24 May 2017

4QFY17 Results Update | Sector: Textiles

SRF Ltd

Buy

BSE SENSEX

30,302

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,361

SRF IN

57.4

91.0/1.4

1970 / 1166

-10/-8/12

389

47.6

CMP: INR1,585

TP: INR1,816(+15%)

Refrigerants business on strong footing; Maintain Buy

EBITDA below estimate, Chemicals continues to underperform:

SRF reported

overall revenue of INR13.3b (est. of INR12.3b) in 4QFY17, as against INR11.1b in

4QFY16. On a YoY basis, Chemicals grew by 11.7%, Technical Textiles by 23.3%

and Packaging by 26.3%. EBITDA margin contracted from 20.2% in 4QFY16 to

16.3% (est. of 20.5%) in the quarter. EBITDA declined 4% to INR2,157m (est. of

INR2,533m) from INR2,248m in 4QFY16. Segment-wise, PBIT margin for

Technical Textiles was at 10% (v/s 11.1% in 4QFY16), Chemical at 16.6% (v/s

23.2% YoY) and Packaging at 9.7% (v/s 12.8% YoY). Consequently, adj. PAT grew

7% from INR1,072m in 4QFY16 to INR1,147m (est. INR1,161m) in 4QFY17. For

FY17, revenue grew 5% YoY to INR48.2b, EBITDA margin shrunk 110bp to 20.1%,

while adj. PAT grew 13% to INR4.9b.

Refrigerant Gas business on strong footing:

R-134a gas registered healthy

growth, driven by exports. Total volume for FY17 is expected to have crossed

~10,000t (v/s ~7,000t for full-year FY16), in line with management guidance. Due

to anti-dumping levied on Chinese R-134a in the US, SRF’s performance should

see a boost in terms of volumes and margins (approx. 200bp improvement).

Specialty Chemicals to remain subdued in 1HFY18:

Management highlighted

that the global agri-chem environment continues to remain weak, impacting its

SpChem business, and the pain will continue for next few quarters. However, the

pipeline of molecules or funnel remains healthy, with SRF continuing to invest in

capability building.

Valuation and view:

We believe SRF is the best play in chemicals as it is highly

R&D-driven and operating in a niche area. We believe once the global agrochem

situation improves, SRF will benefit the most as it has capacities in place along

with improved R&D prowess. However, considering an increase in the tax rate

and higher depreciation due to new capex, we cut FY18E/FY19E earnings by

12%/12%. We expect 16% revenue CAGR and 15% adj. PAT CAGR over FY17-19E.

We value the stock on SOTP basis and maintain

Buy

with a TP of INR1,816.

Financials & Valuations(INR b)

2017 2018E

Y/E Mar

48.2

56.6

Net Sales

9.7

10.8

EBITDA

4.9

5.1

PAT

85.9

89.0

EPS (INR)

12.8

3.6

Gr. (%)

544.6

613.5

BV/Sh (INR)

16.6

15.1

RoE (%)

17.7

19.2

RoCE (%)

18.4

17.8

P/E (x)

2.9

2.6

P/BV (x)

2019E

65.3

13.1

6.5

111.5

25.3

701.9

17.0

23.6

14.2

2.3

Estimate change

TP change

Rating change

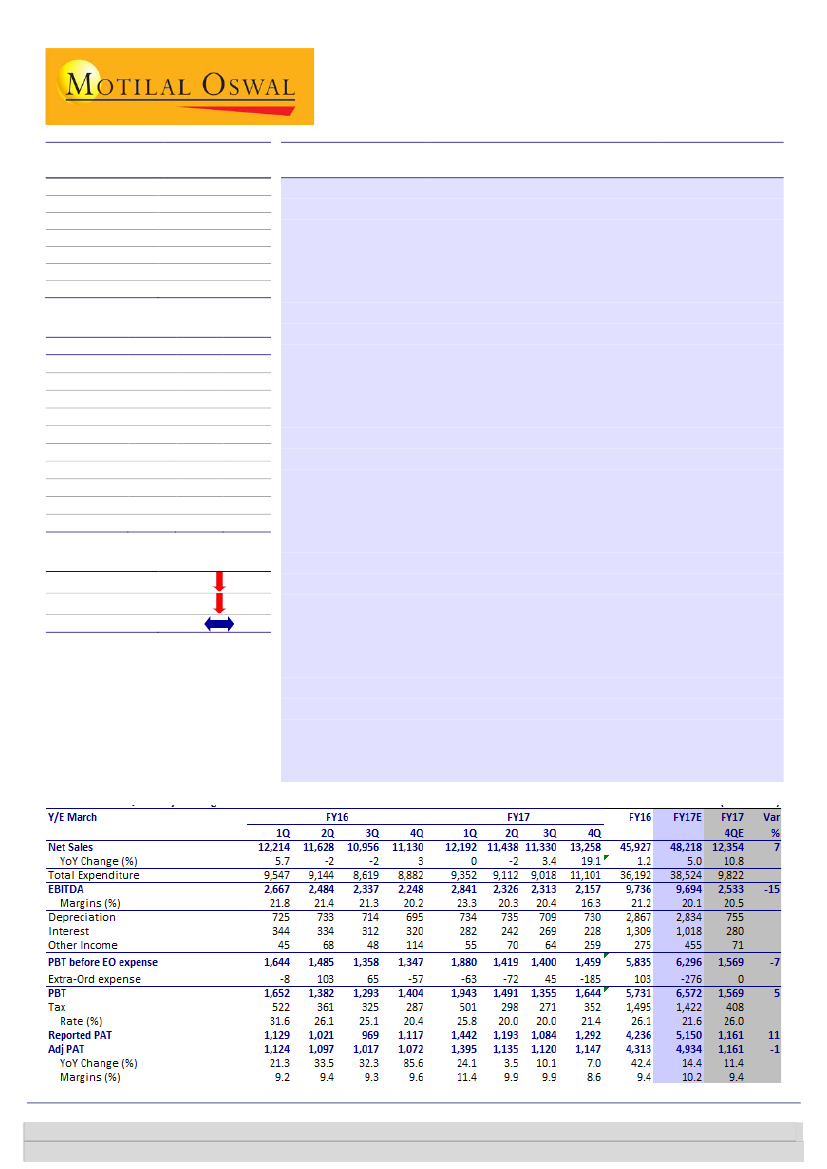

Quarterly Performance (Consolidated)

Investors are advised to refer through important disclosures made at the last page of the Research Report.

MotilalOswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Chintan Modi(Chintan.Modi@MotilalOswal.com);+91

22 6129 1554

Niket Shah(Niket.Shah@MotilalOswal.com);+91

22 6129 1535