22 May 2017

Results Update | Sector: Utilities

Tata Power

Sell

BSE SENSEX

30,465

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,428

TPWR IN

Net Debt to Equity increases to ~3.5x

2,705

Lack of RoE accretive growth and high leverage; Maintain Sell

227.6 / 3.4

n

Tata Power’s (TPWR) 4QFY17 PAT, adjusted for the write-off of INR6.5b

849 / 405

relating to advance paid to DOCOMO for TTSL, was down 36% QoQ to

-3/4/3

INR3.9b (est. INR5.4b) on lower billing in Delhi distribution and higher

242.8

50.1

interest cost. EBITDA (incl. JVs) was down 11% QoQ to INR19.6b. For FY17,

CMP: INR84

TP: INR67(-20%)

Financials & Valuations (INR b)

2017 2018E

Y/E Mar

Net Sales

279.0

341.6

EBITDA

58.5

67.1

PAT

14.0

18.3

EPS (INR)

5.2

6.7

Gr. (%)

21.1

30.7

BV/Sh (INR)

43.5

48.7

RoE (%)

11.2

14.6

RoCE (%)

6.6

6.6

P/E (x)

16.3

12.5

P/BV (x)

1.9

1.7

2019E

358.7

69.5

19.0

7.0

3.8

54.2

13.6

6.5

12.0

1.6

Estimate change

TP change

Rating change

EBITDA (inc. JVs) was up 2% YoY to INR78b, while adj. PAT was up 83% YoY to

INR13.9b on lower tax. Net Debt at INR482b (incl. perpetual securities of

INR15b), represented debt/equity ratio of 3.5x (excl. perpetual securities

which is reported as part of net worth).

n

Standalone:

EBIT (incl. rate regulatory items), adj. for the provision of

INR0.3b for Trombay U-6 plant, was flat YoY due to stricter regulatory norms

and lower regulatory assets. The management highlighted the risk of

Trombay generation PPAs expiring in March 2018; clarity is likely in the next

couple of quarters.

n

CGPL & Coal:

Under-recovery increased from INR0.7/kWh in 3QFY17 to

INR0.86/kWh in 4QFY17. PAT loss was however lower (INR1.4b vs. INR2.4b in

3Q) on FX reversal and lower interest cost (on waiver by parent). Coal mines

EBITDA was up 29% QoQ to INR5.7b (ex-Arutmin) on higher coal prices.

n

Sale of non-core investments:

The management assured progress on sale of

non-core investments in FY18. Stake in Tata Sons is not considered as non-

core.

Lack of RoE accretive growth opportunities and high leverage; Sell

n

TPWR’s net worth is down by 21% since 1HFY17 to INR117b as at the end of

FY17 due to change in accounting of investments (from fair value to cost).

Resultantly, RoEs estimates for FY18-20E now look higher at ~13-14% v/s.

~10-11% earlier. We thus revise our P/BV multiple from 1x earlier to 1.2x.

The TP is revised marginally lower to INR67/sh. from earlier 69/sh. as higher

multiple is offset by lower BV. TPWR is facing slower growth in the regulated

business, risk of expiry of generation PPAs, competition in RE and a highly

leveraged balance sheet. We maintain

Sell

rating.

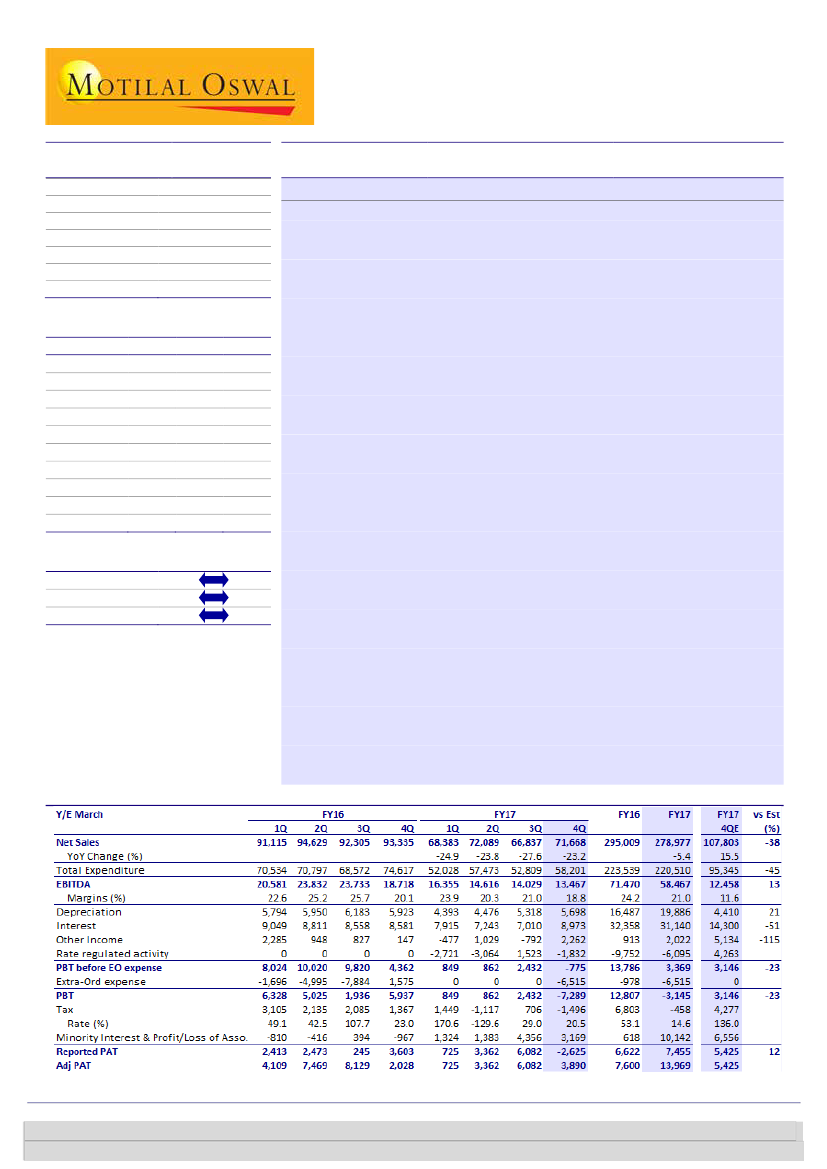

Quarterly Performance (Consolidated)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 6129 1549

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 6129 1523