21 July 2017

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team.

We

request your ballot.

Today’s top research idea

Kotak Mahindra Bank: Strong all-around performance; Merger

synergies yielding results

v

KMB's strong operating performance was marked by robust performance in

both standalone bank and its other businesses.

v

Strong presence across geographies/products and healthy capitalization (T1 of

~19%) place the bank in a sweet spot to capitalize on growth opportunities

and gain market share.

v

KMB’s premium multiples are likely to sustain, considering strong growth and

operating leverage available across businesses, and a clean loan portfolio.

v

Comfort on asset quality remains the highest, with no SDR/5:25, negligible

SMA2 (21bp) and OSRL (6bp). At our SOTP of INR1,153, KMB will trade at 4.2x

2019E consol. BV. Buy.

Market snapshot

Equities - India

Close

Chg .%

Sensex

31,904

-0.2

Nifty-50

9,873

-0.3

Nifty-M 100

18,291

-0.3

Equities-Global

Close

Chg .%

S&P 500

2,473

0.0

Nasdaq

6,390

0.1

FTSE 100

7,488

0.8

DAX

12,447

0.0

Hang Seng

10,847

-0.1

Nikkei 225

20,145

0.6

Commodities

Close

Chg .%

Brent (US$/Bbl)

49

-0.9

Gold ($/OZ)

1,237

-0.2

Cu (US$/MT)

5,925

-0.1

Almn (US$/MT)

1,892

-0.1

Currency

Close

Chg .%

USD/INR

64.4

0.2

USD/EUR

1.2

-0.2

USD/JPY

112.4

0.3

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.5

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

20-Jul

MTD

FIIs

0.0

0.2

DIIs

0.0

0.3

Volumes (INRb)

20-Jul

MTD*

Cash

297

282

F&O

9,907

5,485

Note: YTD is calendar year, *Avg

YTD.%

19.8

20.6

27.5

YTD.%

10.5

18.7

4.8

8.4

15.5

5.4

YTD.%

-12.1

6.7

7.3

11.0

YTD.%

-5.0

9.1

-4.1

YTDchg

-0.1

-0.1

YTD

8.7

3.6

YTD*

285

4,969

Research covered

Cos/Sector

Mahindra & Mahindra

Reliance Inds.

Kotak Mah. Bank

Wipro

Hind.Zinc

Bajaj Auto

ABB

Alembic Pharma

D B Corp

Zensar Tech.

NIIT Tech.

KPIT Tech

Results Expectation

Key Highlights

Getting future ready; UV segment needs push; tractor segment healthy

Standalone EBITDA/PAT largely in line; GRMs at USD11.9/bbl

Strong all-around performance; Merger synergies yielding results

Revenue beat offset by 2Q guidance

Operating performance in line

Operating performance below expectations; high RM cost hurt margins

Performance hurt by ECL provisioning; valuation premium warrants Sell

Weak results; GST implementation impacts domestic growth

In-line operational performance; ad performance healthier than expected

Miss led by top client weakness; Quarterly performance misses estimates

In-line performance; navigating client-specific challenges

Profitability resurrection pushed further ahead

Ashok Leyland | Dewan Housing | Indian Bank | MRPL | Persistent System

Piping hot news

Under Vikram Limaye, NSE applies to settle co-location case with Sebi

v

The National Stock Exchange of India Ltd (NSE) on Thursday sought a

settlement with the markets regulator over allegations that it had provided

unfair access to its high-frequency trading systems to some brokers.

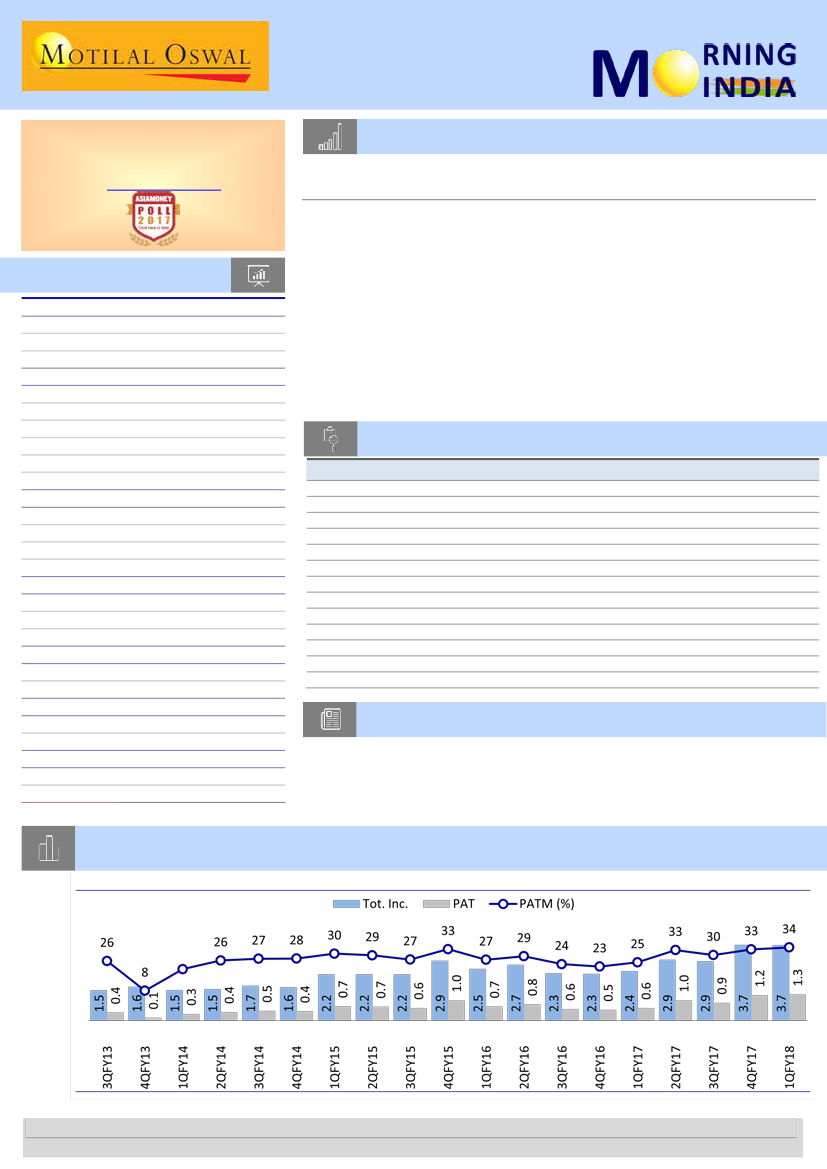

Chart of the Day: Kotak Mahindra Bank: Strong all-around performance; Merger synergies

yielding results

Steps taken to enhancing shareholder value

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.