Shriram City Union Finance

BSE SENSEX

29,895

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

S&P CNX

9,312

SCUF IN

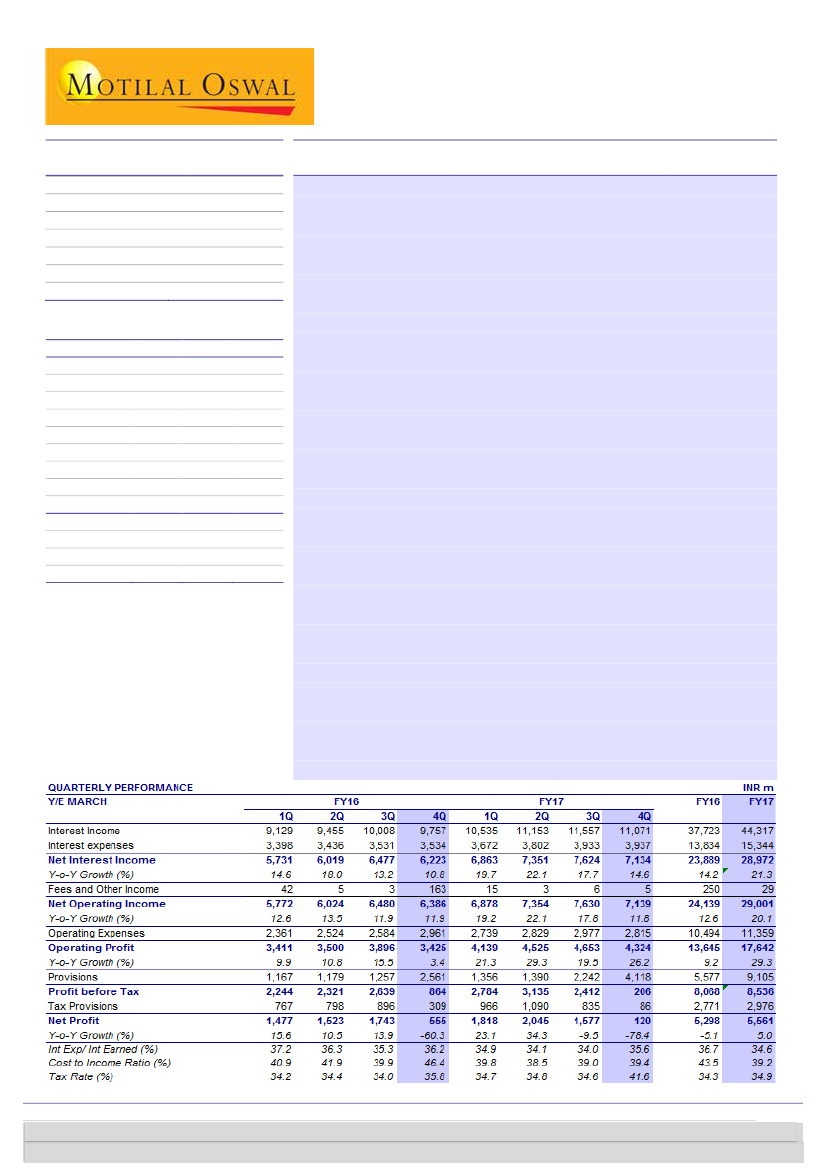

Strong operating performance; estimates largely unchanged

65.9

n

Shriram City Union Finance’s (SCUF) 4QFY17 PAT declined 78% YoY to

141.0/2.1

INR120m. However, this belies the strong operating performance in the

2650 / 1507

quarter. Operating profit was up 26% YoY (est. of +11%), driven by strong

-8/-23/11

loan growth, lower cost of funds and controlled opex.

124

66.2

n

After a muted 3Q, disbursements picked up 20% YoY to INR62.5b. As a

3 May 2017

4QFY17 Results Update | Sector: Financials

CMP: INR2,138

TP: INR2,689 (+26%)

Buy

Financials & Valuations (INR b)

Y/E March

2017 2018E

NII

28.9

33.7

PPP

17.6

21.0

PAT

5.6

8.6

EPS (INR)

84

130

EPS Gr. (%)

5

55

BV/Sh. (INR)

750

859

RoA (%)

2.7

3.6

RoE (%)

11.8

16.2

Payout (%)

23

17

Valuations

P/E (x)

25.3

16.4

P/BV (x)

2.9

2.5

Div. Yield (%)

0.7

0.8

2019E

39.5

n

24.8

10.9

165

26

n

997

3.9

17.8

16

13.0

2.1

n

1.0

n

result, AUM grew 18% YoY (+2.6% QoQ) to INR231b, driven by MSME

loans. Management continues to target 20%+ AUM growth in the non-

gold financing portfolio.

Total operating expenses declined 5% YoY/QoQ to INR2.8b, driven by a

9% decline in employee costs. Management is confident of improvement

in opex ratios in FY18/19 as the impact of the new MSME loan sourcing

strategy (under consultation with McKinsey) plays out.

Asset quality performed better than expectations. GNPL ratio of 6.73%

beat our estimate of 7.47%; however, write-offs were high at INR1.4b

(2.5% annualized). Collections, which dipped 9.9% in 3QFY17, improved

to 8.2% in the quarter. The company continues to make prudent

provisions on its NPLs, with PCR of 73% at the end of the quarter. Note

that SCUF’s PCR is best-in-class among our NBFC coverage companies.

Shriram Housing Finance, however, had a tough quarter with a decline in

disbursements (30% QoQ, 53% YoY) due to a difficult environment. The

company also sold loans (NPLs) worth INR500m to ARCIL, due to which

GNPL ratio improved 95bp QoQ to 2.6% (5.3% incl. sold-down loans).

Valuation and view:

SCUF is a niche play in the retail NBFC space with a

focus on MSME lending. Its business model offers high growth potential

with strong profitability. While we expect GNPL% to rise due to NPA

migration by FY18, we believe loan loss provisioning will decline as SCUF

has strong PCR of 73%. We believe this is a 3.5-4.0%+ RoA and 17-18%

RoE business on a run-rate basis. We keep our estimates largely

unchanged as lower opex in FY18/19 is offset by higher credit costs.

Buy

with a TP of INR2,689 (2.7x FY19E BVPS).

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Piran Engineer

(Piran.Engineer@MotilalOswal.com); +91 22 3980 4393

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.