29 May 2017

4QFY17 Results Update | Sector: Utilities

NTPC

BSE SENSEX

31,109

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,605

NTPC IN

8,245

1,417.8 / 21.1

178 / 138

-9/-22/-5

758

30.3

CMP: INR156

TP: INR198 (+27%)

Buy

PAT growth muted on change in GCV measurement

Capacity addition to accelerate and drive earnings growth; Maintain Buy

NTPCsa (NTPC standalone) 4QFY17 PAT, adjusted for investment write-off of

INR7.8b and employee wage hike provision of INR3.2b (not considered as pass-

through in tariff for now), was up 14% YoY to INR31.8b. However, on a like-to-

like basis, adjusting for prior-period items, we estimate PAT was broadly flat YoY

at INR26.6b (est. of INR24.1b), primarily due to the impact of change in

measurement of GCV. Regulated equity (RAB) increased 6% YoY to INR440b. For

FY17, adjusted for one-offs/prior-period items, PAT rose 1% YoY to INR96b.

Pay revision impacts reported performance:

Of the pay revision provision of

INR8.7b, NTPC has conservatively recognized INR3.5b (50% of ex-gratuity

hike) as non-recoverable through tariff. However, we estimate the regulator,

like in the past, would allow complete pass-through of wage hike.

Commercialization of 4.7GW (NTPCsa ex-solar)

(Exhibit 3) and capitalization

of 5.3GW are guided for FY18. We estimate commercialization would be

lower at 3.3GW (NTPCsa ex-solar), still an increase from 1.4GW in FY17.

JV performance improves:

PAT of JVs increased from INR1.6b in FY16 to

INR6.2b in FY17, driven by improved performance at NTPC-SAIL, NTPC-TN

and Aravali. Consolidated reported PAT was flat YoY at INR107b in FY17.

Expect some delay in execution, but earnings outlook remains robust

Although there are some delays in project execution, the earnings growth

outlook remains robust. We expect CAGR 9.5% in DC and 17% in regulated

equity over FY16-21E.

NTPC’s consolidated EPS CAGR is estimated at 11% over FY17-21E. RoE is

expected to improve from ~11% in FY17 to ~12% in FY20. We value the stock

at INR198 based on DCF. Maintain

Buy.

Financials & Valuations (INR b)

2016 2017E

Y/E Mar

787.1

826.9

Net Sales

191.6

232.2

EBITDA

101.3

99.4

PAT

12.3

12.1

EPS (INR)

15.4

-1.8

Gr. (%)

108.2

115.4

BV/Sh (INR)

11.9

10.8

RoE (%)

7.3

6.4

RoCE (%)

14.0

14.3

P/E (x)

1.6

1.5

P/BV (x)

2018E

963.5

300.4

118.0

14.3

18.7

124.3

11.9

7.5

12.0

1.4

Estimate change

TP change

Rating change

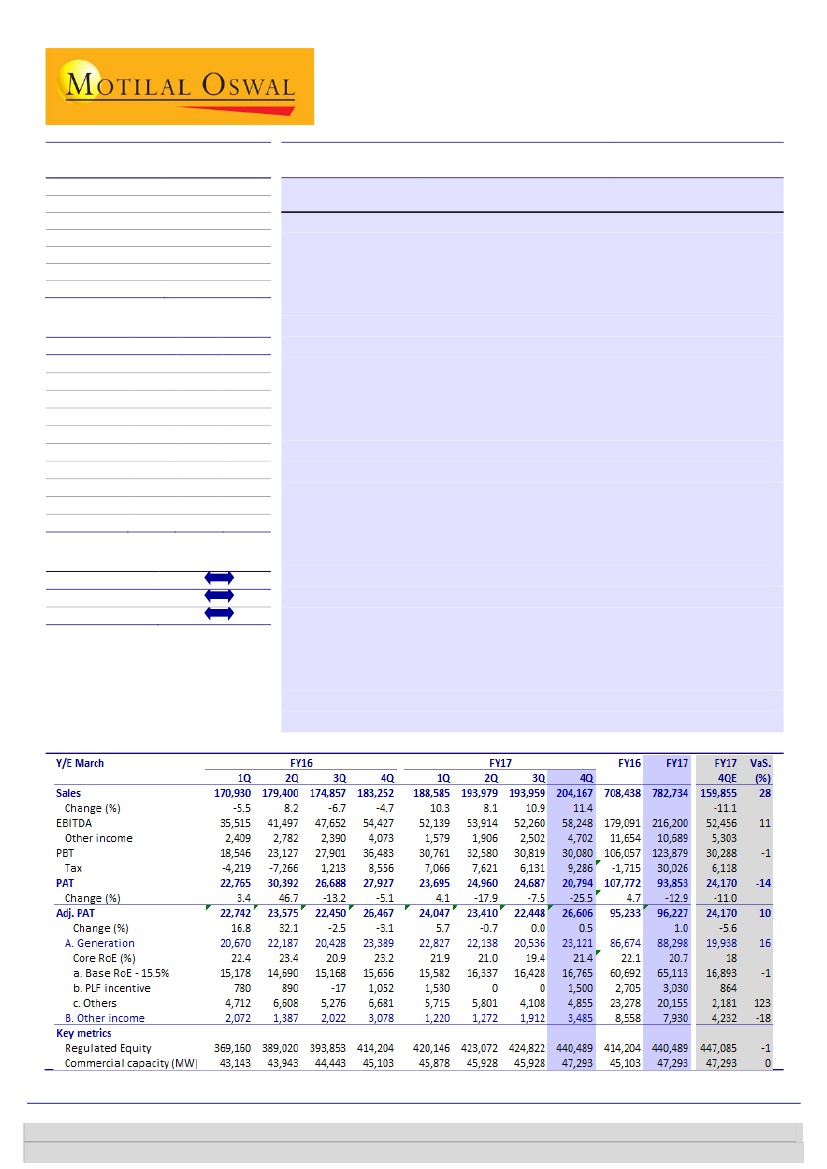

Quarterly Performance (standalone) – INR m

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 6129 1523

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 6129 1549