19 May 2017

Corporate performance

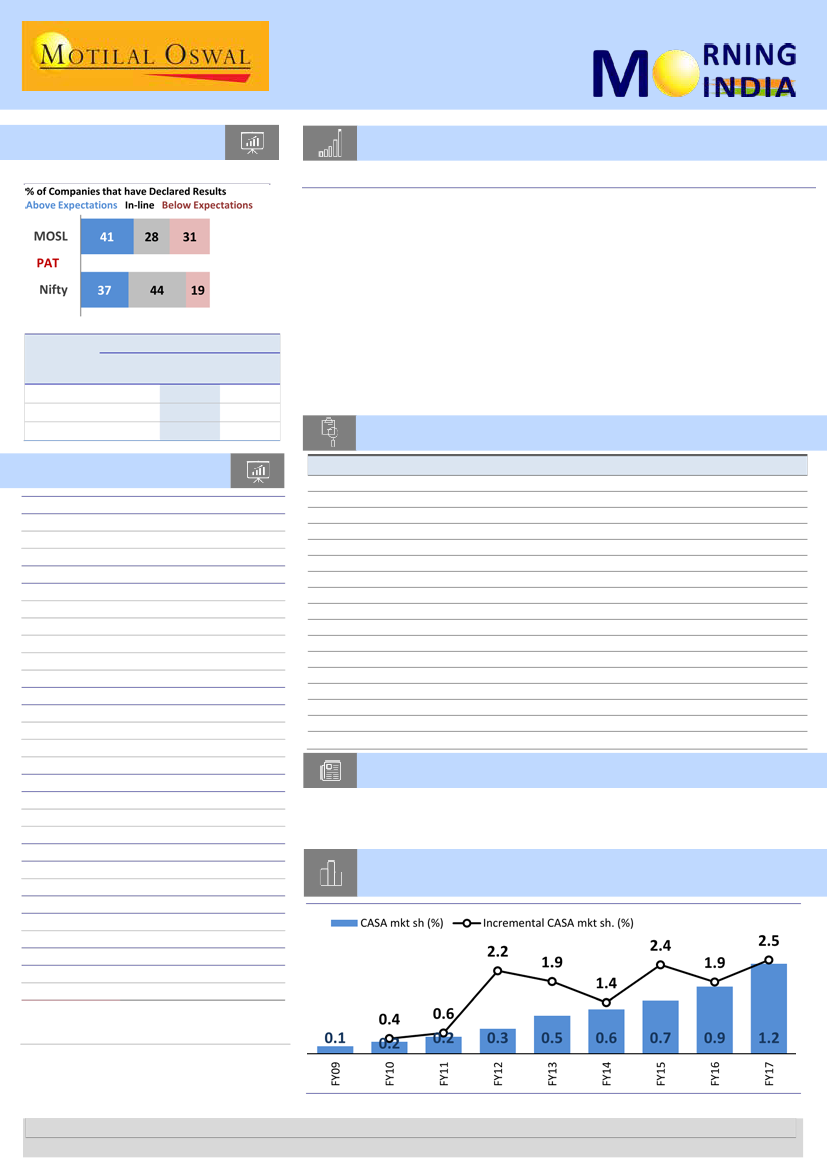

4QFY17: Expectations v/s delivery

Today’s top research idea

Yes: Annual report analysis - A much stronger liability franchise

v

YES’ annual report analysis suggests strong performance across parameters in

a challenging environment. Liability franchise has strengthened significantly,

with sustained improvement in CASA, improving deposit concentration ratios,

and more favorable ALM profile.

v

YES reported ~76bp GNPA for FY16, whereas the RBI estimated 5% GNPA.

While rule-based accounting (90dpd) allows banks to classify some accounts

as standard, RBI may ask banks to classify accounts with inherent weaknesses

as NPAs. Bank has fully accounted for divergences in FY17.

v

Loan market share increased to 1.7% of the system, while return ratios have

been robust – RoA of 1.8% and RoE of 20%. Recent capital raising (INR49b)

provides cushion for future growth. YES remains our top pick among mid-sized

private banks. Reiterate Buy, with a TP of INR2,110/share.

(no of

companies)

Sales

EBIDTA

PAT

Growth (YoY, %)

MOSL

Nifty

Sensex

(100)

(27)

(16)

13.7

11.5

11.5

15.7

33.4

7.7

14.9

6.2

14.9

Research covered

Cos/Sector

Key Highlights

FY17 annual report analysis – A much stronger liability franchise

Capitalizing on multiple opportunities; NBFC and Pharma are key value drivers

GST council finalizes tax rates

Driving value through simplification

Below est.; BS3-related discount, adverse mix, high RM cost hurt margins

Stress additions remain elevated; provisions mar earnings

Results better on all fronts

Highly uncertain operating environment leads to downgrade to Neutral

Robust operating performance supported by impressive asset quality

Dhariwal starts full supplies to Noida PPA

Demon hangover remains, ad growth under pressure

Subdued performance; Household Insecticides declines again

Rail margins impacted; Maintain Buy

Ad pain continues; contained opex salvages margins

EBITDA disappointment led by lower realizations

IPM delivered moderate growth in April 2017

GSK Pharma | Grasim Inds | HT Media | Just Dial | SBI

Yes Bank

Piramal Enterprises

GST

CESC

Bajaj Auto

Bank of Baroda

Pidilite Inds

United Breweries

Muthoot Finance

CESC

D B Corp

Jyothy Lab

Gateway Distripark

Hindustan Media

JK Lakshmi Cement

Healthcare

Results Expectation

Market snapshot

Equities - India

Close

Chg .%

Sensex

30,435

-0.7

Nifty-50

9,429

-1.0

Nifty-M 100

18,030

-2.3

Equities-Global

Close

Chg .%

S&P 500

2,366

0.4

Nasdaq

6,055

0.7

FTSE 100

7,436

-0.9

DAX

12,590

-0.3

Hang Seng

10,271

-1.1

Nikkei 225

19,554

1.3

Commodities

Close

Chg .%

Brent (US$/Bbl)

52

1.0

Gold ($/OZ)

1,264

1.5

Cu (US$/MT)

5,562

-0.5

Almn (US$/MT)

1,921

0.0

Currency

Close

Chg .%

USD/INR

64.9

1.2

USD/EUR

1.1

0.2

USD/JPY

111.0

-1.4

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.7

0.0

10 Yrs AAA Corp

7.8

0.0

Flows (USD b)

18-May

MTD

FIIs

-0.1

0.7

DIIs

0.1

0.2

Volumes (INRb)

18-May

MTD*

Cash

325

297

F&O

8,650

4,776

Note: YTD is calendar year, *Avg

YTD.%

14.3

15.2

25.6

YTD.%

5.7

12.5

4.1

9.7

9.3

2.3

YTD.%

-6.2

9.0

0.7

12.7

YTD.%

-4.4

5.6

-5.3

YTDchg

0.2

0.3

YTD

7.0

1.8

YTD*

284

4,655

Piping hot news

12-18% GST rate for most products; foodgrain exempted, 5% tax on coal

v

The Goods and Services Tax (GST) Council, at its meeting in Srinagar on

Thursday, approved rates for about 1,200 items…

Chart of the Day: YES - A strengthening liability franchise:

Incremental CASA market share of 2.5%+

Quote of the day

The real key to making money in stocks is

not to get scared out of them

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.