22 May 2017

Metals Weekly

Metal Prices

CMP

19-May

% 12-May

change since

%

1-Jan

%

1-Apr

TMT- Mumba i (INR/ton)

HRC- Mumba i (INR/ton)

HRC (USD/ton) fob CIS

30,200

35,111

445

-3 31,200

-1 35,556

2

435

-4 16,200

-2 24,675

2

61

-9

170

0

251

3

4

-2

-1

1

-1

1

1

4

1,880

121

1,545

2,582

166

346

5,520

356

325

-1 30,600

-8 38,222

-10

495

-2 15,950

7 22,550

-21

79

-36

240

-10

278

13

9

-32

0

-4

-20

2

-4

8

1,714

116

2,202

2,563

174

428

5,501

374

312

9 27,600

14 30,667

21

368

17 13,300

25 19,300

14

55

89

82

7

235

27

25

-46

39

-86

-21

15

13

135

1,524

101

2,783

1,842

1,222

435

4,880

319

143

Sponge i ron - Ra i pur (INR/ton)

15,600

Pi g i ron - Ra i pur (INR/ton)

24,100

Iron ore s pot (USD/ton) cfr Chi na

63

Coki ng coa l (USD/ton) fob Aus .

155

Shred. s cra p (USD/ton) Rotterda m

251

LME Spot (USD/ton)

Indi a n pri ces (INR ‘000/ton)

LME i nventori es (‘000 ton)

LME Spot (USD/ton)

Indi a n pri ces (INR ‘000/ton)

LME i nventori es (‘000 ton)

LME Spot (USD/ton)

Indi a n pri ces (INR ‘000/ton)

LME i nventori es (‘000 ton)

Gol d (INR/10gms )

Sl i ver (INR/1kg)

Lea d Spot LME (USD/ton)

Brent crude (USD/bbl )

INR/USD

BDI

1,938

126

1,507

2,569

167

343

5,596

359

337

28,659

38,690

2,088

53.6

64.5

956

2 28,042

1 38,209

-4 2,166

5

50.8

0

-4

64.2

994

3 27,812

-1 38,921

5 1,985

-6

56.8

-5

-1

68.0

961

-1 29,080

6 36,651

21 1,720

39

38.7

-3

112

66.2

450

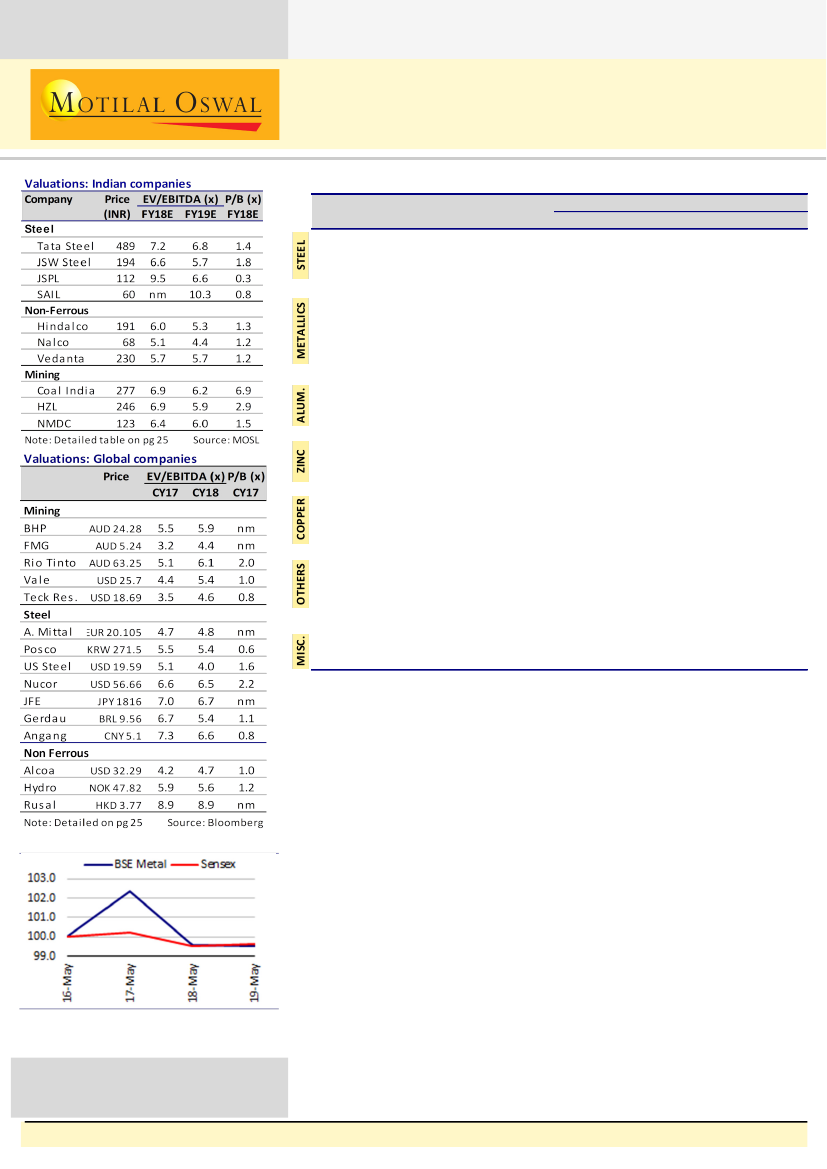

BSE Metals Index v/s Sensex

Source: Bloomberg

Note: Indexed to 100 on 20 March 2017

Stock performance table on pg 26

Investors are advised to refer through

important disclosures made at the last

page of the Research Report

.

Indian steel:

Long product (TMT Mumbai) prices were down ~3% WoW.

Sponge iron fell ~4% WoW while domestic scrap prices were down ~2%

WoW. Domestic iron ore prices were unchanged. Pellet prices were lower.

Domestic HRC prices were down ~1% WoW.

Raw Materials:

Iron ore prices (China cfr) were down ~1% WoW. Thermal

coal prices were unchanged. Coking coal prices were down by ~9% WoW.

China pellet import prices were up ~5% WoW

Europe:

HRC prices were prices were unchanged. EU steel spreads have

improved on sharp decline in coking coal prices. CIS export HRC prices

were up ~2%. Rotterdam scrap prices were flat WoW.

China:

local HRC prices were up ~4% WoW, reversal in trend over the past

few weeks, while rebar prices rose ~3% WoW. Chinese steel product

spreads improved, with spreads on rebars at multi-year high. Export

HRC/rebar prices were up ~1% WoW.

Base metals:

Aluminum (cash LME) was up ~3% WoW. Alumina prices

were marginally higher. Zinc (cash LME) was down ~1% WoW while lead

was down ~4% WoW. Copper was up ~1% WoW. Crude oil (Brent) prices

were up ~5% WoW.

Chinese steel prices trend higher, domestic prices remain weak

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412 /

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com)