24 May 2017

4QFY17 Results Update | Sector: Healthcare

Lupin

Buy

BSE SENSEX

30,302

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,361

LPC IN

Weak 4Q; Guides for muted FY18

448

Lupin’s (LPC) 4QFY17 revenue grew 2% YoY to INR42.5b (~6% below est.).

549.6 / 8.2

The miss in revenue is primarily attributed to weak US sales (-13% YoY/QoQ).

1750 / 1168

Despite this, gross margin expanded ~120bp QoQ to 72.1%. Excluding the

-16/-33/-36

one-time impact of INR3.3b (related to provisioning against patent litigation

1699

and forex loss), EBITDA declined 15.3% YoY to INR11.1b (3% below est.), with

53.3

CMP: INR1,228

TP: INR1,475(+20%)

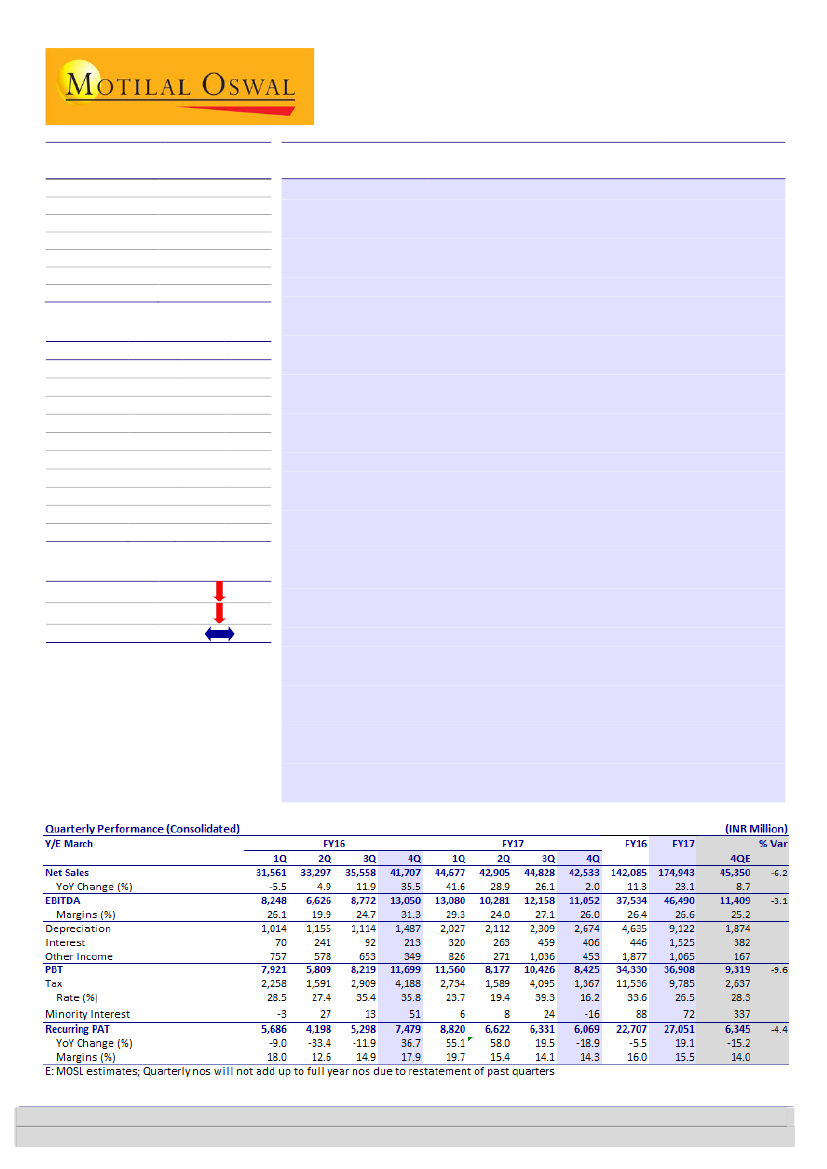

Financials & Valuations (INR b)

Y/E Mar

2017 2018E

Net Sales

174.9

189.6

EBITDA

46.5

47.0

PAT

26.7

27.1

EPS (INR)

59.2

60.2

Gr. (%)

17.5

1.6

BV/Sh (INR)

293.5

343.1

RoE (%)

22.0

18.9

RoCE (%)

14.7

13.1

P/E (x)

20.7

20.4

P/BV (x)

4.2

3.6

2019E

214.9

55.5

33.2

73.7

22.5

406.2

19.7

14.2

16.7

3.0

Estimate change

TP change

Rating change

the margin at 26% v/s our estimate of 25.2%. R&D expense stood at 16% of

sales, higher than the normalized rate of 12-13%.

FY18 growth expected to be muted:

LPC delivered revenue/EBITDA growth

23%/24% in FY17, led by Fortamet/Glumetza ramp-up. However, revenue

growth in FY18 is expected to be ~8% YoY, with flat EBITDA. We expect US

business to decline ~5% YoY in FY18 due to new competition in the diabetes

portfolio, further channel consolidation (impact of which will be visible in

2H) and likely deferral of key approvals for products like sevelamer/co-

sevelamer to 2HFY19. EBITDA margin is expected to shrink to 24.8% in FY18

(v/s management guidance of 26-28%) as it will be difficult to compensate

for the loss of the high-margin US business.

Key earnings call takeaways:

1) 30+ ANDA approvals expected in FY18. 2)

Advair filing to happen in FY19. 3) Tamiflu approval expected in six months.

4) Medicaid accounts for 6-7% of sales in the US. 5) Branded biz sales at

USD78m in FY17. 6) R&D expense as % of sales to be in line with FY17. 7) 14

FTF launches expected over next five years. 8) Renexa and minocycline ER

FTF launch expected in FY19E. 9) ProAir TAD in Sep-17; Indore observations

procedural in nature.

Near-term earnings under pressure; stock already factors in the impact:

Competition in Glumetza and Fortamet is expected to lead to a decline in US

sales in FY18. Due to this, we expect EBITDA margin to contract in FY18. We

believe the recent stock price decline already factors in this impact. Maintain

Buy

with a TP of INR1,475 @ 20x FY19E PER (v/s INR1,850 @ 22x 1HFY19E

PER). We cut FY18E/19E EPS by ~16% as we build in the impact of

competition in key products in the US. Cut in target multiple is attributed to

the weak industry outlook.

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.