Eveready Industries

BSE SENSEX

31,146

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

Financials & Valuations (INR b)

2017

2018E

Y/E Mar

Net Sales

13.6

15.3

EBITDA

1.3

1.6

PAT

0.9

1.0

EPS (INR)

12.9

14.4

Gr. (%)

35.5

12.1

BV/Sh (INR)

39.8

49.6

RoE (%)

37.7

32.3

RoCE (%)

27.5

25.1

P/E (x)

24.8

22.1

P/BV (x)

8.0

6.4

S&P CNX

9,621

EVRIN IN

Appliance and Lighting to drive growth ahead

73

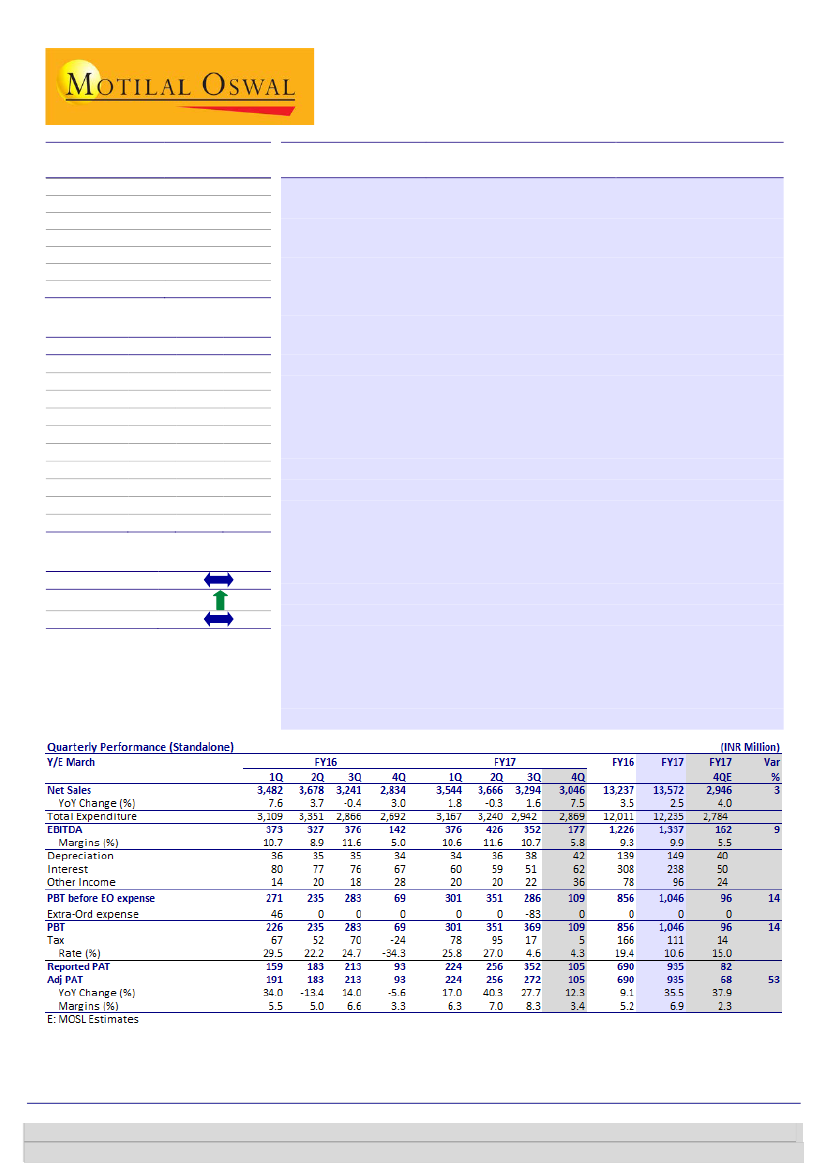

Revenue in-line, PAT beats estimates:

EVRIN reported overall revenue of

17.5 / 0.3

INR3,046m in 4QFY17 (est. of INR2,946m) v/s INR2,834m in 4QFY16,

335 / 190

marking an increase of 7.5%, mainly due to significant turnover growth in

0/30/19

lighting and appliances segments. Lighting grew robustly by 26% in 4QFY17.

47

EBITDA rose 24% YoY to INR177m (est. of INR162m), with the margin

56.0

31 May 2017

4QFY17 Results Update | Sector: Others

CMP: INR319

TP: INR368(+15%)

Buy

2019E

16.8

1.8

1.3

17.5

21.4

61.2

31.6

26.9

18.2

5.2

Estimate change

TP change

Rating change

expanding 80bp to 5.8% (est. of 5.5%). Adj. PAT thus grew from INR93m to

INR105m (est. INR68m), marking YoY growth of 12.3%. For FY17, EBITDA

margin stood at 10% (+60bp YoY) and PAT at INR935m (+35% YoY).

Significant opportunity in appliance:

Revenue from appliance segment

stood at INR400m in FY17 – the first year of operations. EVRIN plans to

achieve revenue of INR1b in FY18 from appliance (making the segment

EBITDA breakeven) and then ~INR2,500m by FY20. The size of fan &

appliance market stands at INR150b, with average industry growth at 10-

15%. We believe EVRIN has significant opportunity to grow this business,

with access to 6,000 retail outlets (200 distributors). It plans to increase

outlets to 10,000 by FY18. The business can generate asset turnover of 5x.

JV with McLeod to develop packet tea business:

EVRIN will initiate

discussions with McLeod for a JV to develop its packet tea business.

Management cited McLeod will invest required capital for marketing of tea

business and will bring in its expertise/sourcing capabilities. EVRIN has

access to 1m outlets, allowing it to aggressively grow the business.

Valuation and view:

We believe that appliances and LED businesses will

drive growth for Eveready, leveraging upon its strong brand and distribution

network. We thus maintain our earnings estimates. We expect revenue

CAGR of 11% and PAT CAGR of 17% over FY17-19E. We value the stock at

21x FY19E, and maintain

Buy

with a target price of INR368.

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 6129 1535

Chintan Modi

(Chintan.Modi@MotilalOswal.com); +91 22 6129 1554