5 May 2017

4QFY17 Results Update | Sector: Technology

L&T Infotech

Buy

BSE SENSEX

29,859

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

Financials & Valuations (INR b)

2017

2018E

Y/E Mar

Net Sales

65.0

70.8

EBITDA

12.3

13.0

PAT

9.7

10.4

EPS (INR)

55.5

59.7

Gr. (%)

5.9

7.6

BV / Sh (INR)

159.5

204.8

ROE (%)

40.4

32.8

ROCE (%)

42.7

33.5

P /E (x)

13.2

12.3

P / BV (x)

4.6

3.6

S&P CNX

9,285

LTI IN

Broad-based momentum helps shun seasonality

171

4QFY17 revenue beat on broad-based momentum:

LTI’s 4QFY17 revenue

120.9 / 1.9

grew 2.4% QoQ in constant currency (CC) terms, against our expectation of

729 / 595

1.3%. Revenue growth was broad-based across verticals and geographies.

-/-/-

For FY17, CC growth of 10% was at the higher end of the industry. The year

128

was marked by stabilization of the Energy vertical and 8.4% growth in BFS

15.7

CMP: INR733

TP: INR850(+16%)

2019E

78.7

14.2

11.4

65.0

8.8

254.2

28.3

30.2

11.3

2.9

Estimate change

TP change

Rating change

despite this being a pressure-point for the industry.

Healthy momentum drives sanguine FY18 outlook:

Heading into FY18, this

momentum is expected to continue, led by: [1] Visibility from ramp-up in

deals, [2] Broad-based traction with no segment expected to decline, [3]

continued momentum in Digital, which is 28% of revenue.

Margin beat in part from one-time expenses:

Despite seasonality, higher

SGA (+60bp to 16.8%) and INR appreciation, LTI’s EBITDA margin expanded

by 90bp QoQ to 19% against our expectation of 20bp expansion to 18.3%.

Margin expansion was partly led by some accrual accounting at the year-end

around employee leaves encashment. However, with confidence of revenue

growth and multiple traditional levers in hand, there appears limited risk to

our assumption of a cumulative 80bp decline in margins over FY18-19.

4QFY17 PAT at INR2.5b (+2.7% QoQ) was higher than our estimate, led by

operational beat and higher other income.

Valuation view:

LTI is trading at 12.3/11.3x FY18/19E earnings. Our target

price of INR850 (+16%) discounts FY19E earnings by 13x - in the range of as

PSYS and MTCL which have demonstrated potential in newer services, but at

a premium to peers such as MPHL, KPIT and NITEC. This, we believe is

justified given strong positioning, superior cash generation, return ratios and

track record. Maintain Buy.

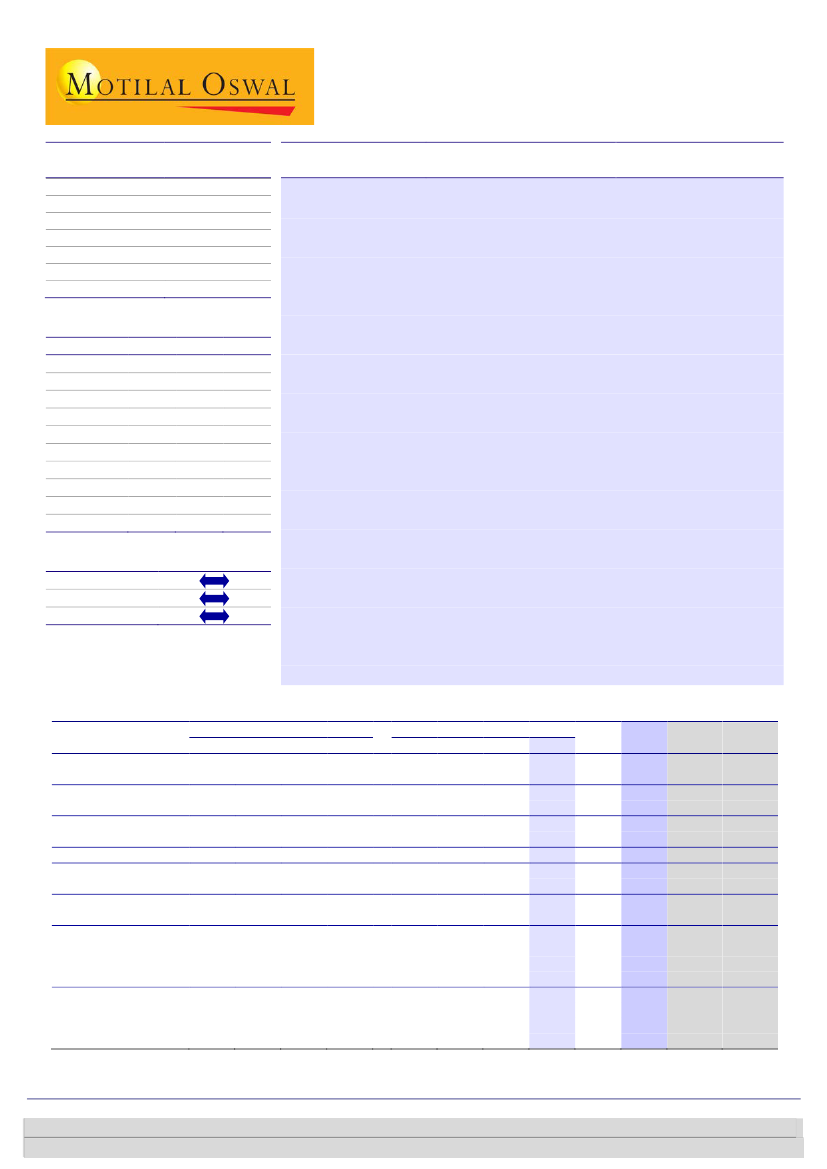

FY17

FY16

FY17

2Q

3Q

4Q

240

245

254

887

970

3.7

2.3

3.7

9.5

9.3

16,020 16,667 16,772 58,471 65,009

9.1

12.1

7.7

17.5

11.2

35.4

34.3

35.8

33.5

35.2

16.4

16.2

16.8

15.8

16.3

3,044 3,020 3,190 10,359 12,303

19.0

18.1

19.0

17.7

18.9

16.1

15.3

16.5

14.7

16.2

365

597

503 2,802 1,837

21.0

21.2

22.3

19.7

21.4

2,326 2,481 2,547 9,171 9,711

-1.4

6.7

2.7

21.3

10.5

11.4

21.5

5.9

13.3

14.2

14.6

52.4

55.5

21,074 20,605 21,023 20,072 21,023

78.7

78.1

78.3

73.8 7807.5

18.5

18.1

51.2

52.3

51.3

49.7

48.3

(INR Million)

Est. Var. (% /

4QFY17

bp)

249

1.9

1.7

195

16,605

1.0

4.2

348

34.3

153

16.0

79

3,035

5.1

18.3

74

15.3

119

261

92.5

21.0

2,219

14.8

-10.5

1,320

-16.1

2,751

12.7

22,246

(5.5)

76.0

230

52.7

(139)

Quarterly Performance

Y/E March

Revenue (USD m)

QoQ (%)

Revenue (INR m)

YoY (%)

GPM (%)

SGA (%)

EBITDA

EBITDA Margin (%)

EBIT Margin (%)

Other income

ETR (%)

PAT

QoQ (%)

YoY (%)

EPS (INR)

Headcount

Util incl. trainees (%)

Attrition (%)

Offshore rev. (%)

1Q

209

0.0

13,332

14.5

34.0

18.5

2,068

15.5

12.2

512

18.2

1,746

-21.2

7.5

10.0

20,331

73.8

20.1

51.9

FY16

2Q

3Q

4Q

224

225

230

7.3

0.5

2.1

14,682 14,870 15,579

18.7

12.4

17.8

34.5

36.4

33.5

17.9

16.8

15.4

2,431 2,914 2,820

16.6

19.6

18.1

13.6

16.7

15.3

532

285

526

24.4

18.8

21.6

1,917 2,245 2,286

9.8

17.1

1.8

7.2

12.5

3.2

11.0

12.8

13.1

22,689 22,477 20,072

72.8

74.0

75.9

19.7

18.5

18.4

51.7

51.3

52.4

1Q

231

0.6

15,550

16.6

35.3

15.7

3,050

19.6

16.9

372

21.2

2,359

3.2

35.1

13.5

19,292

77.4

19.5

51.9

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Sagar Lele

(Sagar.Lele@MotilalOswal.com); +91 22 6129 1531

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 6129 1530