Alkem Laboratories

BSE SENSEX

31,028

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,595

ALKEM IN

120

263.9 / 4.1

2238 / 1200

-10/-8/31

108

33.0

27 May 2017

4QFY17 Results Update | Sector: Healthcare

CMP: INR1,866

TP: INR1,900(+2%)

Neutral

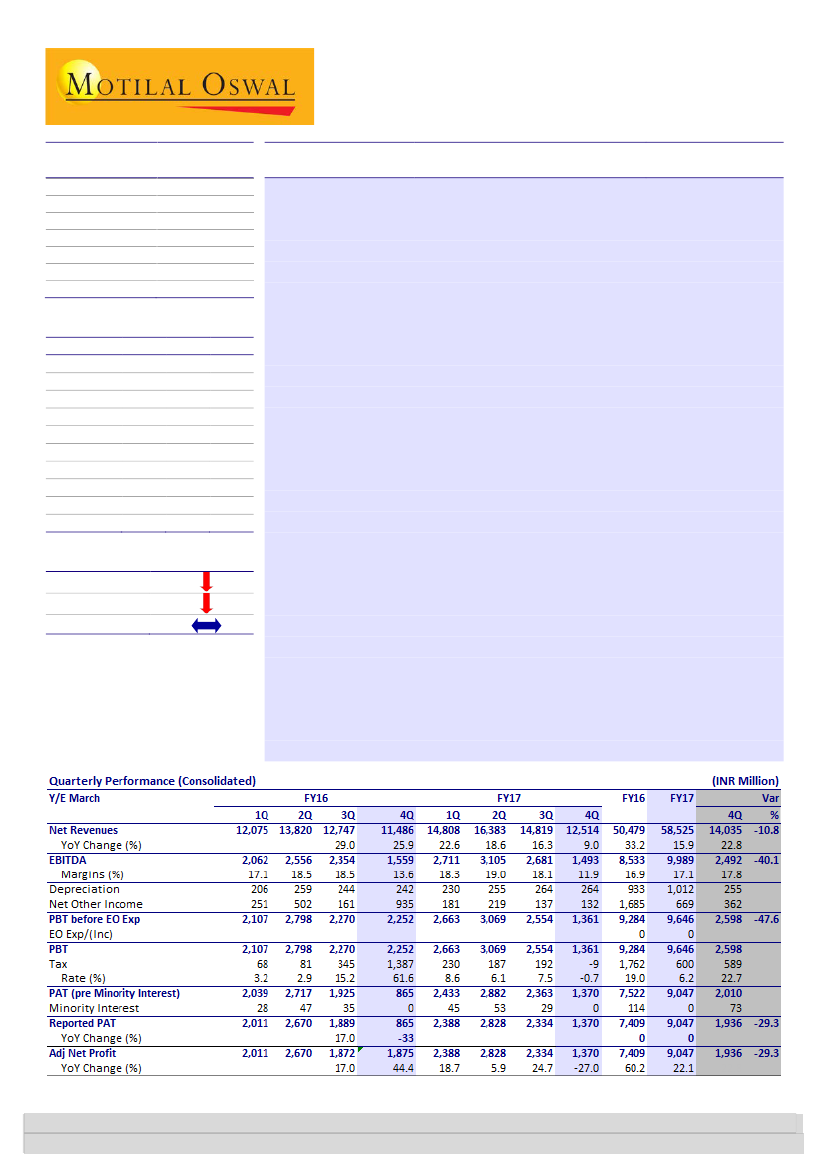

Weak 4Q; domestic business delivers muted performance

Revenues grew 9% YoY to INR12.5b, missing estimate by 10.8%, primarily due

to weak domestic business growth of ~7%. US business sales stood at USD44m

(v/s USD50m in 3QFY17). EBITDA of INR1.5b declined 4% YoY, with the margin

contracting 160bp YoY (-620bp QoQ) to ~11.9%, mainly due to higher R&D

spend (7.3% of sales v/s normalized rate of ~4-4.5%), muted growth in

domestic business and addition of 400-500 MRs in the acute segment.

Domestic business – weak growth:

Domestic business grew by a muted 7% YoY

to INR8.6b due to a decline in the anti-infective market, demonetization impact

and destocking in the channel due to GST. Despite the impact of GST in the near

term, Alkem expects its domestic business to grow at mid-teens in FY18.

US – sequential decline due to seasonality:

US sales declined 12% QoQ (+20%

YoY) to USD44m due to seasonality (Benzonatate sales goes up in winter). We

expect ramp-up in US business in coming quarters on the back of four ANDA

launches in 4Q and expected high-single-digit launches in FY18.

Key concall takeaways:

a) Net cash at end-4Q stood at INR7.2b. b) R&D as % of

sales stood at 7.3% in 4Q (v/s 5.2% in FY17). c) Impact of GST will be ~2.5% of

domestic sales; mitigation of this impact will depend upon price escalation. d)

R&D guidance of ~6% in FY18. e) Planning to file 12-15 ANDAs in FY18. f) Tax

rate guidance of ~MAT rate in FY18 and 12-15% in FY19 (lower in FY19 due to

annual impact of tax benefit from new Sikkim plant). g) Capex expected to be

~INR6b in FY18 (INR6.27b invested in FY17). h) Trade generics account for

>10% of domestic sales.

Maintain Neutral:

We continue believing that Alkem is the best way to play the

domestic growth story (>70% of revenue and >85% of EBITDA came from India

in FY17). Having said that, at current valuations, the stock offers limited upside

potential. Our target price of INR1,900 is based on 20x FY19E PER (v/s INR1,850

@ 20x 1HFY19E PER).

Financials & Valuations (INR b)

Y/E Mar

2017 2018E 2019E

Net Sales

58.5

65.4

76.4

EBITDA

10.0

11.6

13.8

PAT

9.0

9.6

11.3

EPS (INR)

75.7

80.0

94.9

Gr. (%)

7.5

5.8

18.6

BV/Sh (INR)

353.4 415.4 489.0

RoE (%)

23.4

20.8

21.0

RoCE (%)

21.3

18.9

23.1

P/E (x)

24.7

23.3

19.7

P/BV (x)

5.3

4.5

3.8

Estimate change

TP change

Rating change

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.