20 June 2017

Market snapshot

Close

Chg .%

Equities - India

Sensex

31,312

0.8

Nifty-50

9,658

0.7

Nifty-M 100

17,996

0.0

Equities-Global

Close

Chg .%

S&P 500

2,453

0.8

Nasdaq

6,239

1.4

FTSE 100

7,524

0.8

DAX

12,889

1.1

Hang Seng

10,521

1.3

Nikkei 225

20,068

-0.6

Commodities

Close

Chg .%

Brent (US$/Bbl)

46

-0.8

Gold ($/OZ)

1,243

-0.8

Cu (US$/MT)

5,703

1.1

Almn (US$/MT)

1,875

1.0

Currency

Close

Chg .%

USD/INR

64.4

0.0

USD/EUR

1.1

-0.3

USD/JPY

111.4

0.5

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.5

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

19-Jun

MTD

FIIs

0.0

0.3

DIIs

0.1

0.6

Volumes (INRb)

19-Jun

MTD*

Cash

231

263

F&O

4,296

4,401

Note: YTD is calendar year, *Avg

YTD.%

17.6

18.0

25.4

YTD.%

9.6

15.9

5.3

12.3

12.0

5.0

YTD.%

-16.4

7.9

3.3

10.0

YTD.%

-5.2

6.1

-4.7

YTDchg

0.0

-0.1

YTD

8.1

2.9

YTD*

285

4,755

Today’s top research idea

Prabhat Dairy: Solid institutional player; Moving toward

consumer business

Prabhat Dairy is a fully integrated dairy products company. The company sells

specialty and co-manufactured products to its institutional customers, as well as

branded dairy products.

v

The consumer branded business (B2C) is expected to account for ~50% of its

revenues by 2020 (30% as on FY17), led by Hotels, Restaurants and Caterers

(HoReCa), and Retail.

v

Prabhat targets 80% direct sourcing of milk by FY20 (~70% currently), which

should help it source higher volumes of good-quality raw milk.

v

Utilization at its cheese manufacturing facility is expected to increase from

~20% currently to 80% by FY20.

v

Over the past 4 years, the company has delivered revenue, EBITDA and PAT

CAGR of 22%, 15% and 25%, respectively. The stock trades at 19x FY19E EPS.

Research covered

Cos/Sector

Prabhat Dairy (Spotlight)

Tata Steel

Voltas

Ecoscope

Metals Weekly

Key Highlights

Solid institutional player; Moving toward consumer business

Selling Tata Motors’ shares will boost equity value by

INR31/share; stake in Tata Sons is worth at least INR135/share

Room AC segment to feel the heat of GST in 1QFY18

Has demonetization led to higher digital payments? Doubtful;

ATM cash withdrawals back to pre-demonetization levels

China local steel prices increase, inventories continue to decline

Piping hot news

Punjab farm loan waiver: CM Amarinder Singh says will waive loans of

8.75 lakh farmers

v

Punjab farm loan waiver: In a significant move today, Punjab Chief Minister

Quote of the day

Learning to trust is one of life's most

difficult tasks

Amarinder Singh announced his government’s decision to waive off the loans

of as many as 8.75 lakh farmers.

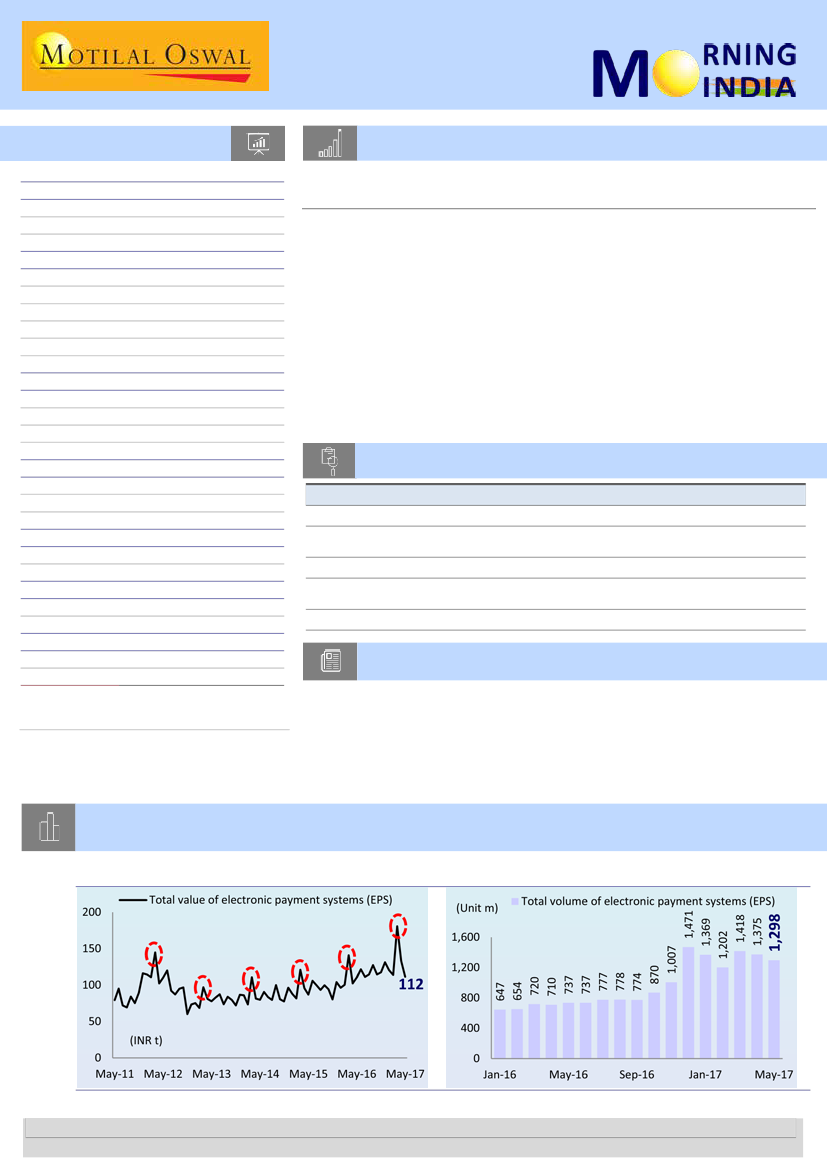

Chart of the Day: Has demonetization led to higher digital payments?

Aggregate value of all digital payment transactions didn’t

witness any increase post demonetization…

… however, total volume of digital payments has

stabilized at higher level

Research Team (Gautam.Duggad@MotilalOswal.com)

# Implied savings; Does not include ‘errors & omissions’

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.