19 June 2017

Prabhat Dairy

spotlight

The Idea Junction

Stock Info

Bloomberg

PRABHAT IN

CMP (INR)

122

Equity Shares (m)

97.7

M.Cap. (INR b)/(USD b)

11.8/0.2

52-Week Range (INR)

150/77

1,6,12 Rel. Perf. (%)

-3/6/2

Solid institutional player

Moving toward consumer business

Incorporated in 1998 by the Nirmal family, Prabhat Dairy (Prabhat) is a fully integrated

milk & dairy products company engaged in the sale of products to institutional and retail

customers. The company sells specialty and co-manufactured products to its institutional

customers, as well as branded dairy products under the brand names of

Prabhat,

Prabhat Flava, Prabhat Milk Magic

and

Volup

(a recently launched brand for ice-cream).

It aims to become a larger and stronger regional player with a good mix of liquid milk,

fresh value-added products and longer-shelf-life products.

The consumer branded business (B2C) is expected to account for ~50% of its overall

revenues by 2020 (30% as on FY17), led by Hotels, Restaurants and Caterers

(HoReCa), and Retail.

The B2B business already has a solid foundation with a healthy list of clients, which

can be leveraged to develop new products and add new clients to drive steady

growth over FY17-20.

Prabhat targets 80% direct sourcing of milk by FY20 (~70% currently), which should

help it source higher volumes of good-quality raw milk on a consistent basis.

Utilization at its cheese manufacturing facility (third largest in India after Parag Milk

Foods and Amul, with capacity of 30 MT/day) is expected to increase from ~20%

currently to 40% in FY18 and 80% by FY20.

The company has delivered a strong operating performance over past four years,

with revenue, EBITDA and PAT CAGR of 22%, 15% and 25%, respectively. At CMP, the

stock trades at 19x FY19E EPS.

Financials & Valuation (INR m)

Y/E March

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2017 2018E 2019E

14.1

1.3

0.3

3.5

48.9

70.5

5.2

4.6

34.3

1.7

17.0

1.4

0.3

3.5

-1.5

72.5

4.9

5.7

34.8

1.7

19.6

1.8

0.6

6.4

83.8

77.7

8.5

8.2

18.9

1.6

Shareholding pattern (%)

As on

Mar-17

Promoter 48.9

DII

3.9

FII

2.6

Others

44.6

Dec-16

44.4

3.0

2.8

49.9

Mar-16

44.2

26.5

4.6

24.7

Notes: FII includes depository receipts

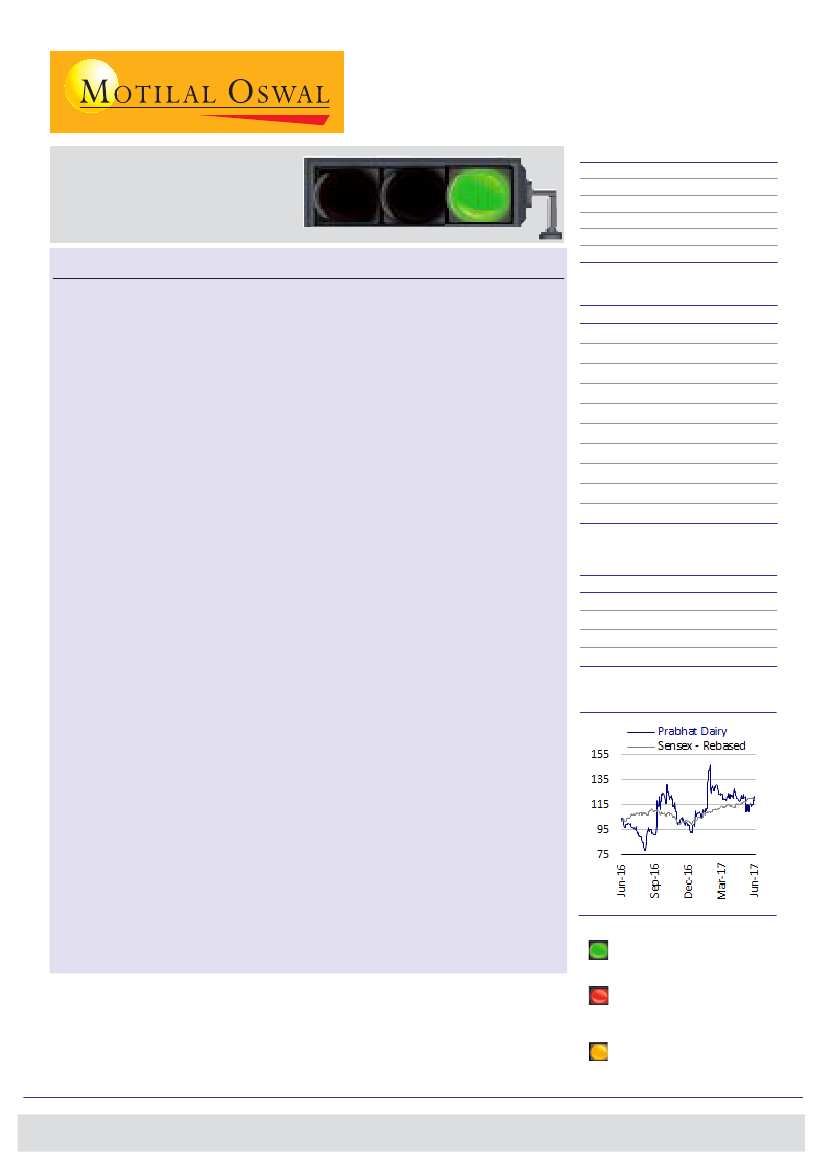

Stock performance (1 year)

Branded business to be revenue and margin driver

Prabhat is one of the emerging names in the value-added dairy products space,

launching a range of products under the Prabhat brand over past two years. The

focus on the B2C business will not only help grow revenues, but also aid

margins as it commands higher gross margins. The company sells pouched milk

& fresh dairy products in and around Maharashtra, while it sells long-shelf-life

products (like ghee and UHT milk) across the country. Management aims to

increase the contribution of the B2C segment to 50% of overall revenues,

mainly led by growth in value-added products like cheese, ghee, dahi and

paneer. In terms of distribution, the company now has presence across 26

states (was present in just Maharashtra in 2012), with around 1,200 distributors

and 0.1m retail outlets. It plans to expand its reach to ~0.2m outlets by FY19.

Our coverage universe is a wide representation of investment opportunities in India. However, there are many

emerging midcap names that are not under our coverage.

Spotlight

is our attempt to feature such stocks based

on fundamental analysis and site visits, without initiating formal coverage on them. Spotlight adopts a descriptive

rating system, which uses terms like Interesting, Cautious and In Transition (see definitions alongside). We do

not assign Buy, Sell or Neutral recommendations to the stocks under Spotlight. Investors should carefully read

Motilal Oswal Research in its entirety, and not draw inferences from the ratings alone. Ratings should not be

used or relied upon as investment advice.

Interesting: Currently, the

analyst believes that this is an

interesting stock based on its

fundamental strength

Cautious: Currently, the analyst

does not have adequate

conviction based on fundamental

assessment of the stock

In Transition: Currently, the

analyst thinks that the stock is

in transition from "Cautious" to

"Interesting"

Vishal Punmiya

(Vishal.Punmiya@MotilalOswal.com); +91 22 3980 4261

Krishnan Sambamoorthy

(Krishnan.Sambamoorthy@MotilalOswal.com); +91 22 3982 5428

Investors are advised to refer through important disclosures made at the last page of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.