Ipca Laboratories

BSE SENSEX

31,159

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,625

IPCA IN

Weak quarter; resolution of FDA issue key

126

4QFY17 revenue of INR6.7b (+7% YoY) came in 16% below our estimate,

67.7 / 1.1

primarily due to muted performance by the generic and domestic

656 / 402

businesses. EBITDA margin contracted significantly to 10.2% (-480bp QoQ

-22/-32/-6

and flat YoY) due

to muted sales and lower gross margin. Reported PAT of

119

INR444m included the impact of deferred tax asset of INR237m in 4Q. For FY17

53.9

30 May 2017

4QFY17 Results Update | Sector: Healthcare

CMP: INR489

TP: INR480(-2%)

Neutral

Financials & Valuations (INR b)

2017 2018E

Y/E Mar

Net Sales

32.1

35.0

EBITDA

4.4

5.4

PAT

2.0

2.8

EPS (INR)

16.1

22.4

Gr. (%)

52.8

39.4

BV/Sh (INR)

194.1

213.1

RoE (%)

8.6

11.0

RoCE (%)

7.4

9.5

P/E (x)

30.4

21.8

P/BV (x)

2.5

2.3

2019E

40.6

6.7

3.8

29.9

33.5

238.5

13.2

11.4

16.3

2.0

Estimate change

TP change

Rating change

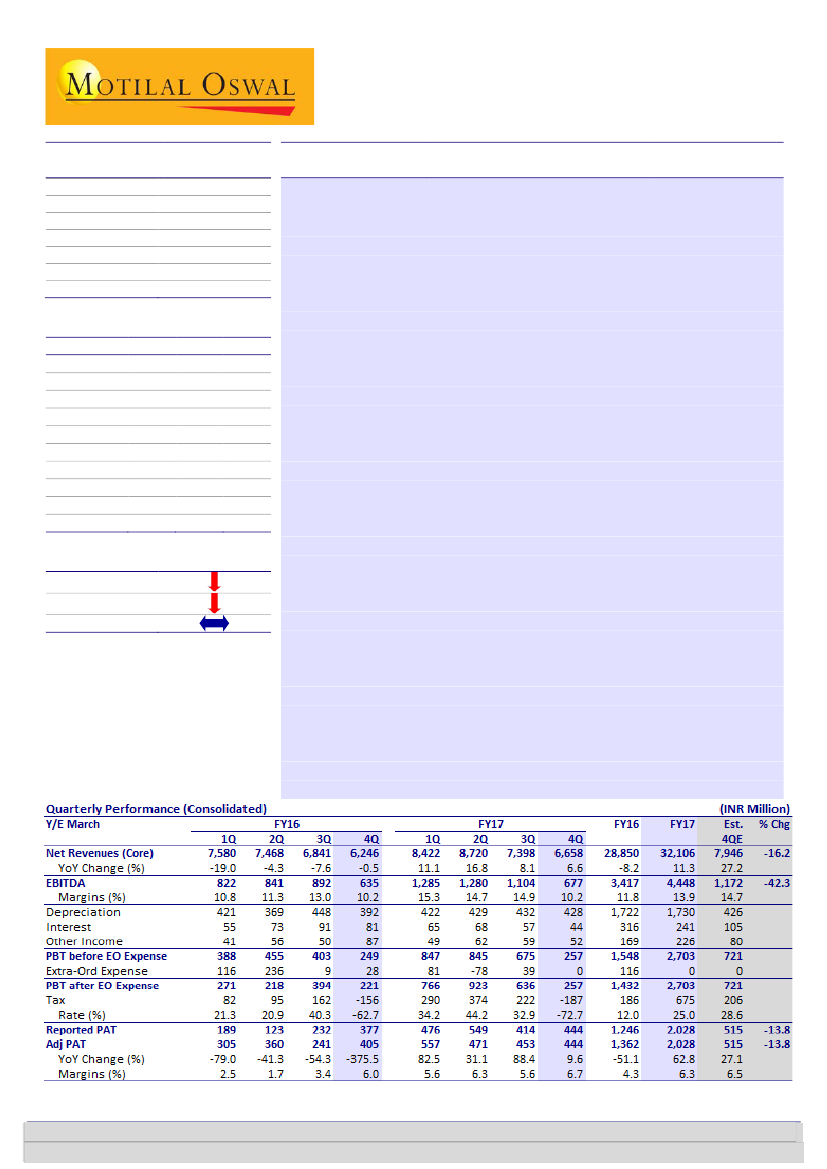

sales, EBITDA and Adj. PAT stood at INR32b (+11%YoY), INR4.4b (+30%YoY) and

INR2b (+53%YoY) respectively

Domestic/generic businesses deliver muted performance:

India formulation

sales grew ~11% YoY to ~INR2.8b. India business growth was impacted by the

demonetization drive. Apart from this, NLEM and FDC ban impacted domestic

revenue growth by ~4% and 2%, respectively. Management expects domestic

business to grow at ~12-14% YoY in FY18 as the impact of demonetization is

already fading. Export formulations segment declined ~10% YoY due to a fall in

generics business by ~16% YoY to INR1b and in institutional business by 34% YoY

to INR310m. Generic business declined due to weak EU sales growth.

Update on regulatory resolution:

IPCA management is planning to meet USFDA

in Jun-17 to offer invitation for Piparia inspection. Invite for Pithampur

inspection is expected by mid-3Q. Currently >90% of ANDAs are linked to API

from Ratlam. Given that the remediation process at Ratlam will only get over by

end-CY17, we do not expect full regulatory resolution before 2HFY19E.

Key earnings call takeaways:

a) R&D as % of sales expected to be ~4% in FY18E.

b) Filed 1 new ANDA in FY17; total 43 ANDA filings – 2 in market, 25 pending

and 18 approved. c) Debt of INR7.2b at FY17 end; d) Received RFP from global

funds for institutional business tender scheduled at 2018 beginning; expected to

participate without USFDA resolutions.

Resolution of regulatory issues key:

At CMP, the stock trades at 21.8x FY18E

EPS, at a discount to three-year average P/E. We do not expect a revival in US

business before 2HFY19E. Despite the stock’s attractive valuation, we believe

regulatory overhang will keep multiples under check in the near term. Reiterate

Neutral

on IPCA with a TP of INR480 @ 16x FY19E, discount of ~15-20% to its

peers (v/s INR540 @ 16x 1H FY19E). We have cut our FY18/19E EPS by ~19% as

we build in delay in USFDA resolution and muted margins in base business.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Kumar Saurabh

(Kumar.Saurabh@MotilalOswal.com); +91 22 6129 1519