Torrent Pharmaceuticals

BSE SENSEX

31,028

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,595

TRP IN

169

207.4 / 3.2

1768 / 1186

-19/-28/-29

381

28.8

28 May 2017

4QFY17 Results Update | Sector: Healthcare

CMP: INR1,224 TP: INR1,450(+19%)

Muted performance in key markets impacts results

Buy

Financials & Valuations (INR b)

2017

2018E

Y/E Mar

Net Sales

58.6

65.4

EBITDA

13.8

15.9

PAT

9.3

10.1

EPS (INR)

55.2

59.8

Gr. (%)

-7.6

8.3

BV/Sh (INR)

235.5

273.7

RoE (%)

25.3

23.5

RoCE (%)

21.3

21.3

P/E (x)

22.2

20.5

P/BV (x)

5.2

4.5

2019E

76.1

19.0

12.4

73.2

22.4

320.5

24.6

23.7

16.7

3.8

Estimate change

TP change

Rating change

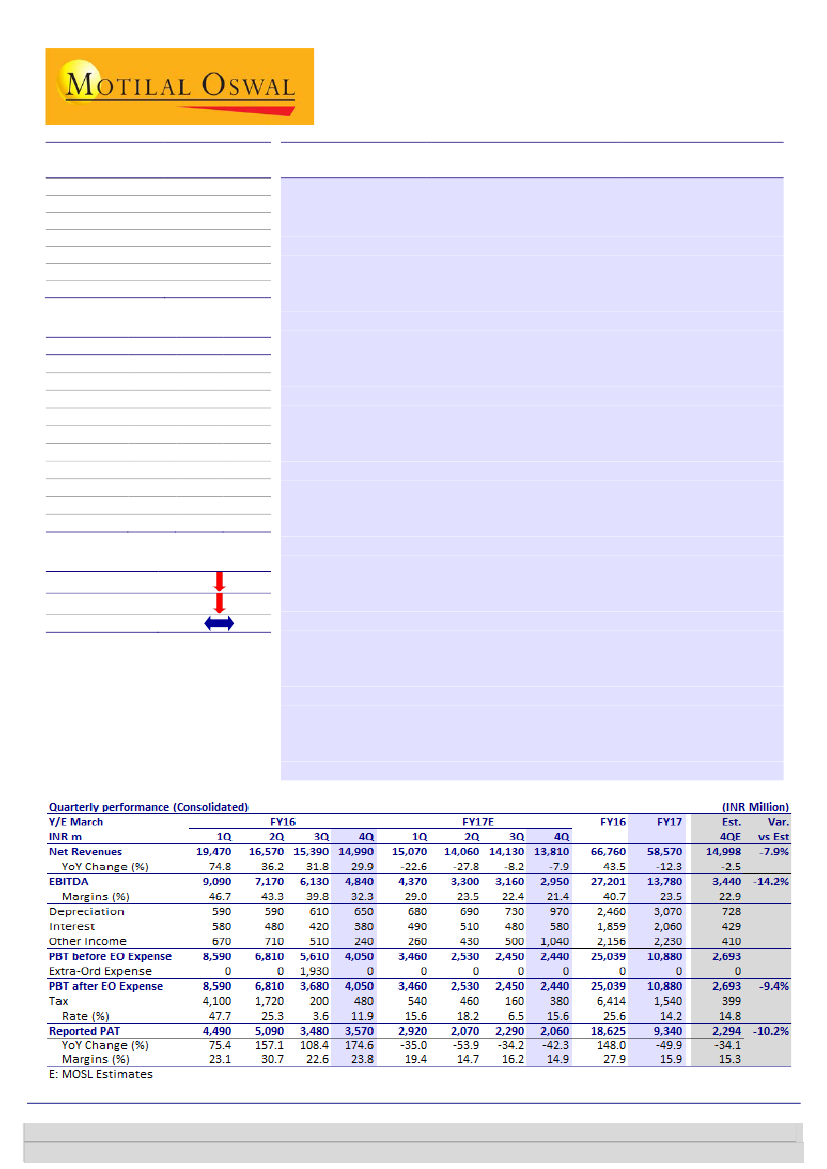

TRP reported sales of INR13.8b (-8% YoY; ~8% below est.), with EBITDA of

INR2.95b (est. of ~INR3.4b) and PAT of INR2.1b (-42% YoY; est. of INR2.3b).

The miss in numbers is attributed to weak sales in India and the US due to

pricing pressure and limited launches. For FY17 sales, EBITDA and PAT

stood at INR58.6b (-12.3%YoY), INR13.8b (-49%YoY) and INR9.3b (-48%YoY)

respectively.

US, India deliver muted performance:

US business

declined 45% YoY (-10%

QoQ) to INR2.8b due to continued pricing pressure in base business and

limited launches YTD. We expect this business to remain under pressure in

FY18 due to further price erosion in base business, partially offset by 8-10

new launches in FY18E (~25 pending ANDAs; six approved ANDAs that were

not launched in FY17). TRP is also focusing on in-licensing of products in the

US.

India business

grew at ~6% YoY, with chronic and sub-chronic segment

secondary sales outpacing industry growth. The company expects India

business to grow in double-digits, led by strategic initiatives undertaken

since 2QFY16.

Earnings call takeaways:

1) 16 ANDAs filed in FY17; re-looking R&D

strategy – will focus on complex products requiring clinical trials. 2) Mid-

teens pricing pressure expected in FY18 in the US. 3) Normalized

depreciation rate of ~INR800-810m/quarter v/s INR970m in 4Q. 4) Capex of

INR4b expected in FY18/FY19 toward Sikkim expansion and Onco block &

Dahej Phase-2. 5) Renagel launch deferred for more than one year. 6) Tax

rate to stay at ~20% in FY18. 7) Germany sales to grow at >15% YoY. 8)

Govt. allowed price increase in Brazil; to be ~3% in FY18 v/s ~12.5% in FY17.

Current price more than factors in concerns:

Although growth in the US

and India will continue to be under pressure in FY18 (due to pricing

pressure in the US and GST rollout in India), we believe the impact of these

issues is more than factored in the current price. Maintain

Buy

with a TP of

INR1,450, @20x FY19E PER (v/s INR1,700 @ 20x 1HFY19E EPS). We cut

FY18E/19E EPS by 19-20% as we build in the impact of higher pricing

pressure in the US and lower EBITDA margin.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519

Tushar Manudhane

(Tushar.Manudhane@MotilalOswal.com); +91 022 6129 1536