8 May 2017

4QFY17 Results Update | Sector: Financials

Canara Bank

Neutral

BSE SENSEX

27,035

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

8,349

CBK IN

543.0

215.0/3.2

415 / 171

29/29/97

1092

33.7

CMP: INR396

n

TP: INR380 (-4%)

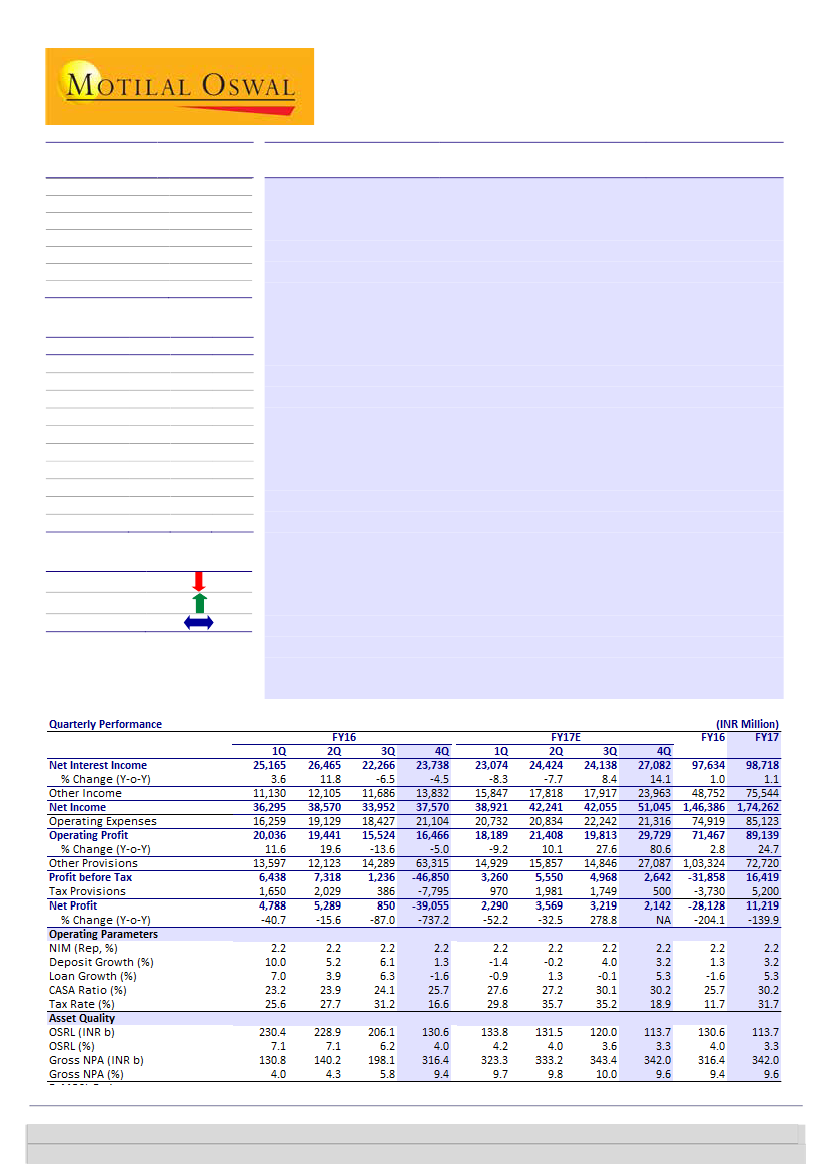

Gross slippages jump QoQ; elevated provisions led to PAT miss

Canara Bank’s (CBK) earnings (INR2.1b; -105% YoY) missed our estimate by

~53% due to elevated provisions of INR27.1b (27% miss). Loan growth for FY17

stood at 5% YoY, with infra loans (15% of advances) declining 8% YoY, but retail

loans growing 7% YoY.

Reported NIM expanded 8bp QoQ to 2.27% (domestic NIM at 2.39%, global

NIM at 2.23%). However, 3QFY17 NII had interest reversal of INR2b for

SDR/S4A accounts, adjusting for which calculated NIM expanded 3bp QoQ.

4QFY17 NII also had an interest on IT refund component of INR1.25b.

Gross slippages of INR31b (+25% QoQ) had INR9b contribution from the

standard restructured book. Absolute GNPA was flat QoQ at INR342b, while

GNPA/NNPA stood at 9.63%/6.33% (-34bp/-39bp QoQ). Write-offs were high

during the quarter at INR24.7b. Total stressed book stood at 12% of loans.

Other highlights:

(a) Non-interest income grew 34% QoQ, aided by a gain of

INR7.04b on Canfin Homes stake sale and INR850m of PSLC sales income. (b) As

of 4QFY17, the bank held additional provisions of INR5b for NPAs over and

above RBI norms. c) Tier 1 ratio/CAR stood at 8.92%/12.86%. During the

quarter, the bank raised INR11.24B via rights issue.

Valuation and view:

Net stress addition has been coming down over past two

quarters, which is a positive, and management expects this trend to continue.

However, given the weak operating environment, we would wait and watch

developments in asset quality. Contribution of trading profits to PPoP was high

at 47%, and with an expected decline in trading gains, we expect overall PPoP

growth to be muted at -4.5% for FY18. Our SOTP-based target price is INR380

(0.6x FY19 BV+INR73 for other investments). Maintain

Neutral.

n

Financials & Valuations (INR b)

Y/E March

2017 2018E 2019E

NII

98.7 107.5 122.9

OP

89.1

85.1

97.4

NP

11.2

19.7

29.2

EPS (INR)

18.8

33.0

48.9

EPS Gr. (%)

NM

75.5

48.4

BV/Sh. (INR)

468

497

540

RoE (%)

4.2

6.8

9.4

RoA (%)

0.2

0.3

0.4

P/E (x)

21.1

12.0

8.1

P/BV (x)

0.8

0.8

0.7

n

n

n

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Subham Banka

(Subham.Banka@MotilalOswal.com); +91 022 6129 1567