11 May 2017

4QFY17 Results Update | Sector: Healthcare

Granules India

Buy

BSE SENSEX

30,251

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,422

GRAN IN

Margin expansion continues; Strong FY18 guidance

216.7

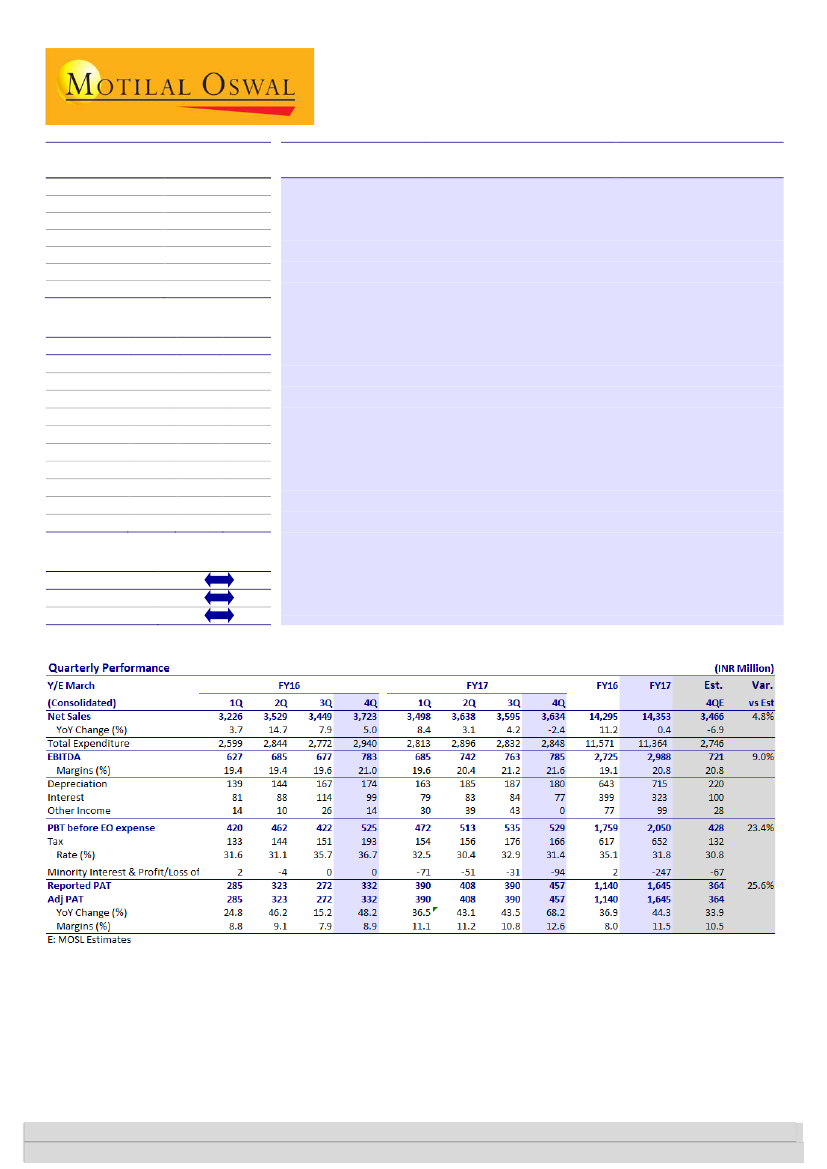

Sales declined 2.4% YoY to INR3.6b (5% above est.) in 4QFY17. EBITDA came

27.1 / 0.4

in at INR785m (9% above est.), with the margin expanding 60bp YoY (+40bp

154 / 91

QoQ) to 21.6% (est. of 20.8%). Notably, EBITDA margin has improved from a

3/21/-6

197

low of ~11% in FY13 to current levels, led by a change in product mix and

46.5

capacity expansion. PAT rose 68.2% YoY (+17% QoQ) to INR457m (25.6%

CMP: INR146

TP: INR200(+37%)

Financials & Valuations (INR b)

2017 2018E

Y/E Mar

Net Sales

14.4

17.4

EBITDA

3.0

3.7

PAT

1.7

2.1

EPS (INR)

7.3

8.1

Gr. (%)

32.7

12.0

BV/Sh (INR)

43.5

60.4

RoE (%)

20.0

16.3

RoCE (%)

11.6

9.8

P/E (x)

20.1

18.0

P/BV (x)

2.6

1.9

2019E

23.9

5.2

2.8

11.1

37.0

68.9

17.2

11.0

13.1

1.7

above est.). Associate income posted profit of INR94m v/s loss of INR25.2m

in 4QFY16, mainly due to higher contribution from Omnichem JV.

Strong FY18 guidance; US business commercialization expected from FY19

:

GRAN guided for strong revenue growth of ~20% and >20% PAT growth on

ramp-up of new capacity, strong growth in formulations and Omnichem JV.

Two complex filings were done from its Virginia facility (mkt. size of

USD660m; 3-4 player market at the time of launch). Monetization of these

products is expected in FY19 (target action date of Jan-18 for one product).

Concall takeaways:

1) To file 12 ANDAs in FY18 (incl. six complex filings from

Virginia); 2) To spend INR6b as capex in FY18 (~USD40m in US, rest in India);

3) sales from Auctus at INR1.6b in FY17; 4) USD1.2b incurred in US in FY17.

Earnings acceleration to drive valuation

:

GRAN trades at ~13x FY19E EPS

(despite assuming equity dilution of >10%). We raise target multiple for GRAN to

18x from 16x (~5-10% premium to peers) on strong EPS CAGR of ~30% till FY20E.

Our TP of INR200 is based on 18x FY19E PER (v/s INR160 @16x 1HFY19E PER).

Estimate change

TP change

Rating change

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.