E

CO

S

COPE

Government collected INR5.2t from petroleum sector in FY17

Petroleum products unlikely to be included under GST even at a later stage

29 June 2017

The Economy Observer

It is generally argued that the states appealed to keep key petroleum products out of the GST ambit, citing them as

their main source of income. However, the center’s dependence on petroleum products is just as high. Also, it is the

central government that has played with prices in recent years.

In FY17, the central government collected INR3.35t from the petroleum sector, amounting to 16% of gross receipts,

while the state governments received INR1.89t – 16% of their own receipts. Further, the central tax on diesel and

petrol (per liter) increased 4x and 2x, respectively over the past three years. State taxes, on the other hand, increased

by just ~20%, even lower than the increase in dealer commissions.

Considering consumers’ welfare, bringing retail fuel products under GST would be favorable, as they are probably the

highest taxed items. However, the inclusion of excluded petroleum products under GST would have hurt the center

more than the states. Who would then push to include excluded petroleum products under GST at a later stage?

The Goods & Services Tax (GST) will be implemented from July 1, 2017. One of the

major compromises made to make GST a reality was the exclusion of petroleum

products#. Though it is generally believed that states had appealed to exclude

petroleum products, we argue that the center would have lost higher revenues had

all petroleum products been brought under GST.

Contribution of petroleum sector to the government(s)

As per recent data released by the Petroleum Planning & Analysis Cell (PPAC), the

The general government

central government collected INR3.34t from the petroleum sector in FY17, of which

(center + states) collected

INR2.4t was collected as excise duty. Further, the state governments collected

INR5.22t from the

petroleum sector,

another INR1.88t from the petroleum sector, majority of which was in the form of

accounting for 16% of all

sales tax/VAT on petroleum products

(Exhibit 1).

Overall, the general government

total receipts in FY17 – the

(center + states) collected INR5.22t from the petroleum sector, accounting for 16%

highest in a decade

of all total receipts in FY17 – the highest in a decade

(Exhibit 2).

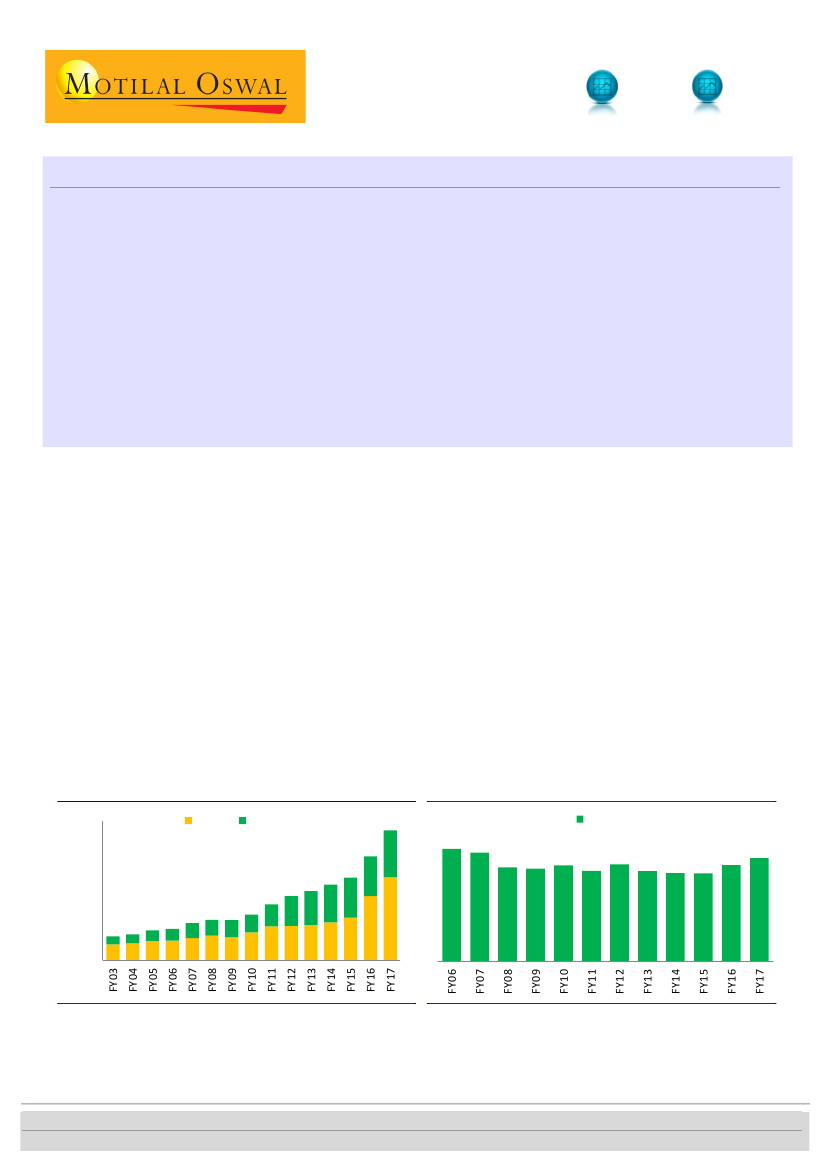

Exhibit 1:

Total receipts from the petroleum sector for the

center and states (INR b)

5,600

4,200

2,800

1,400

0

Center

States

17.4 16.8

Exhibit 2:

Center’s receipts from petroleum sector have

increased disproportionately (% of gross receipts)

General government

14.9

14.6 14.4 14.9 14.0 15.0 14.0

13.7 13.6

16.0

Source: PPAC, Reserve Bank of India (RBI), CEIC, MoSL

# Please note only five products – crude oil, natural gas, aviation fuel, patrol & diesel – have been excluded, while other products such as kerosene,

naphtha and LPG are included under GST. However, since no product-wise break-up is available, we discuss the total contribution of the petroleum

sector to the governments in this note.

Nikhil Gupta

(Nikhil.Gupta@MotilalOswal.com); +91 22 3982 5405

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.