Shriram Transport Finance

BSE SENSEX

30,030

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,342

SHTF IN

226.9

236.9 / 3.6

1325 / 778

-1/-11/-11

826

73.9

27 April 2017

4QFY17 Results Update | Sector: Financials

CMP: INR1,044

TP: INR1,269 (+22%)

Buy

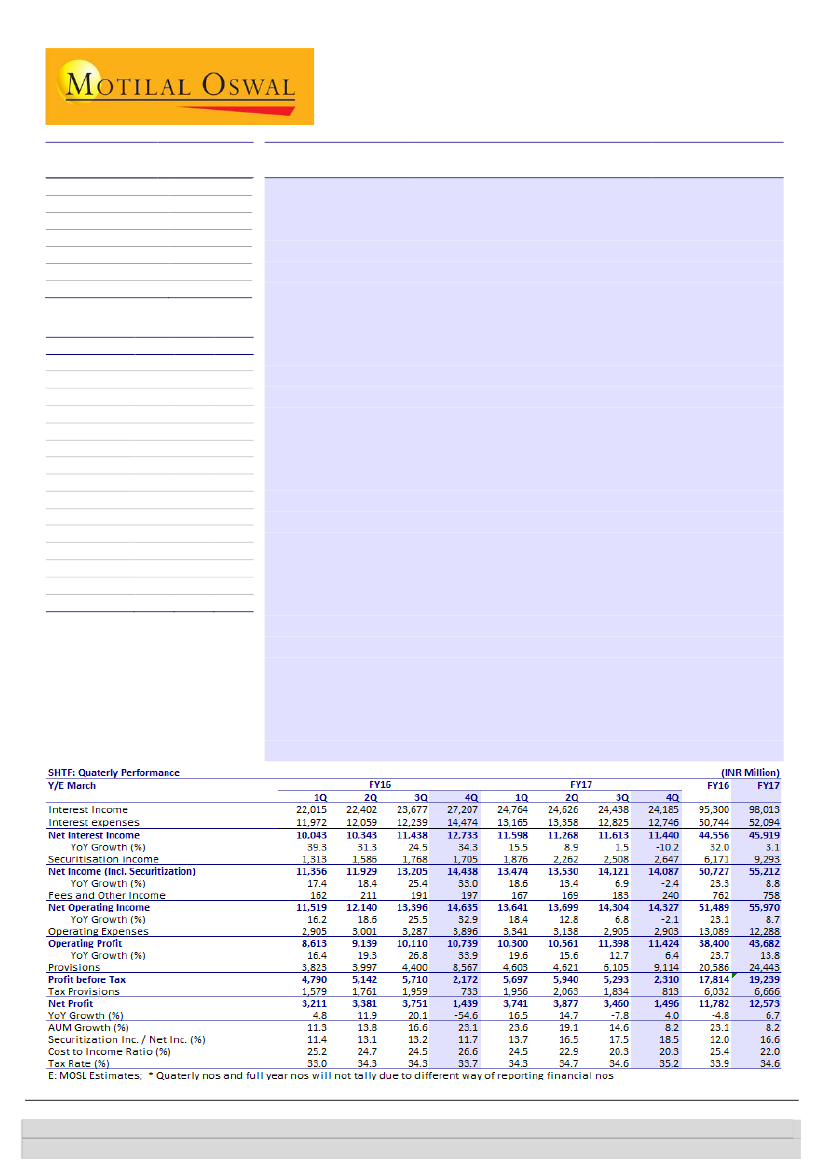

Performance better than expectation despite migration to 120dpd

Shriram Transport’s (SHTF) 4QFY17 PAT of INR1.5b was in line with our

estimate. Better-than-expected margins and controlled opex led to an 8% beat

on operating profit (+6% YoY).

Despite migration to 120dpd (15% of GNPA), management kept its focus on

balance sheet strength. PCR declined to just 70% from 75% a quarter ago.

Hence, provisioning was higher than estimate and led to in-line PAT.

Disbursement in old vehicle loans was INR93.5b, in line with the trend

witnessed over past 6-7 quarters. Management guided that a complete

recovery is 2-3 quarters away and that near-term growth will be driven by

improved agri demand. Management guided for 12-15% AUM growth in FY18.

Reported NIM on AUM contracted 20bp QoQ to 6.97%, driven by lower yields

due to interest reversals. However, we are enthused by the reduction in cost of

funds over past two quarters (-60bp). SHTF has borne significantly higher cost

of funds than peers (refer to Exhibit 2) due to high cost of legacy borrowings.

We expect a gradual decline in cost of funds over next 1-2 years as these

borrowings are replaced by lower-cost NCDs.

GNPL ratio increased 160bp QoQ to 8.2% due to the impact of NPA recognition

migration. GNPL on 180dpd basis was 4.55% v/s 4.5% in 2QFY17 and 4.3% in

4QFY16 (ignoring QoQ comparison due to demon impact).

PAT for FY17 was up 7% YoY at INR12.6b, while RoA/RoE was 1.7%/11.7%.

Valuation and view:

SHTF’s return ratios are at cyclical lows, with decadal high

credit cost and NPLs. We believe the worst of asset quality troubles is behind, and

SHTF should witness improving return ratios due to lower credit costs. Additionally,

we believe margin compression fears are overplayed with the company yet to reap

significant benefit on CoF. Delayed pick-up in infra activities is a risk. We cut our

FY18-19 estimates by 6%/2% to factor in slower AUM growth and higher PCR. The

stock trades at 1.9x/1.6x FY18/19E BV.

BUY

with a TP of INR1,269 (2x FY19E BVPS).

Financials & Valuations (INR b)

Y/E March

2017 2018E 2019E

Net Inc.

55.2 61.0 69.4

PPP

43.7 47.9 54.6

PAT

12.6 17.3 22.0

Cons.PAT

12.6 17.6 22.4

EPS (INR)

55.4 76.3 96.9

Cons. EPS (INR)

55.6 77.4 98.6

BV/Sh (INR)

498

554 634.0

Cons. BV (INR)

493

556 638.0

RoA on AUM (%)

2.0

2.6

2.9

RoE (%)

11.7 14.5 16.3

Payout (%)

21.2 18.6 17.4

Valuations

P/Cons. EPS (x)

18.8 13.5 10.6

P/Cons. BV (x)

2.1

1.9

1.6

Div. Yield (%)

1.0

1.2

1.4

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Piran Engineer

(Piran.Engineer@motilaloswal.com); +91 22 6129 1539

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.