19 July 2017

1QFY18 Results Update | Sector: Media

HT Media

Neutral

BSE SENSEX

31,955

S&P CNX

9,900

CMP: INR88

TP: INR90 (+2%)

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team. We

request your ballot.

GST impacts ad growth, cost efficiencies lead to margin beat

Maintain EPS estimates and TP

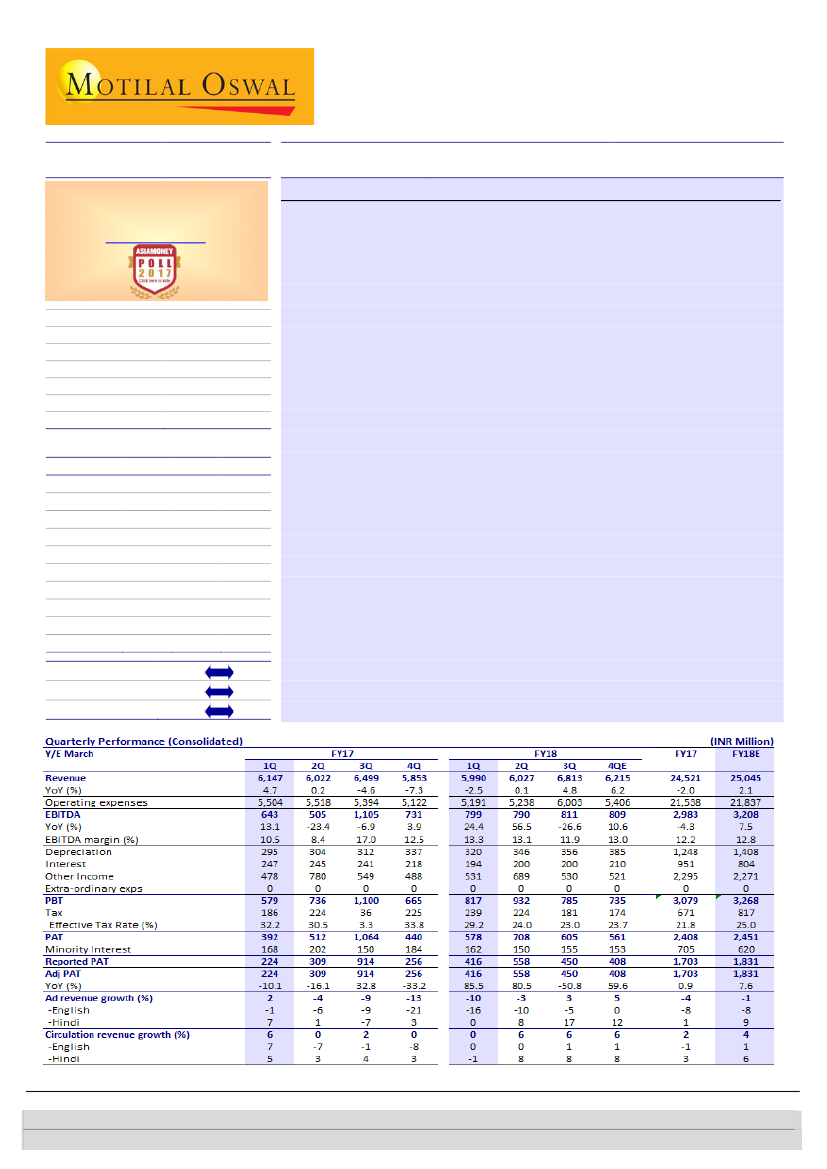

EBITDA up 24%, above estimate; PAT nearly doubles:

EBITDA rose 24% YoY

to INR799m, 21% above our estimate of INR657m, despite the revenue

disappointment, as HT Media’s cost-efficiency efforts bore fruit. Opex levers

more than cushioned the impact of subdued ad/circulation performance.

PAT grew 86% YoY to INR416m, significantly above our estimate of

INR236m, largely due to EBITDA beat flowing through.

Print ad and circulation growth disappoints:

Revenue fell 3% YoY to

INR5.99b (est. of INR6.24b). Ad revenue declined 10% YoY to INR4.07b (est.

of INR4.5b) as volumes were impacted in the month leading to GST roll-out.

English ad revenue fell 16% YoY to INR2.29b, while Hindi ad revenue

remained flat YoY at INR1.78b (4% miss). Circulation revenue remained flat

YoY at INR770m (est. of INR800m). Radio revenue grew 30% YoY to

INR430m (est. of INR398m), mainly on increased inventory sale from new

radio station launches and also growth in existing stations. Like-to-like radio

business growth fell 7% YoY (new stations contributed INR120m in 1Q).

EBITDA margin expands ~290bp YoY, significant beat:

Despite the GST

impact (which put brakes on ad/circulation growth), HTML more than

salvaged margins (+290bp YoY) to 13.3% (est. of 10.5%), as its cost-efficiency

drive across all opex items helped it report healthy margin expansion.

Valuation and view:

While 1Q profitability remained healthy due to cost

efficiencies, the ad pain continues (66% of revenue). While we remain

positive on the regional business, sluggish English ad growth and low

dividend payout remain the key concerns. We maintain our earnings

estimates and

Neutral

stance with a target price of INR90 (11x FY19E EPS).

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

Financials & Valuations (INR b)

2017 2018E

Y/E Mar

Net Sales

24.5

25.0

EBITDA

3.0

3.2

PAT

1.7

1.8

EPS (INR)

7.4

7.9

Gr. (%)

2.1

7.0

BV/Sh (INR)

109.8

120.1

RoE (%)

7.1

6.9

RoCE (%)

8.5

8.2

P/E (x)

11.9

11.1

P/BV (x)

0.8

0.7

HTML IN

233

19.2 / 0.3

96 / 70

5/-10/-5

23

30.5

2019E

26.3

3.1

1.9

8.1

1.5

130.4

6.4

8.1

11.0

0.7

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Jay Gandhi

(Jay.Gandhi@MotilalOswal.com); +91 22 6129 1546

Aliasgar Shakir

(Aliasgar.Shakir@motilaloswal.com); +91 022 3982 5423