South Indian Bank

BSE SENSEX

31,805

S&P CNX

9,816

12 July 2017

1QFY18 Results Update | Sector: Financials

CMP: INR28

n

TP: INR34 (+21%)

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

PPoP growth marred by provisions; balance sheet clean-up accelerates

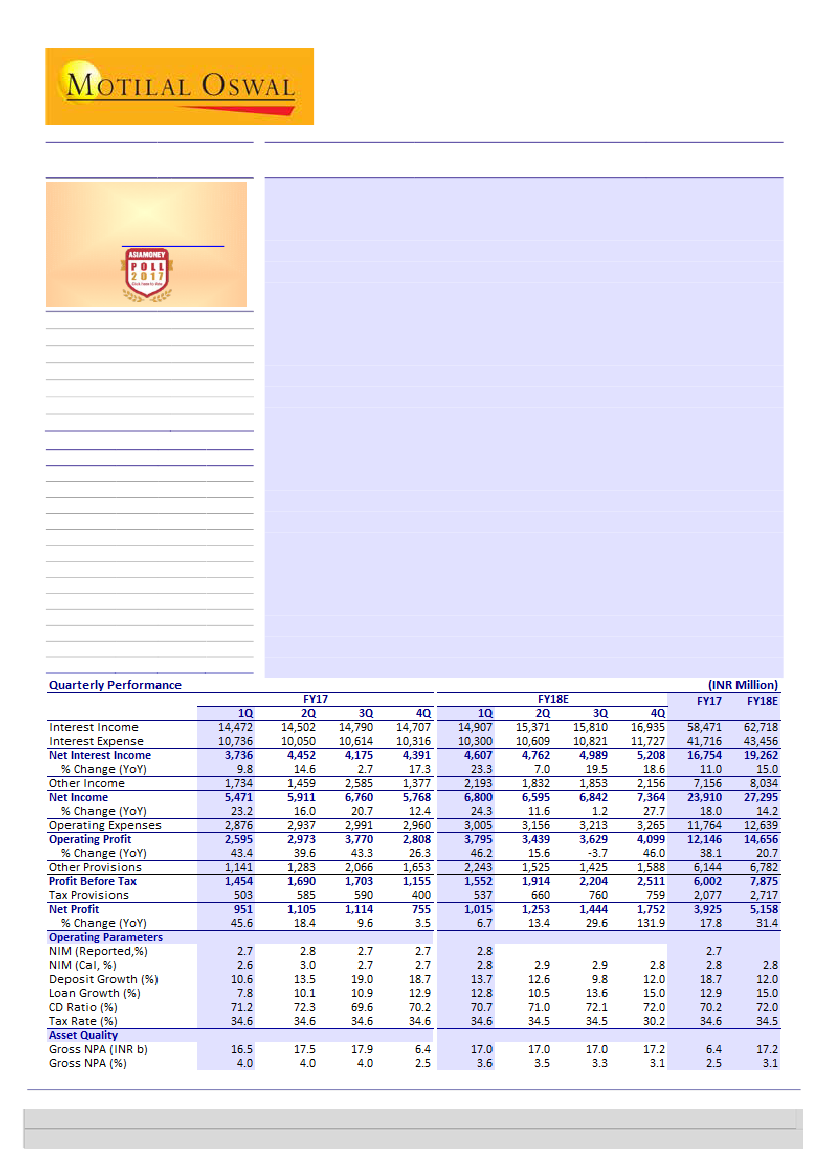

South Indian Bank (SIB) reported PAT growth of 34%/7% QoQ/YoY. PPoP

growth stood at 35%/46% QoQ/YoY, led by high trading gains (~44% of total

other income – second highest in 13 quarters, barring 3QFY17). However,

provisions soared 36%/97% QoQ/YoY, restricting YoY PAT growth.

NII grew 5%/23% QoQ/YoY on the back of advances growth of 0%/13%

QoQ/YoY and NIM expansion of 6bp QoQ/YoY to 2.8%. Opex growth was

controlled at 2%/4% QoQ/YoY. CI ratio declined to 44.2%. The bank has guided

to CI ratio of 47%-48% for FY18.

Loan growth of 0%/13% QoQ/YoY was led by robust growth in retail (+4%/20%

QoQ/YoY) and SME/agri (+1%/+11% QoQ/YoY) loans, while corporate book

grew -2%/10% QoQ/YoY, as per the bank's retail-focused strategy.

Asset quality deteriorated as the bank's absolute GNPA/NNPA soared 48%/75%

QoQ to INR17b/INR11.8b (3.61%/2.54%, +116bp/+109bp QoQ). However, the

bank recognized its entire watch-list (INR6.1b at end-4QFY17) as NPA, leading

to a clean balance sheet with no watch-list. Total net stressed assets of the

bank stood at 3.06% (v/s 3.43% in 4QFY17).

Valuation and view:

Management is focused on building a low-ticket loan book

with steady balance sheet clean-up, which will help improve asset quality

substantially. In view of continued reduction in net stressed assets,

comfortable capital position and improved profitability, we maintain our

Buy

rating with a TP of INR34.3 (1.1x June 2019E BV, slight increase over earlier

multiple of 1.0x Mar 2019E BV in view of significantly improved visibility of

asset quality/profitability).

n

SIB IN

1343.9

50.1/0.6

30 / 17

-1/30/24

277

100.0

Financials & Valuation (INR Billion)

Y/E Mar

2018E 2019E 2020E

NII

19.3

21.8

25.0

OP

14.7

16.4

19.1

NP

5.2

6.6

7.6

NIM (%)

2.7

2.7

2.7

EPS (INR)

2.9

3.7

4.2

EPS Gr. (%)

31.4

28.9

13.7

BV/Sh (INR)

27.6

30.4

33.5

ABV (INR)

24.7

28.6

32.5

RoE (%)

10.8

12.7

13.1

RoA (%)

0.7

0.7

0.7

P/E (x)

9.9

7.7

6.7

P/BV (x)

1.0

0.9

0.8

Div. Yield (%)

2.2

2.9

3.3

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

12M Avg Val (INR M)

Free float (%)

n

n

n

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Subham Banka

(Subham.Banka@MotilalOswal.com)

/ Anirvan Sarkar

(Anirvan.Sarkar@MotilalOswal.com);