24 July 2017

Motilal Oswal values your support in the

Asiamoney Brokers Poll 2017 for India

Research, Sales and Trading team.

We

request your ballot.

Today’s top research idea

Reliance Industries: Standalone EBITDA/PAT largely in line

v

RIL reported standalone financials in line with expectation. However, GRM of

USD11.9/bbl was higher than our estimate. RIL's GRM has shown strong

resilience towards weak crack spreads, narrowing light-heavy differential and

narrowing Brent -dubai differential due to better yield/crude optimization &

risk management. Petrochem has also shown improvement in margin due to

rise of 69% QoQ delta in PP, 5% QoQ rise in PE delta and almost doubling of

SBR & PBR deltas. Commissioning of ROGC would be done in next 45-60days

while petcoke gasifier is expected to be commissioned fully by Mar-18.

v

RIL announced launch of its Jio phone which is targeting current pool of 530m

feature phone users. Current paid subscriber base has improved to 100m.

Going further, Telecom would be a major driver of stock performance.

Market snapshot

Equities - India

Close

Chg .%

Sensex

32,029

0.4

Nifty-50

9,915

0.4

Nifty-M 100

18,262

-0.2

Equities-Global

Close

Chg .%

S&P 500

2,473

0.0

Nasdaq

6,388

0.0

FTSE 100

7,453

-0.5

DAX

12,240

-1.7

Hang Seng

10,787

-0.6

Nikkei 225

20,100

-0.2

Commodities

Close

Chg .%

Brent (US$/Bbl)

47

-2.7

Gold ($/OZ)

1,248

0.9

Cu (US$/MT)

5,971

0.8

Almn (US$/MT)

1,892

0.0

Currency

Close

Chg .%

USD/INR

64.3

-0.2

USD/EUR

1.2

1.2

USD/JPY

111.8

-0.5

YIELD (%)

Close

1MChg

10 Yrs G-Sec

6.4

0.0

10 Yrs AAA Corp

7.5

0.0

Flows (USD b)

21-Jul

MTD

FIIs

0.0

0.2

DIIs

0.0

0.3

Volumes (INRb)

21-Jul

MTD*

Cash

342

286

F&O

5,736

5,502

Note: YTD is calendar year, *Avg

YTD.%

20.3

21.1

27.2

YTD.%

10.4

18.7

4.3

6.6

14.8

5.2

YTD.%

-14.5

7.6

8.1

11.0

YTD.%

-5.2

10.4

-4.6

YTDchg

-0.1

-0.1

YTD

8.7

3.6

YTD*

285

4,975

Research covered

Cos/Sector

Telecom

Reliance Inds.

Bajaj Auto

United Spirits

Avenue Supermarts

Britannia Industries

Ashok Leyland

MRPL

Divi's Lab

Indian Bank

Dewan Hsg. Fin.

JK Bank

Persistent System

Zensar Tech.

Results Expectation

Key Highlights

RJio’s big-bang VoLTE feature phone launch to expand its target market

Standalone EBITDA/PAT largely in line; GRMs at USD11.9/bbl

Higher RM cost, negative operating leverage results in 8-year low margins

Highway ban impact greater than expected

Revenue, EBITDA and PAT post strong growth

Well positioned in a high-potential market

EBITDA margins disappoint led by increased costs

EBITDA impacted by inventory loss; core GRM at USD7.07/bbl

Regulatory issues impacted revenues

Focus on core operating parameters continues; Asset quality improves

Growth surprises positively; re-rating to continue

Balance sheet clean up phase; PAT positive after 3 quarters

A stern test of our margin recovery thesis

Legacy pressures offset Digital pivot

ACEM | BHIN | DELTA | HDFCB | IHFL | INFOE | LTI | MMFS | TCOM | Z

Piping hot news

ONGC not to make open offer post HPCL acquisition

v

ONGC will not be required to make an open offer to minority shareholders of

HPCL after buying out government’s 51.11 per cent stake as the deal won’t

trigger takeover norms as did the IOC-IBP merger in 2002, a senior

government official said.

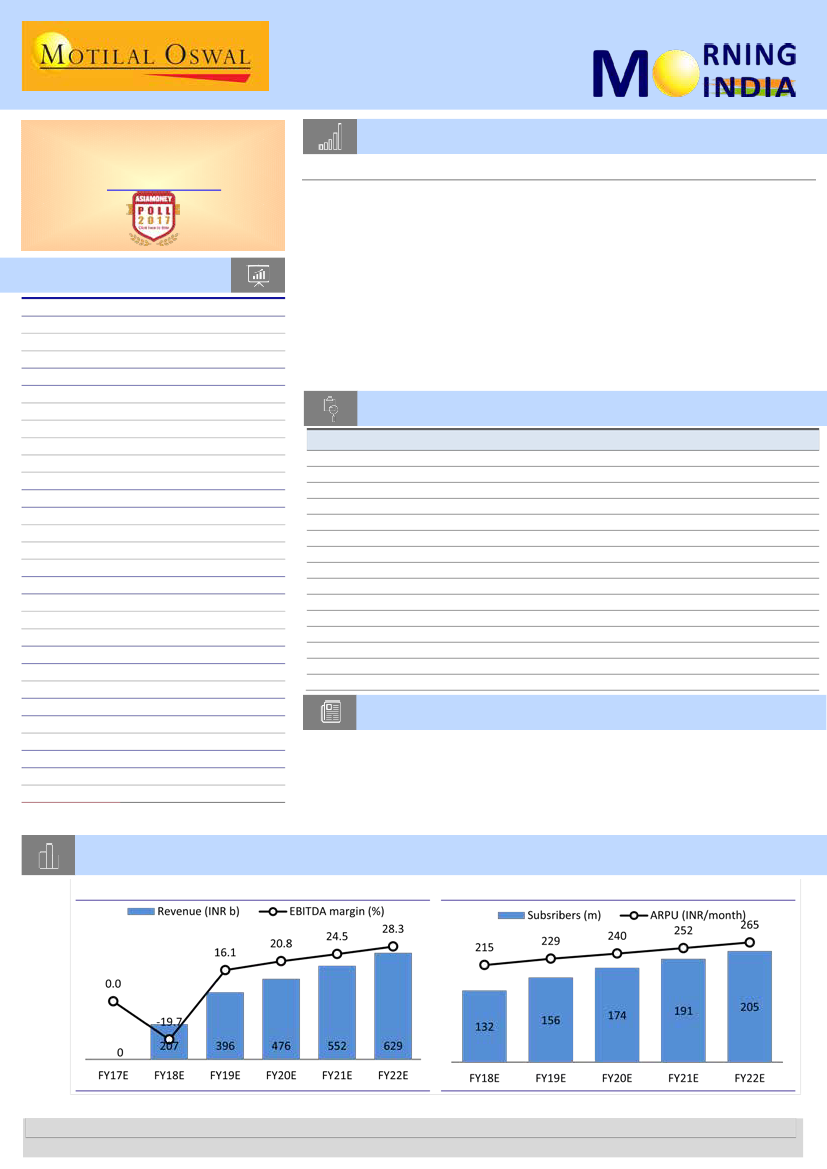

Chart of the Day: RJio’s big-bang VoLTE feature phone launch to expand its target market

Exhibit 1:

Revenues & margin to soar

Exhibit 2:

Subscribers & ARPU trends

Research Team (Gautam.Duggad@MotilalOswal.com)

Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital.

Investors are advised to refer through important disclosures made at the last page of the Research Report.