Kotak Mahindra Bank

BSE SENSEX

31,904

S&P CNX

9,873

20 July 2017

1QFY18 Results Update | Sector: Financials

CMP: INR980

TP: INR1,153(+18%)

Buy

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team. We

request your ballot.

Strong all-around performance; Merger synergies yielding results

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

KMB IN

1,839

1,366.3 / 20.0

1019 / 692

-3/18/11

2001

69.9

Financials & Valuations (INR b)

Y/E March

2018E 2019E

NII

93.9 112.1

OP

72.7 90.6

Cons. NP

61.7 78.1

Cons. EPS (INR)

32.4 41.0

EPS Gr. (%)

20.9 26.5

Cons. BV. (INR)

232

272

Cons. RoE (%)

15.0 16.3

RoA (%)

1.8

2.0

P/E(X) (Cons.)

30.2 23.9

P/BV (X) (Cons.)

4.2

3.6

2020E

135.3

113.2

96.6

50.8

23.7

321

17.1

2.0

19.3

3.1

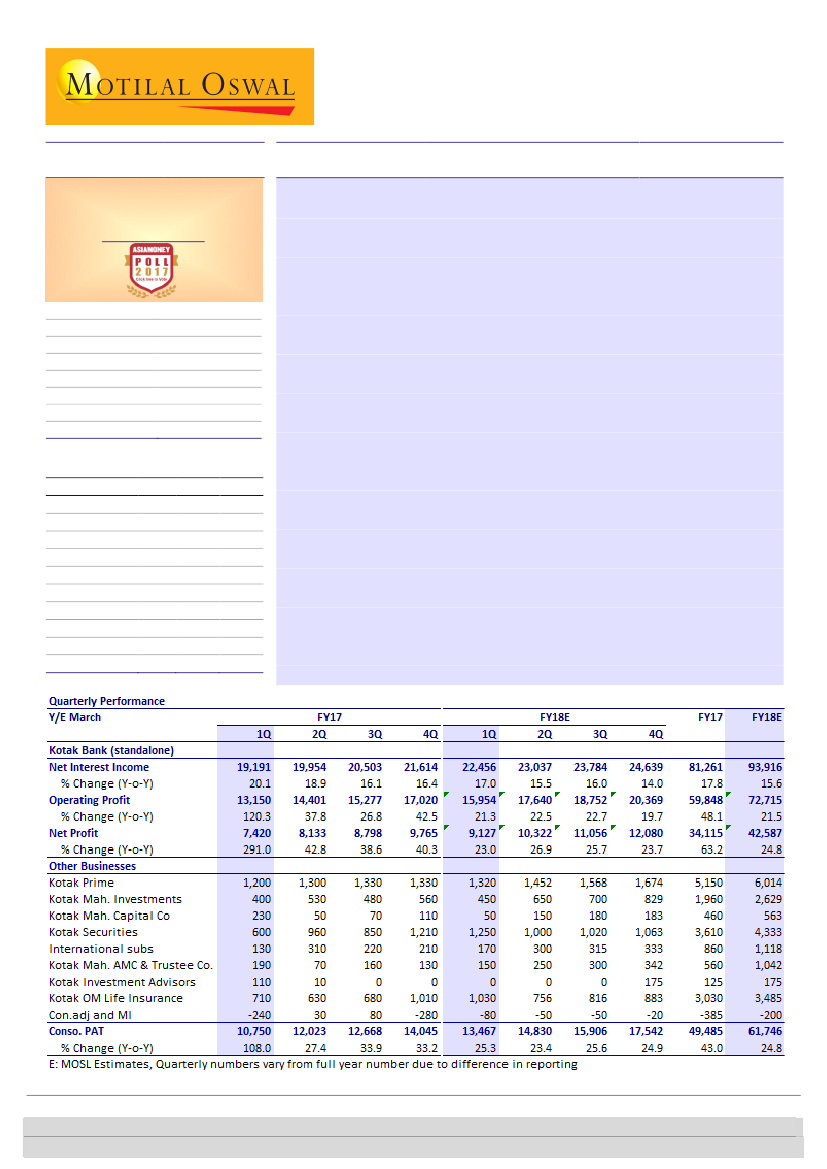

Standalone results:

PAT grew 30% YoY to INR9.1b (in-line). Core operating

profit grew strongly by 30% YoY, led by healthy NII growth (17% YoY; NIMs

strong at 4.5%), acceleration in fee income (+43% YoY) and pristine asset

quality (stable GNPAs at 2.6%). KMB holds more than requisite provisioning

in relation to its exposure of INR2.36b to the 12 accounts identified by the

RBI for bankruptcy proceedings under NCLT (four accounts inherited from

ING Vysya Bank). Loan growth came in at 18% YoY (+6% QoQ; +15% in

4QFY17), led by robust growth in CV (+6% QoQ, 35% YoY), corporate banking

(+21/8% YoY/QoQ) and unsecured loans (+24/5% YoY/QoQ).

Other highlights:

a) CASA ratio remained stable QoQ at 44%, despite

moderation in CA deposits, led by robust SA mobilization (+44/6% YoY/QoQ).

b) SMA2 increased 11bp QoQ to 0.21%; OSRL fell 21% to 6bp.

Other businesses:

a) Profitability at its capital market business improved to

INR1.3b (+57% YoY), led by 108% YoY PAT growth of K-Sec to INR1.25b. b) K-

Sec market share declined 30bp QoQ to 1.9%. c) Overall AUM increased 8%

QoQ (+37% YoY), led by strong inflows in equity AUM (+92% YoY).

Valuation and view:

With the completion of merger integration with eIVBL,

synergies are likely to flow in. Strong presence across geographies/products

and healthy capitalization (T1 of ~19%) place the bank in a sweet spot to

capitalize on growth opportunities and gain market share. KMB’s premium

multiples are likely to sustain, considering strong growth and operating

leverage available across businesses, and a clean loan portfolio. Comfort on

asset quality remains the highest, with no SDR/5:25, negligible SMA2 (21bp)

and OSRL (6bp). At our SOTP of INR1,153, KMB will trade at 4.2x 2019E

consol. BV.

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 6129 1526

Subham Banka

(Subham.Banka@MotilalOswal.com); +91 22 6129 1567

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.