Hindustan Unilever

BSE SENSEX

31,711

S&P CNX

9,827

18 July 2017

1QFY18 Results Update | Sector: Consumer

CMP: INR1,158 TP: INR1,285(+11%)

Buy

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

Decent sales/margins performance in a quarter affected by destocking

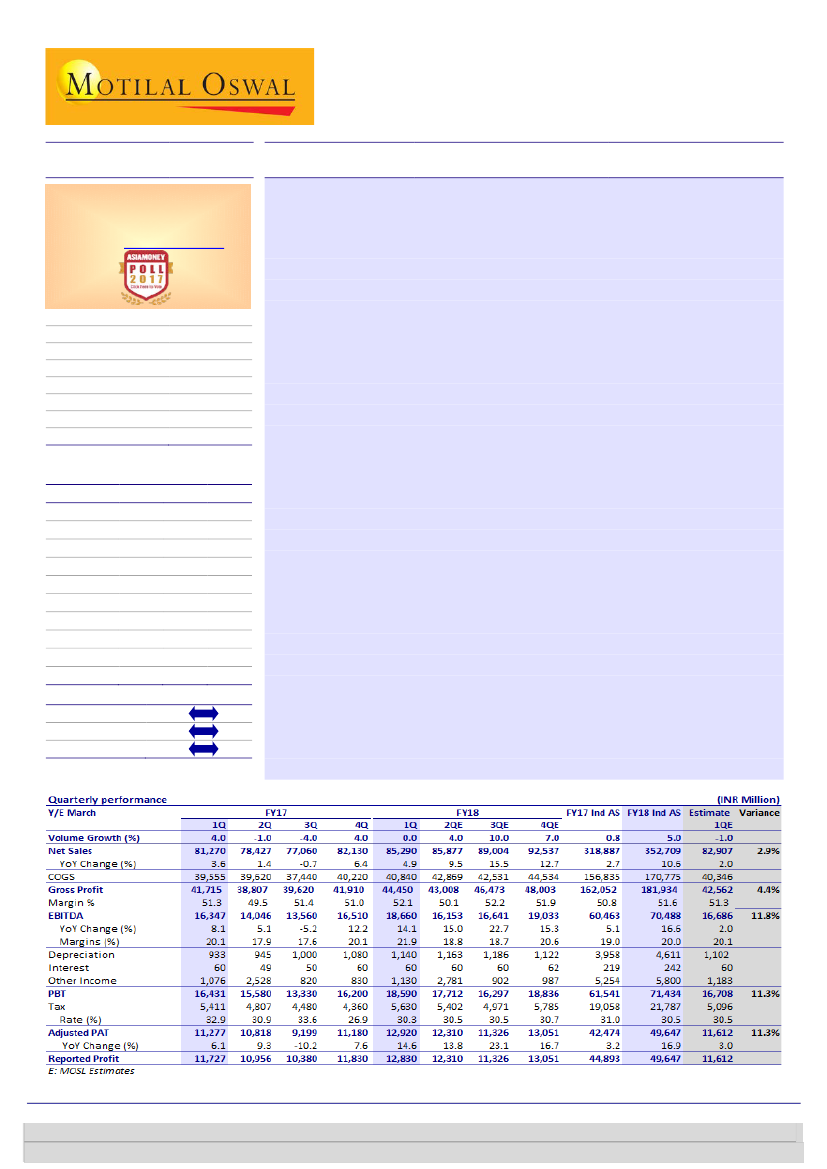

Hindustan Unilever’s (HUVR) 1QFY18 net sales increased 4.9% YoY

(est. of

+2%) to INR85.3b. Domestic consumer business grew 6% YoY, with flat volumes

(est. -1%). EBITDA increased 14.1% YoY to INR18.7b (12% above estimate) and

PAT (bei) rose 14.6% YoY to INR12.9b (11% above estimate).

Home care revenues were up 5.9% YoY, while personal care witnessed 3.5%

YoY growth in sales. Foods business sales were up 4.3% YoY, while refreshment

sales increased 10.8% YoY. Home care EBIT margin expanded by 230bp YoY and

personal care margin by 50bp YoY. Among the smaller segments, foods margin

expanded by 820bp YoY (off a very low base) and refreshment margin by

310bp YoY.

Gross margin expanded 80bp YoY to 52.1%.

EBITDA margin expanded 180bp

YoY to 21.9%, aided by gross margin improvement, and a decline of 30bp

YoY in staff costs, 20bp YoY in adspend and 40bp YoY in other expenses.

EBITDA increased 14.1% YoY to INR18.66b, higher than our estimate of

INR16.69b. PAT (bei) rose 14.6% YoY to INR12.92b.

Concall highlights:

(1) Absence of CSD offtake from the beginning of June

affected sales by 2% for the quarter. (2) Management expects a gradual

recovery in rural demand. (3) Company aims to attain significant savings in

each cost item over the next few years.

Valuation and view:

HUL has all the levers in place to drive earnings revival,

including good monsoon, benefits of low base of preceding years, return of

price part of sales growth, lower promotion spends, continuing premiumization

and various government schemes (DBT implementation, 24% increase in rural

outlay in the budget, farm loan waiver in Uttar Pradesh, etc.). Consequently,

we expect EPS CAGR of 18% over FY17-19, well above 3-year/5-year/10-year

EPS CAGR of 6.1%/10.6%/10.1%. Return ratios and dividend yield are best-of-

breed. We maintain our target multiple of 45x FY19E June-19 EPS (5% premium

to 3-year average), resulting in a target price of INR1,285. Maintain

Buy.

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm/ Vol m

Free float (%)

HUVR IN

2,164.3

2,159.4 / 33.7

1190 / 783

4/18/12

1226

32.8

Financials & Valuations (INR b)

Y/E Mar

2017 2018E 2019E

Net Sales

313.0 346.2 392.7

EBITDA

60.5

70.5

83.5

PAT

42.5

49.6

59.2

EPS (INR)

19.6

22.9

27.3

Gr. (%)

1.9

16.8

19.2

BV/Sh (INR)

30.8

31.9

34.1

RoE (%)

65.6

73.1

82.8

RoCE (%)

87.3

97.0

110.1

P/E (x)

59.0

50.5

42.3

P/BV (x)

37.6

36.3

34.0

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 3982 5428

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 3980 4261