28 June 2017

Market snapshot

Equities - India

Close

Chg .%

Sensex

30,958

-0.6

Nifty-50

9,511

-0.7

Nifty-M 100

17,456

-1.3

Equities-Global

Close

Chg .%

S&P 500

2,419

-0.8

Nasdaq

6,147

-1.6

FTSE 100

7,434

-0.2

DAX

12,671

-0.8

Hang Seng

10,498

-0.3

Nikkei 225

20,225

-0.4

Commodities

Close

Chg .%

Brent (US$/Bbl)

46

0.6

Gold ($/OZ)

1,251

0.7

Cu (US$/MT)

5,838

1.2

Almn (US$/MT)

1,877

1.2

Currency

Close

Chg .%

USD/INR

64.5

0.0

USD/EUR

1.1

0.9

USD/JPY

111.6

0.4

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.5

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

27-Jun

MTD

FIIs

0.0

0.5

DIIs

0.0

0.7

Volumes (INRb)

27-Jun

MTD*

Cash

285

270

F&O

8,261

4,976

Note: YTD is calendar year, *Avg

YTD.%

16.3

16.2

21.6

YTD.%

8.1

14.2

4.1

10.4

11.7

5.8

YTD.%

-17.5

7.9

5.7

10.1

YTD.%

-5.0

6.8

-4.7

YTDchg

-0.1

0.0

YTD

8.3

3.0

YTD*

285

4,827

Today’s top research idea

Titan Company: Ambitious 20% CAGR targeted in Jewelry sales

Fair valuations limit upside

v

Management outlined the five key pillars that would help it achieve targeted

growth of 2.5x over the next five years (20% CAGR): (1) Wedding Jewelry, (2)

High-value Diamond Jewelry, (3) Golden Harvest Scheme, (4) Store Addition

and (5) Market Share Growth.

v

The company is also investing in loyalty programs, a weak area.

v

Higher compliance focus under the GST regime should boost growth.

v

Valuations at 42.2x FY19E are fair for a business with~20% RoEs, and earnings

CAGR is expected at 16%. Watches and Eyewear segments continue to be a bit

of drag on overall earnings growth. We maintain

Neutral

rating with a target

price of INR525 (valued at 41x June-2019E EPS, in line with three-year average

multiple).

Research covered

Cos/Sector

Financials

Technology

Titan Company

United Spirits

Key Highlights

INR6t opportunity in affordable housing finance

TCS and Infosys AGMs

Ambitious 20% CAGR targeted in Jewelry sales

Significant challenges on the horizon

Piping hot news

Bankruptcy proceedings started against Essar Steel, Monnet Ispat

v

Essar Steel Ltd and Monnet Ispat and Energy Ltd have become the first of the

12 big bad loans cases identified by the Reserve Bank of India (RBI) against

which bankruptcy proceedings have been filed, said two people aware of the

matter.

Quote of the day

Time is more valuable than money. You

can get more money, but you cannot get

more time

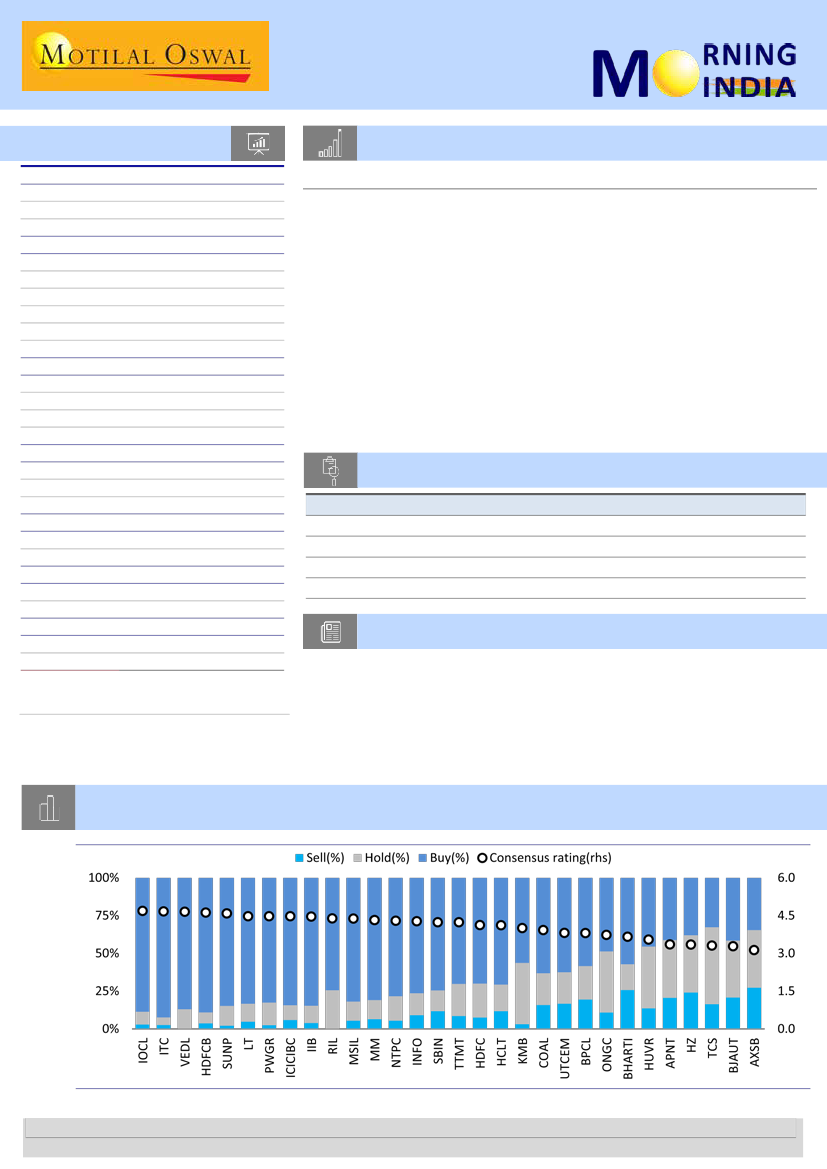

Chart of the Day: Contrarian Investing - Stock popularity of 30 largest companies arranged by consensus

popularity ratings (Consensus rating of 30 largest stocks of BSE100)

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.