11 July 2017

1QFY18 Results Update | Sector: Financials

IndusInd Bank

Buy

BSE SENSEX

31,747

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

S&P CNX

9,786

IIB IN

595.8

928 / 14.4

1572 / 1038

1/9/24

1570

85.0

CMP: INR1,560

TP: INR1,800 (+15%)

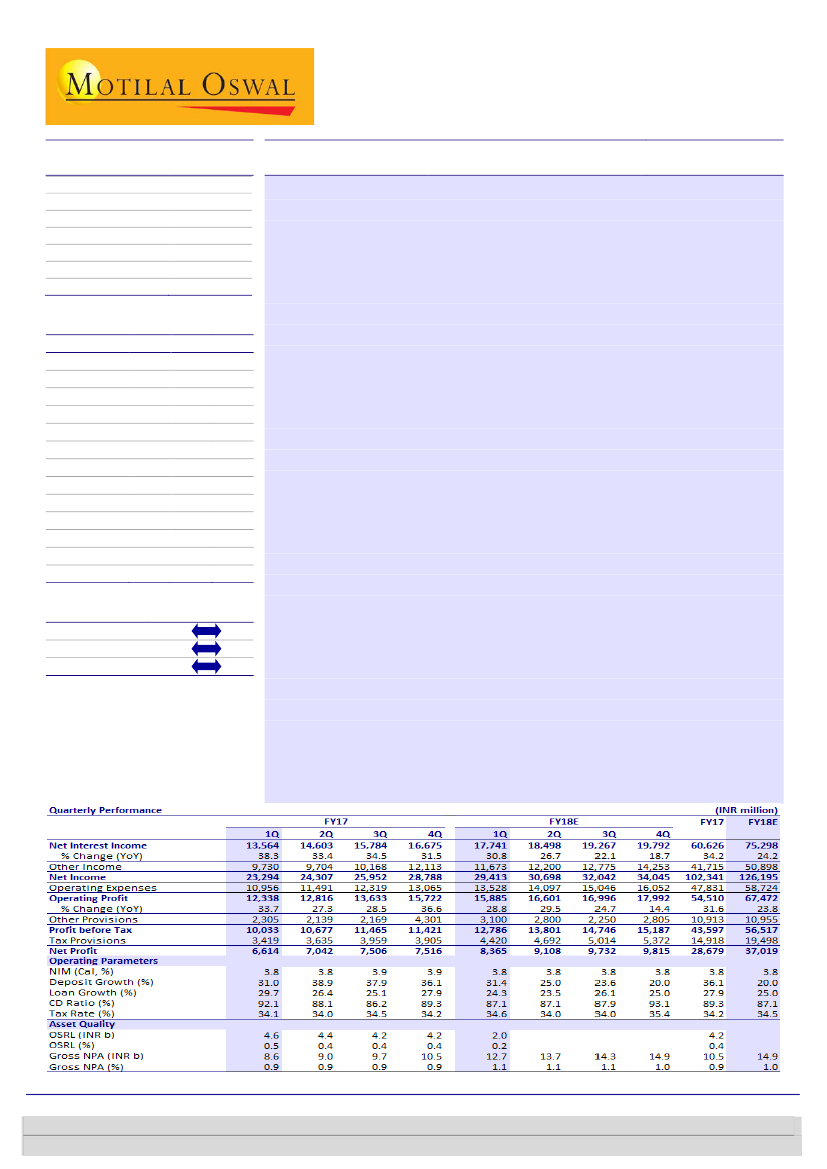

Mixed asset quality; strong operating performance

IndusInd Bank’s (IIB) 1QFY18 PAT grew 31% YoY (in-line) to INR8.4b. Strong

loan growth of 24% YoY (in line with management guidance) and steady NIM at

4% (+3bp YoY; ~10bp higher than expected) drove robust NII performance

(+31% YoY; 5% beat).

Robust NII performance, coupled with strong fee income growth of 25%+,

enabled the bank to deliver impressive core PPoP growth of 29% YoY. Opex

trailed total income growth, with continued moderation in employee expenses

(+18% YoY v/s 17% in 4Q and average of 25%+ in the previous eight quarters).

Both corporate (+26% YoY) and consumer (+22% YoY) loans exhibited healthy

growth. Lower growth in vehicle finance (+17% YoY) was compensated by

strong growth of ~40% YoY in retail non-vehicle loans.

GNPAs increased 21% QoQ to 1.1% of loans (0.9% in FY17), led by high

slippages in both CCB and CFD divisions. Slippages in CFD increased 45% QoQ

(+62% YoY) to INR2.6b. Restructured book declined to 0.17% (-20bp QoQ), led

by relapse of two accounts into NPA. There was a sale to ARC of INR570m

during the quarter.

Other highlights: (1)

Overall CASA ratio improved 90bp QoQ (+330bp YoY) to

~38%, led by robust SA mobilization (+65% YoY).

(2)

IIB has exposure of

~INR500m to three of the 12 accounts referred to NCLT for resolution. The

bank holds substantial provisions here, and incremental provisions are not

expected to exceed ~100-120m (may provide in 2QFY18).

(3)

The bank made

floating provision of ~INR750m during the quarter.

Valuation and view:

IIB’s key focus is to scale up on its retail operations, led by

higher share of non-vehicle retail loans by FY20. The bank is targeting 25-30%

loan growth, driven by continued branch expansion (800+ branch addition) and

strong customer acquisition (2x increase to 20m). Strong core profitability, an

improving CASA profile and healthy return ratios (RoA of 1.9%+ and RoE of 16-

18%) are the key positives. We largely maintain estimates. Maintain

Buy

with a

target price of INR1,800 (3.8x June 2019E BV).

Financials & Valuations (INR b)

Y/E MARCH

2018E 2019E

NII

75.3

94.0

OP

67.5

83.5

NP

37.0

45.9

NIM (%)

4.3

4.4

EPS (INR)

61.9

76.8

EPS Gr. (%)

29.1

24.1

BV/Sh. (INR)

383 446.4

ABV/Sh. (INR)

377 444.5

RoE (%)

17.3

18.5

RoA (%)

1.9

1.9

P/E (X)

25.2

20.3

P/BV (X)

4.1

3.5

P/ABV (X)

4.1

3.5

2020E

114.1

100.4

54.8

4.3

91.7

19.4

522.0

522.4

18.9

1.9

17.0

3.0

3.0

Estimate change

TP change

Rating change

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Subham Banka

(Subham.Banka@MotilalOswal.com); +91 22 6129 1567

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.