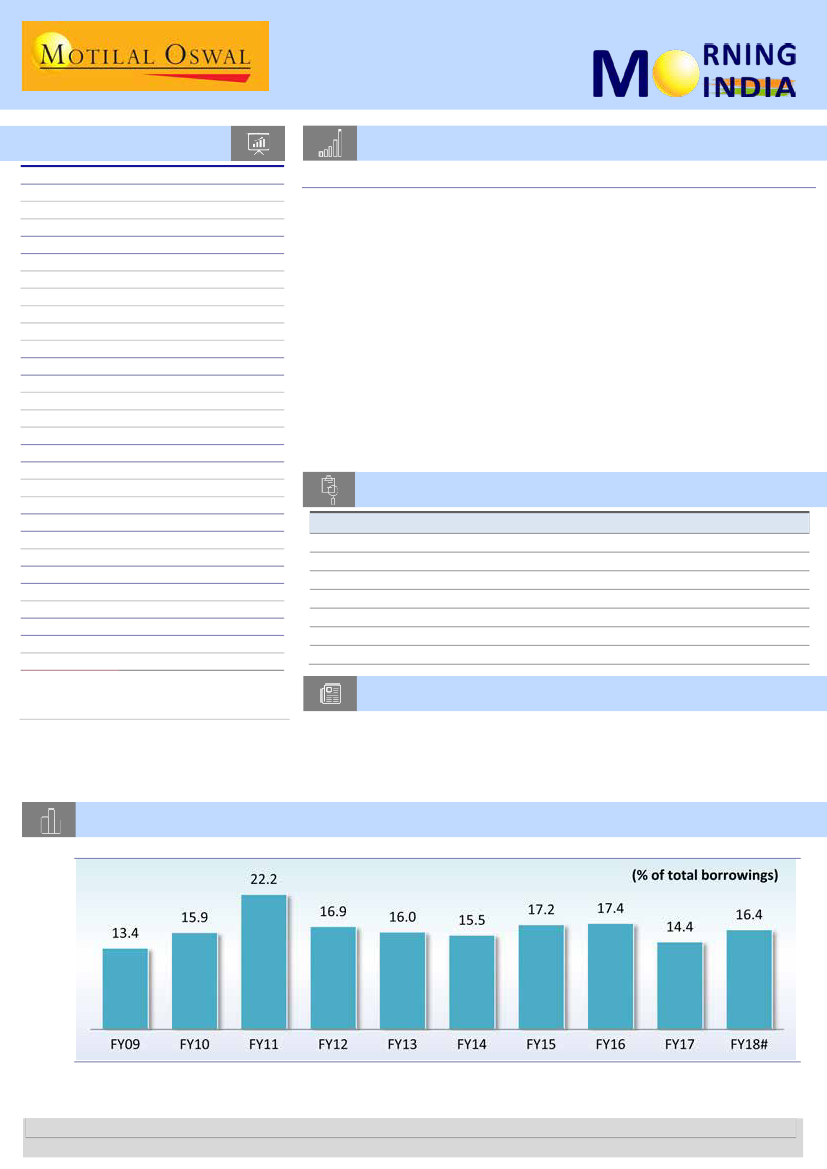

Chart of the Day: Economy (Is fiscal policy reaching limits?)

States estimated to borrow INR4.4t in FY18 (INRb) of which ~17% is planned in the first quarter

#Based on our estimate of full-year borrowings by all states

Source: States budgets, RBI, CEIC, MoSL

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.