Jubilant Foodworks

BSE SENSEX

32,075

S&P CNX

9,916

17 July 2017

1QFY18 Results Update | Sector: Retail

CMP: INR1,275 TP: INR850 (-33%)

Sell

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, (INR m)

Free float (%)

JUBI IN

66.0

65.3 / 1.0

1299 / 761

33/35/-4

680

55.0

Financials & Valuations (INR b)

Y/E Mar

2017 2018E 2019E

Net Sales

25.8

28.8

32.8

EBITDA

2.4

3.0

3.8

PAT

0.6

1.0

1.4

EPS (INR)

10.0

14.8

20.7

Gr. (%)

-32.1 48.0

40.0

BV/Sh (INR)

122.1 133.0 148.3

RoE (%)

8.2

11.1

14.0

RoCE (%)

8.4

11.6

14.7

P/E (x)

127.4 86.1

61.5

P/BV (x)

10.4

9.6

8.6

Estimate change

TP change

Rating change

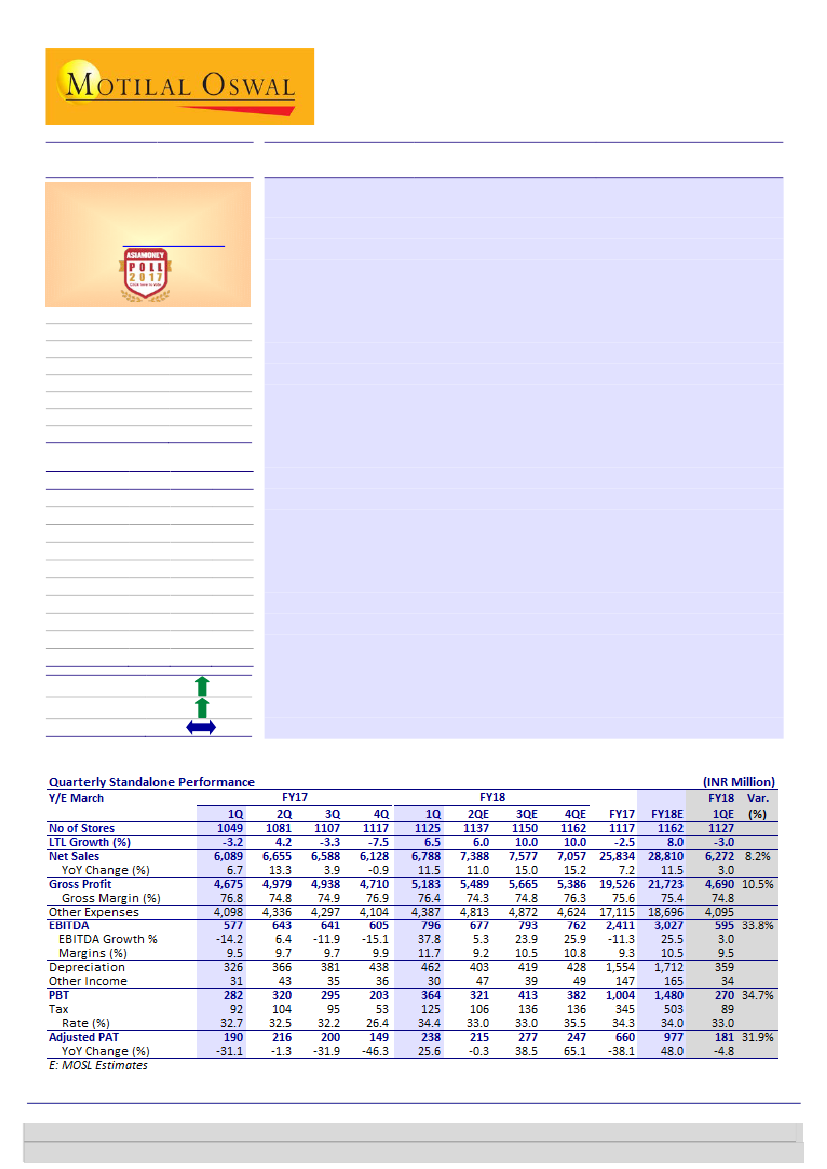

SSSG better than expectation; ‘Everyday Value’ strategy receives good response

Results above expectations:

1QFY18 net sales grew 11.5% YoY (est. of +3%) to

INR6.8b, EBITDA rose 37.8% YoY (est. of +3%) to INR796m and adj. PAT

increased 25.6% YoY (est. of -4.8%) to INR181m. SSS grew 6.5% YoY (est. of

-3%) for the quarter.

Gross margin shrunk 40bp YoY to 76.4%

(est. of -200bp). Lower staff costs

(-130bp to 21.7%), other expenses (-120bp to 31.3%) and rent costs (-20bp to

11.6%) led to EBITDA margin expansion of 220bp YoY to 11.7% (est. of flat

margin).

Concall highlights:

(1) SSSG of 6.5% in 1QFY18 was led by growth in business

volumes, mostly due to good response to ‘Everyday Value’ strategy for

Domino’s Pizza. (2) Benefits of cost rationalization efforts in association with AT

Kearney will be witnessed mainly in 3QFY18 and 4QFY18. (3) 255bp negative

impact due to Dunkin Donuts on margins in 1QFY17 came down to 145bp in

1QFY18.

Valuation view:

Changes to the model have resulted in 21.8%/15.6% increase

in FY18/FY19 EPS. There is, however, no visibility on sustained SSSG growth

beyond the current year, with persistent weak urban consumer sentiment. For

a business that sells an expensive product and where competition has made

significant inroads into its forte of delivery, significant job creation needs to

happen and incomes need to rise sharply – there has been no evidence of this

so far. Although admirable, most of management’s efforts are just damage-

control, in our view. Double-digit SSSG is essential for sustained margin growth

for a business with cost inflation of 6-7%. Despite assuming staggering 54% EPS

CAGR over FY17-19, the stock trades at 61.5x FY19E EPS for a business that

does not make 15% RoE, even in FY19. Maintain

Sell

with a revised TP of

INR850 (multiple unchanged at 38x June 2019E EPS).

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 3982 5428

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 3980 4261

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.