22 June 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

31,284

0.0

Nifty-50

9,634

-0.2

Nifty-M 100

18,046

0.2

Equities-Global

Close

Chg .%

S&P 500

2,436

-0.1

Nasdaq

6,234

0.7

FTSE 100

7,448

-0.3

DAX

12,774

-0.3

Hang Seng

10,394

-0.7

Nikkei 225

20,139

0.5

Commodities

Close

Chg .%

Brent (US$/Bbl)

44

-2.2

Gold ($/OZ)

1,247

0.1

Cu (US$/MT)

5,718

1.5

Almn (US$/MT)

1,858

-1.0

Currency

Close

Chg .%

USD/INR

64.5

0.0

USD/EUR

1.1

0.0

USD/JPY

111.2

-0.4

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.4

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

21-Jun

MTD

FIIs

0.0

0.2

DIIs

0.0

0.7

Volumes (INRb)

21-Jun

MTD*

Cash

291

264

F&O

5,032

4,372

Note: YTD is calendar year, *Avg

YTD.%

17.5

17.7

25.7

YTD.%

8.8

15.8

4.3

11.3

10.6

5.4

YTD.%

-20.2

7.6

3.5

9.0

YTD.%

-5.0

5.7

-5.0

YTDchg

-0.1

-0.1

YTD

8.1

2.9

YTD*

285

4,746

Today’s top research idea

Avenue Supermarts (DMART): Delivering value

Expect PAT CAGR of 41% over FY17-21

DMART derives ~80% of its revenues from Maharashtra and Gujarat, which

together account for 21% of its retail spends in India. DMART intends to invest

75% of its profits in the existing clusters and plans to add 25 stores annually to

boost its growth potential.

Focus on cluster-based store expansion, rich product assortment, owned store

model, centralized sourcing and efficiency (40% of revenues), lower employee

cost (below 2% of sales v/s >4.5% for peers) and upfront payment to get cash

discount have made DMART India’s only retail company to showcase

consistent and profitable growth over the last decade.

We expect DMART to deliver CAGR of 31% in revenue and 41% in PAT over

FY17-21. We value the stock at 45x FY19E EPS, and initiate coverage with a

Neutral

rating and a target price of INR804.

Research covered

Cos/Sector

Avenue Supermarts

(DMART)

Automobiles

Aviation

Key Highlights

(Initiating Coverage) Delivering value

Mini segment recovery helps Maruti gain market share

Fare uptick visible in a seasonally strong 1Q

Piping hot news

Karnataka waives Rs 8,165 cr in farm loans, cites weak monsoon for

decision

Karnataka joined states such as Uttar Pradesh, Punjab and Maharashtra to

Quote of the day

There is a gigantic difference between

earning a great deal of money and being

rich

announce part waiver of farmer loans taken from cooperative banks, as the

ruling Congress gears up for elections next year.

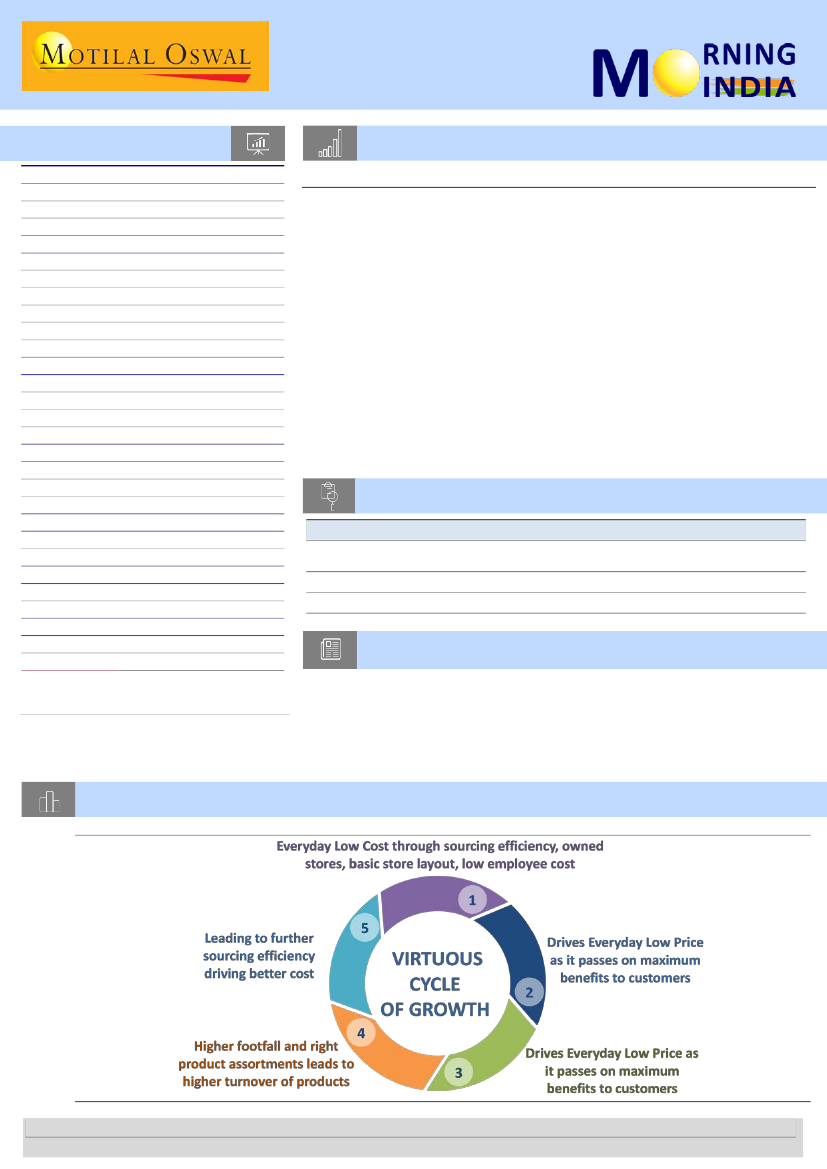

Chart of the Day: Avenue Supermarts (DMART): Delivering value

Virtuous cycle of value retailing

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.