4 May 2017

Corporate performance

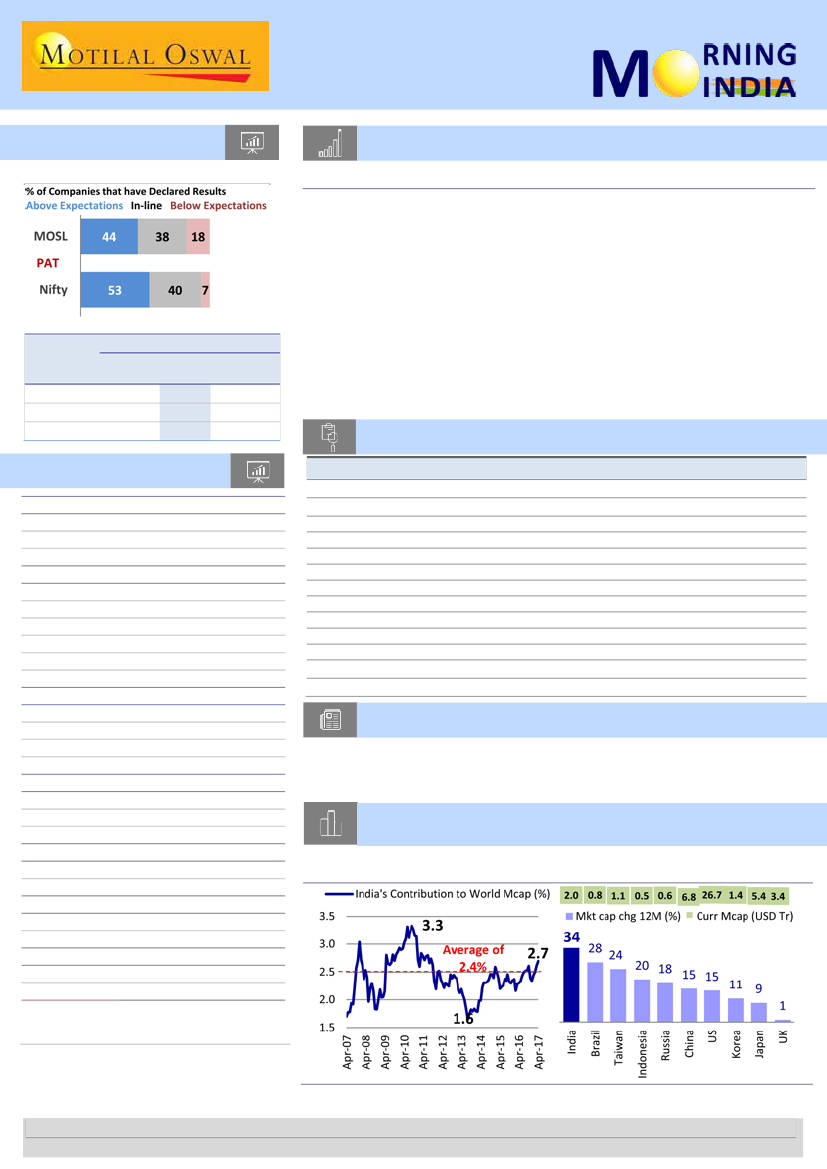

4QFY17: Expectations v/s delivery

Today’s top research theme

Bulls & Bears: Markets consolidate gains; Cyclicals outshine Defensives

v

After delivering 19% returns in FY17, the Nifty made a good start to FY18 with

1.4% gains in April-2017. Indian currency has also rallied 5.4% in the first four

months of CY17, bolstering dollar index returns. However, at 22.5x trailing 12

months and 19x FY18E P/E, valuations do not offer much comfort unless

accompanied by an earnings surprise, in our view.

v

Barring Healthcare, Technology, Oil & Gas and Utilities, all other sectors trade

at a premium to their respective LPA. Cement is now trading at a premium of

53% and 41% on P/E and P/B basis v/s LPA. In this edition of ‘Bulls & Bears’,

we take a deep dive into valuation metrics of the Oil & Gas sector.

v

India’s share in world market cap inches above historical average. Over last 12

months, world market cap has increased 14.4% (USD9.2t); India’s market cap

has increased 34%.

(no of

companies)

Sales

EBIDTA

PAT

Growth (YoY, %)

MOSL

Nifty

Sensex

(45)

(15)

(8)

15.7

16.8

17.5

7.8

10.3

3.7

9.7

1.4

7.8

Research covered

Cos/Sector

Key Highlights

Markets consolidate gains; Cyclicals outshine Defensives

Economic activity growth at five-year low in 4QFY17

Microfinance: Collections picking up in troubled states

Core profitability surprises positively; Stress pool down 3% QoQ

Remarkable volume growth, despite weak operating environment

In-line results; Outlook remains positive

(Result Flash) Strong performance on all fronts

Strong operating performance; estimates largely unchanged

Weak results; investment pay-off still some time away

Spate of new launches planned in a tough environment

Bajaj Auto volumes

Unitech Auto | Balaji Telefilms | Unison | Tiger Logistics

Emami | Exide Ind | HDFC | L&T Infotech | MCX | Tata Comm

Bulls & Bears

EcoScope

Financials

ICICI Bank

Marico

Ajanta Pharma

Dewan Hsg. Fin.

Shriram City Union

Alembic Pharma

Parag Milk Foods

Automobiles

MOBIZ - Key Takeaways

Results Expectation

Market snapshot

Equities - India

Close

Chg .%

Sensex

29,895

-0.1

Nifty-50

9,312

0.0

Nifty-M 100

18,126

-0.3

Equities-Global

Close

Chg .%

S&P 500

2,388

-0.1

Nasdaq

6,073

-0.4

FTSE 100

7,235

-0.2

DAX

12,528

0.2

Hang Seng

10,174

0.0

Nikkei 225

19,446

0.0

Commodities

Close

Chg .%

Brent (US$/Bbl)

50

-1.2

Gold ($/OZ)

1,238

-1.4

Cu (US$/MT)

5,567

-3.5

Almn (US$/MT)

1,916

-0.3

Currency

Close

Chg .%

USD/INR

64.1

-0.1

USD/EUR

1.1

0.1

USD/JPY

112.4

0.2

YIELD (%)

Close

1MChg

10 Yrs G-Sec

7.0

0.0

10 Yrs AAA Corp

8.2

0.0

Flows (USD b)

3-May

MTD

FIIs

-0.1

-0.1

DIIs

0.0

0.1

Volumes (INRb)

3-May

MTD*

Cash

295

298

F&O

3,671

3,659

Note: YTD is calendar year, *Avg

YTD.%

12.3

13.8

26.3

YTD.%

6.7

12.8

1.3

9.1

8.3

1.7

YTD.%

-9.8

7.5

0.8

12.4

YTD.%

-5.6

3.8

-3.9

YTDchg

0.4

0.6

YTD

6.2

1.7

YTD*

283

4,612

Piping hot news

Cabinet approves new NPA policy to deal with stressed assets

v

The Union Cabinet, led by Prime Minister Narendra Modi, on Wednesday

approved a new framework for dealing with Rs 6 lakh crore worth …

Chart of the Day: India’s share in world market cap inches above

historical average

Trend in India's contribution to world

market cap (%)

Market cap change in last 12 months (%)

Quote of the day

Financial crises are an unfortunate but

necessary consequence of modern

capitalism.

Research Team (Gautam.Duggad@MotilalOswal.com)

Source: Company, MOSL

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.