10 May 2017

4QFY17 Results Update | Sector: Metals

Hindalco

Buy

BSE SENSEX

30,248

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,407

HNDL IN

2,243

419.7 / 6.5

204 / 84

-5/-3/91

2087

65.3

CMP: INR187

TP: INR242(+29%)

Novelis: Excellent quarter and an excellent deal

Upgrade TP to factor in sale of Korea unit; Maintain Buy

Novelis reported one of its best-ever EBITDA of USD292m (+5% YoY/15% QoQ;

beat of 7%), led by a better metal mix and operating cost savings. FCF

generation (post capex and interest) rose ~2x YoY to USD332m. Interest cost fell

25% YoY to USD59m on lower debt and refinancing. Adj. PAT was up 62% YoY to

USD47m. For FY17, adj. EBITDA (ex-metal lag) was up 12% YoY to INR1,085m.

FCF generation was higher than guided at USD361m (v/s USD160m in FY16).

Volumes recover on strong auto shipments; margins improve

Shipments were flat YoY at 789kt (1% beat), bucking the declining trend over

past few quarters, led by strong growth in auto shipments (+26% YoY). EBITDA/t

increased USD19/30 YoY/QoQ to USD370/t.

Ulsan plant (S Korea) 50% JV @ USD315m with Kobe Steel is value-accretive

The plant was under-utilized (~220kt production in FY17 v/s capacity of 350-

400kt) and faces competition from Chinese players. The deal would leverage on

Kobe’s facilities in China to drive better utilization and sustainability.

Management expects no EBITDA/volume impact from the deal. Cash flow of

USD260m (net of taxes/fees) would go toward further deleveraging.

Higher volumes, FCF and stable capex in FY18

Guidance (a) volumes to be higher YoY on increase in auto shipment (share to

rise from 20% in 4QFY17 to 25% by end-FY19). (b) Sustainable EBITDA margin of

USD340-360/t. (c) FCF generation higher YoY (d) Capex at USD200-250m.

Deleveraging continues; India business on strong footing; Upgrade TP

Novelis achieved net debt/EBITDA of 4x one year ahead of target. Strong FCF

and asset sale will drive further deleveraging. Management would start

looking at growth opportunities as B/S improves, leveraging its position in

the auto market. Indian business benefits from strong LME/cost advantage.

We include proceeds from Ulsan sale in FY18, resulting in lower debt. TP is

upgraded to INR242/share (from INR235). Reiterate

Buy.

Financials & Valuations (INR b)

Y/E Mar

2017

2018E

Net Sales

1,026

1,092

EBITDA

133.4

142.3

PAT

39.1

50.7

EPS (INR)

17.5

22.6

Gr. (%)

45.8

29.6

BV/Sh (INR)

117.6

146.6

RoE (%)

15.9

17.1

RoCE (%)

8.2

8.7

P/E (x)

10.7

8.3

P/BV (x)

1.6

1.3

2019E

1,108

147.8

58.0

25.9

14.4

171.0

16.3

8.9

7.2

1.1

Estimate change

TP change

Rating change

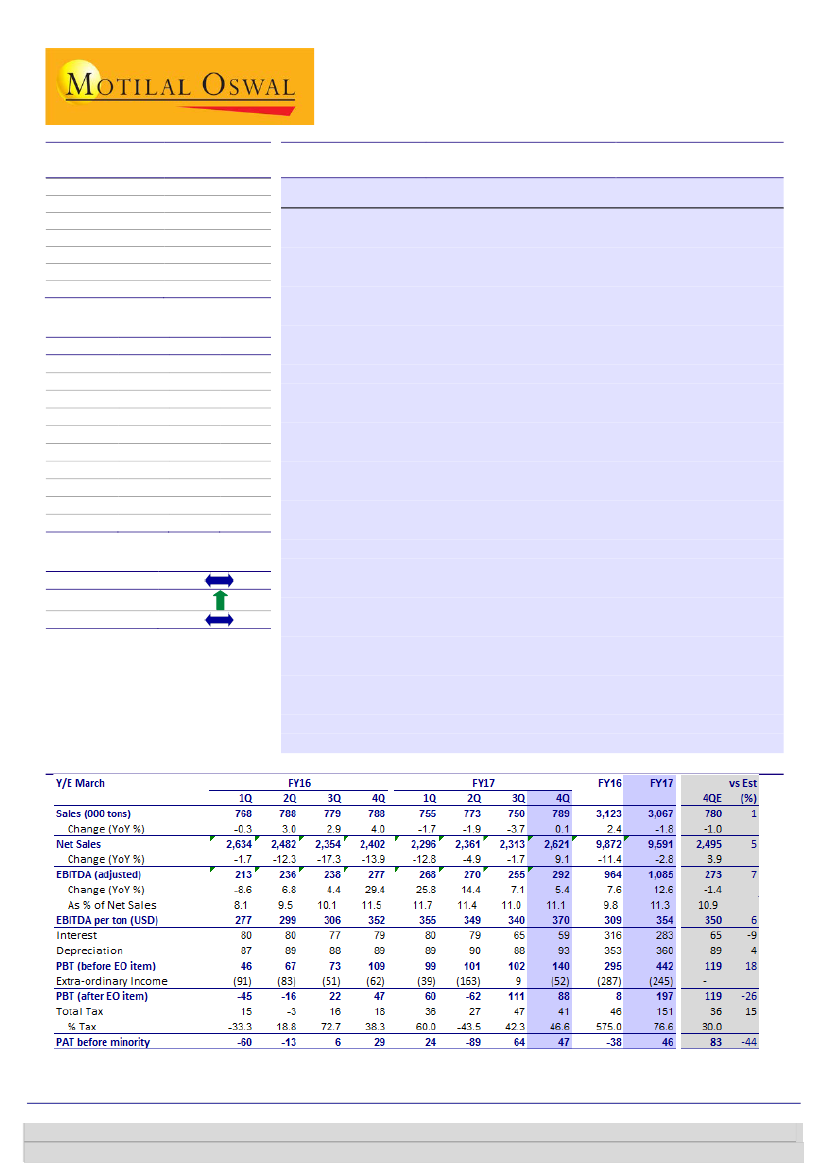

Quarterly Performance – USD m

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 6129 1523

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 6129 1549