21 July 2017

1QFY18 Results Update | Sector: Automobiles

Bajaj Auto

Buy

BSE SENSEX

32,029

S&P CNX

9,915

CMP: INR2,819 TP: INR3,281(+17%)

Motilal Oswal values your support in

the Asiamoney Brokers Poll 2017 for

India Research, Sales and Trading

team. We

request your ballot.

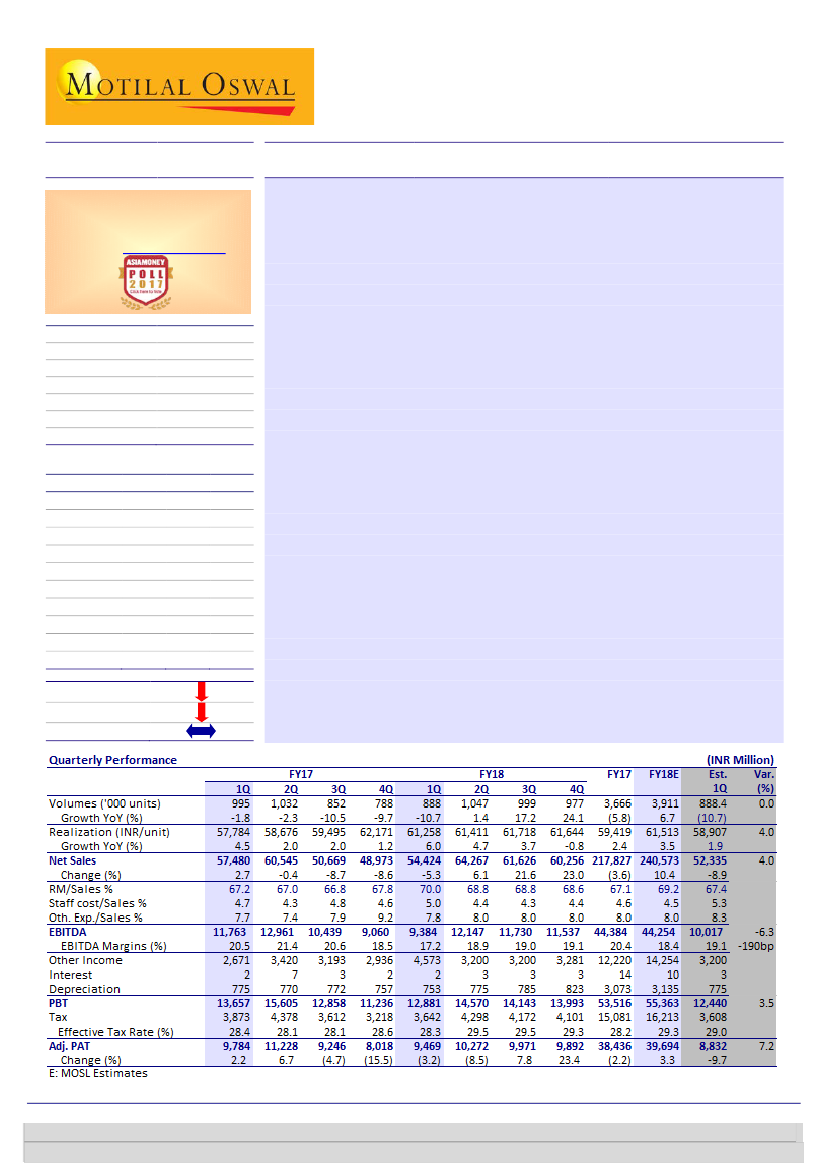

Higher RM cost, negative operating leverage results in 8-year low margins

Volume decline drags revenue; 6% YoY realization growth a surprise:

Net

sales declined 5.3% YoY (grew 11.1% QoQ) to INR54.4b (our estimate:

INR52.3b), as volumes declined 10.7% YoY (grew 12.8% QoQ). In the domestic

market, lower channel inventory and purchase postponement by customers

due to GST impacted wholesale numbers. However, an unexpected ~6% YoY

increase (1.5% QoQ decline) in realization to INR61,258/unit (our estimate:

+2%) aided revenue. Export revenue grew 20.5% YoY to INR24.8b.

EBITDA margin at multi-quarter low on higher RM, operating deleverage:

EBITDA fell 20% YoY to INR9.4b (our estimate: ~INR10b), implying EBITDA

margin of 17.2% (-320bp YoY, -130bp QoQ; our estimate: 19.1%). This was due

to higher RM cost (+280bp YoY, +220bp QoQ) and operating deleverage on

weak domestic volumes. However, adjusted PAT declined just 3.2% to INR9.5b

(our estimate: INR8.8b) due to higher other income. It reported exceptional

cost of INR320m related to GST-related compensation to dealers.

Management commentary:

(a)

Maintained motorcycle industry growth

outlook at 7% in FY18; BJAUT to grow at 10% from July 2017; guided FY18

exports at 1.6m units, (b) Guided EBITDA margin of 19.5-20% v/s 18.3% in

1QFY18, (c) Took price hikes of INR500-1,000/unit in 2W and INR1,500-

2,000/unit in 3W in domestic markets towards the end of May, and indicated a

price hike in exports from July, (d) Aiming at electric 3W launch in two years,

(e) In final stages of announcing a global alliance in 2Ws.

Valuation and view:

We have lowered our EPS estimates by 3-4% for FY18/19

on lower margin assumptions. Valuations at 20.5x/17.2x FY18E/19E standalone

EPS are attractive, considering worst of volumes and margins are behind us.

We value BJAUT at 18x FY19E EPS and add INR214/share for its KTM stake to

arrive at a TP of INR3,281. Maintain

Buy.

Bloomberg

Equity Shares (m)

M.Cap.(INRb)/(USDb)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val, INRm

Free float (%)

BJAUT IN

289

814.6 / 12.7

3122 / 2510

-2/-14/-14

806

50.7

Financials & Valuations (INR b)

2017 2018E 2019E

Y/E Mar

218

241

271

Net Sales

44.2

44.8

53.0

EBITDA

38.3

39.7

47.3

PAT

132

137

164

EPS (INR)

-2.6

3.7

19.2

Gr. (%)

589

648

713

BV/Sh (INR)

25.3

22.2

24.0

RoE (%)

24.6

21.5

23.3

RoCE (%)

21.3

20.5

17.2

P/E (x)

4.8

4.4

4.0

P/BV (x)

Estimate change

TP change

Rating change

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 6129 1524

Deep A Shah

(Deep.S@MotilalOswal.com); +91 22 6129 1533

Jigar Shah

(Jigar.Shah@MotilalOswal.com); +91 22 3982 5402